9.4

7.466 Reviews

English

EN

In recent years, the use of cash has declined sharply. In 2010, more than 60% of transactions were paid in cash, but in 2019 this share was already Halved. During the first lockdown in April 2020, the share of cash payments even dropped rapidly to 13%. After the lockdown Recovered The share of cash payments is increasing, but more and more people are wondering whether cash will remain relevant in the future. Will cash disappear, or will it continue to be in vogue in the future?

The introduction of digital central bank money is a topic of discussion. Both proponents and opponents put forward arguments. Opponents of the digital currency are concerned about privacy, among other things. For example, the new currency could become programmable, which would have far-reaching consequences for users. In a podcast by Holland Gold Arno Wellens also on the fact that a Central Bank Digital Currency (CBDC) allows negative interest rates if recourse to cash is not possible.

Proponents point to the weakened position of central banks if the use of cash continues to decline. Private money has value mainly because it can be exchanged for public money. Money in the bank account created by commercial banks has value mainly because it is denominated in public money; the euro. With a declining use of cash, it seems logical for the central bank to come up with a successor to the banknote, so that a form of public money is also available in the future.

There are reasons why people like to use cash. People don't always want to be dependent on commercial banks, for example by unrest which occasionally strikes in the banking sector. Also, cash has the advantage of always being usable, while digital money sometimes suffers from glitches. In addition, the privacy of cash payments is valued and there are people who trouble with digital banking. Finally, cash is also much more common abroad. Although about 21 percent of transactions in the Netherlands are now handled in cash, that percentage is still much higher in other countrieshigher. In Austria and Italy, the figure is still around 70 percent.

We also see that people are holding cash as a store of value. Especially in times of crisis, the number of banknotes in circulation can increase sharply. Of course, this is most evident during a classic Bank Run, a situation in which people request their money from the bank en masse. People also withdrew more money in other troubled times. For example, in February 2020, at the start of the coronavirus crisis, the number of banknotes in circulation increased by 12%.

The use and acceptance of cash must therefore continue to be guaranteed, according to the Dutch Central Bank (DNB), the bank wrote in 2020. This opinion is also shared by the House of Representatives, which adopted a motion in 2021 to keep cash as legal tender. The accessibility of cash is also laid down in rules. For example, everyone in the Netherlands has to enter five kilometers have access to an ATM even as ATMs become less numerous. Also Retail Organizations have indicated that they will continue to accept cash. In that respect, there is no reason to assume that cash will disappear in the short term.

The documents from DNB and the House of Representatives therefore do not point to a phasing out of cash. As long as there is a demand for cash, that possibility will most likely remain there. Right now says 46 percentof the Dutch think it is important to be able to pay with banknotes and coins, just under half. However, the use of cash could decrease further in the future, as digital payments are usually easier.

The use of cash has been declining in recent years (Source; DNB)

However, there are also disadvantages to using cash. For example, maintaining the infrastructure of cash is very expensive, especially if the use of cash continues to decline. The annual cost of the cash infrastructure is now about one billion euros. Of this, 600 million euros is variable, which means that this part of the costs will decrease if the use of cash also decreases. The high costs associated with maintaining this infrastructure have already led to the introduction of the Geldmaat. Previously, each bank had its own network of ATMs, which meant that there were often several ATMs in the same place. Now, Geldmaat takes care of cash withdrawals for customers of all major banks, saving costs.

Bankers also often argue that cash is too often used for transactions that cannot stand the light of day due to the high level of privacy of cash. Wim Boonstra, economist at Rabobank, contributes a solution for this problem. According to Boonstra, cash could be made less attractive by replacing bills with coins in high denominations. In such a case, criminals quickly need a truck to transport all the coins for large transactions, while such transactions can be made in bills with a suitcase. Incidentally, Boonstra does not think that cash will disappear, as he also indicated on the YouTube channel of Holland Gold.

TU Delft also came up with a plan to use cash more attractive. For example, an alternative to coins was devised, as coins now often disappear into drawers and cupboards. According to a study by TU Delft, plastic chips of different colours can offer the solution. A complete set of these chips can be stored in convenient credit card-sized holders. This makes it much easier and much clearer to store coins. With this solution, the use of coins is suddenly a lot easier.

The solution proposed by TU Delft (Source; Delft University of Technology)

Note that these two solutions can work well side by side. The coins in low denominations will then take the form of handy chips, while coins of 20 and 50 euros will also be issued. For example, cash becomes more attractive and people keep a good alternative to digital money, but the use of cash is more difficult for criminals. As a result, legitimate transactions in large amounts will have to be settled more often by bank transfer.

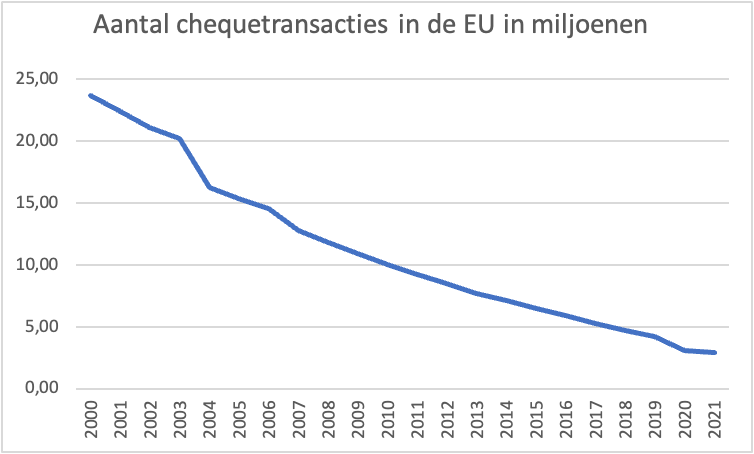

With payment methods that become obsolete, things can go quickly. A good example is the use of bank drafts. Cheques were introduced in the Netherlands in 1967 and soon became widely used in the Netherlands. They were payment orders between two account holders and they were often used for larger transactions. During European integration, Eurocheques were also introduced, which were also accepted across borders. The use of these cheques increased considerably: in 1991 a total of 107.8 million euro cheques were issued, with a combined value of more than 16.7 billion guilders.

But the use of these cheques declined rapidly with the advent of debit cards and internet banking. At the European level, Eurocheques Also becoming less common, as cheques had become inefficient for banks themselves as well. In 2002, Dutch retailers stopped accepting cheques and banks stopped issuing new cheques. In the Netherlands, the securities could still be held by banks up to 2021 be redeemed. The use of cheques decreased spectacularly.

Number of Annual Check Transactions in Millions (Source; Statista)

There is, however, a big difference between countries. In the Netherlands, hardly anyone uses cheques anymore. This is not surprising, because the payment system in the Netherlands is extremely fast and efficient. In France, where digitisation is slower, they are still used.

It is also even more common to write checks in America. Cheques are still seen as a Safer means than cash. After all, you can lose cash more easily, while both parties must be present and agree to the transaction when a check is cashed. The cheque only has value after it has been signed by both parties.

Data on the use of checks in America (Source; Federal Reserve)

So it's hard to say whether cash will actually disappear. Looking at the documents of DNB and the House of Representatives, it seems premature to say that money will disappear. Also, when cash is compared to checks, it is difficult to say whether cash will actually disappear in the future. Cheques may have become extinct in the Netherlands, but they are still relevant in other countries.

In the Netherlands, the government is still committed to the preservation of cash. It is therefore unlikely that cash will show a similar pattern to bank drafts in the short term. However, it is possible that people will gradually pay more often with the debit card or telephone, which will further reduce the use of cash. In the event that there are only a few people who use cash, the infrastructure may disappear. On the other hand, there are ways to make cash more attractive, which could increase its use.

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.