9.3

8.064 reviews

English

EN

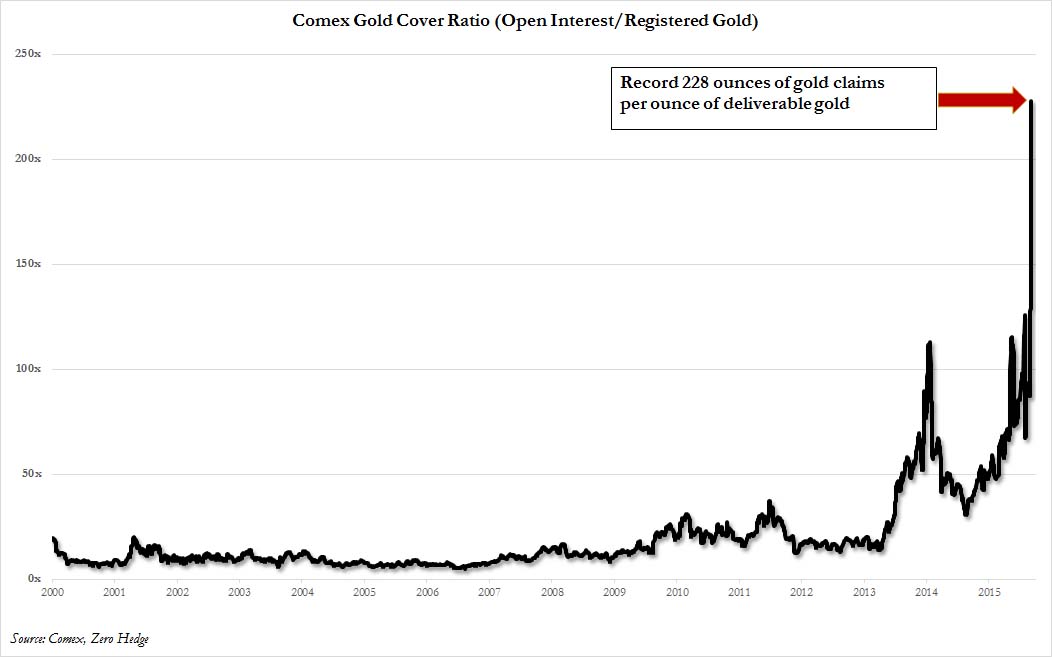

Who has the latest posts on Zero Hedge reads the impression that the Comex is on the verge of collapse, because the number of claims on gold relative to the physical gold supply in the vaults of the Comex has risen to an all-time high in a very short time. For every troy ounce of physical gold, there are now 228 claims circulating on a troy ounce of gold. But what conclusions should we draw from this?

Zero Hedge gives the impression that JP Morgan needs to intervene to prevent a disaster on the Comex, replenishing the gold supply from time to time. Gold Analyst Source: Suchecki explains that this is a misrepresentation and that there is no reason to believe that JP Morgan actually has a position in the silver market. For the sake of clarity, we will first briefly provide some more information about how the Comex works...

Number of claims on Comex gold stock to record?

The Comex gives a daily update of the gold reserves stored in the vaults of the Bullion banks. This is the gold of traders and investors, which has only been deposited with one of the Bullion banks. This gold is marked as 'Eligible' by default, but it can easily be Converted to the 'Registered' category if the owner makes the gold available for physical delivery.

If we look at the latest stock overview of the Comex, we only see that a small part of all the gold in the vaults of the Comex is marked as 'Registered'. In recent years, this supply has become much smaller, which means that the ratio to the number of claims on gold has become increasingly skewed.

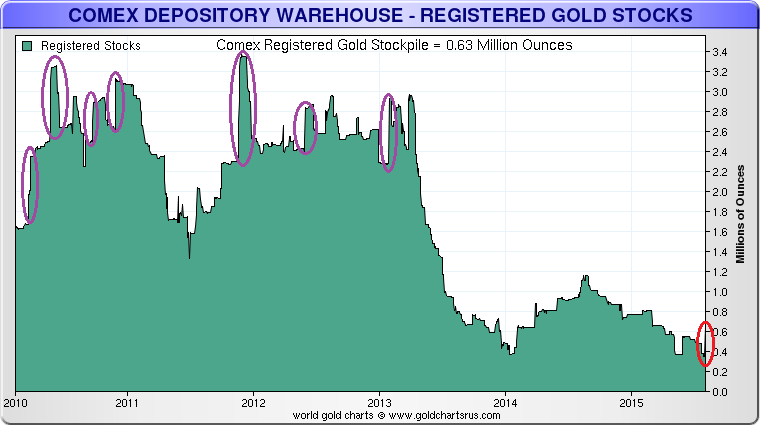

But what Zero Hedge doesn't mention is that traders can easily convert their gold holdings from the 'Eligible' stash to 'Registered'. The gold is already in the safe and can be stored in the accounts of the Bullion Bank can be easily transferred. This has happened several times in recent years, as the following chart from Goldchartsrus shows.

Registered gold stock Comex

Zero Hedge gives the impression that JP Morgan has come to the rescue of the Comex, but that is very unlikely. This bank, together with other Bullion banks as Brink's, HSBC, Delaware, Manfra and Scotia Mocatta are only custodians of the gold and not the owner. Every time gold stocks shift from the 'Eligible' to the 'Registered' gold stock, it is done on behalf of a trader who has a position in the gold market.

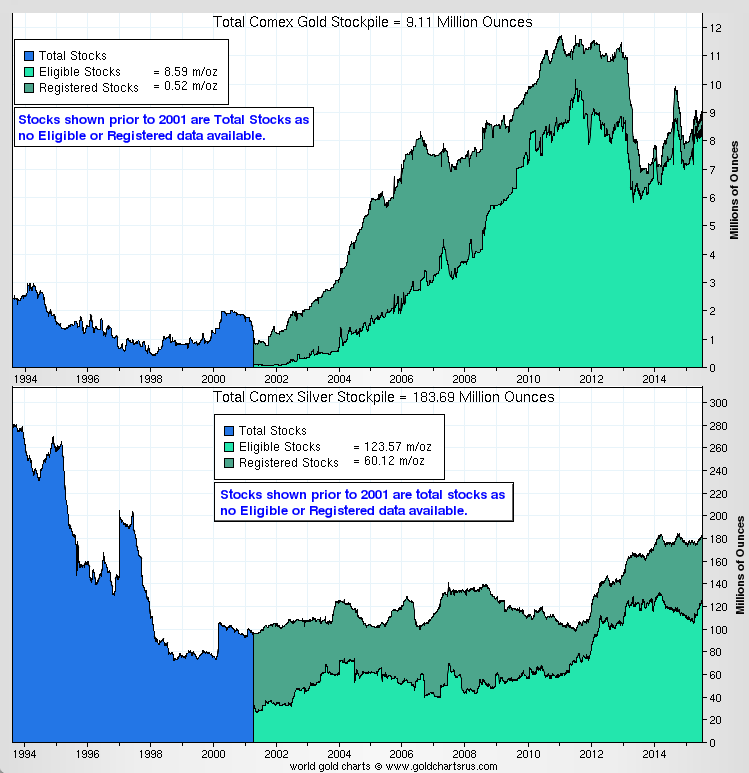

The fact that the gold supply in the Comex is depleted is a misrepresentation of the facts, because the total supply (Registered + Eligible) has been showing an upward trend since 2001. Apart from the year 2013 - when a lot of gold was taken from the vaults of the Bullion banks - there is again an upward trend in the total gold stock of the Comex. There is therefore no question of an exodus in the Comex. Zero Hedge only shows a part of the stock, which could lead to a different (erroneous) conclusion. For those interested: the stocks of silver in the Comex have also increased further in recent years.

The total gold reserves in the Comex have actually increased in recent years

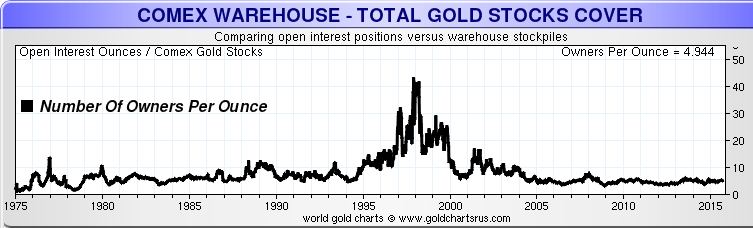

If we compare the number of claims on gold with the total gold reserves of the Comex (Registered + Eligible) and place these figures in historical perspective, we suddenly see a completely different picture. We now see that the number of claims on a troy ounce peaked in 1998 and that in recent years there has actually been no increase in the number of claims on gold in relation to the gold reserves.

Leverage on the total gold supply of the Comex

Zero Hedge – and the countless blogs that overwrite their posts – consciously or unconsciously give the impression that something is about to happen on the Comex and that it is up to JP Morgan to intervene if the gold supply falls below a so-called 'critical level'. But the reality is much less exciting. There is still plenty of gold in the Comex and it is very unlikely that JP Morgan, as custodian of the gold, has anything to say about shifts between the Registered and Eligible supply. JP Morgan manages as Bullion Bank the positions of its clients and earns money from the storage of precious metals.

For years there has been speculation about a run on the gold of the Comex, but the question is whether that will actually ever happen. Only 2 to 4 percent of contracts require physical delivery. Most contracts are rolled over or settled in cash. And if there comes a time when there really isn't enough gold in the Comex, we won't be surprised that all contracts are settled in cash.