9.3

8.064 reviews

English

EN

This week was really only about one thing: the Fed's rate cut. In this weekly selection, we look beyond the Fed's explanation for the rate cut. Many critics cite a different reason. We also read that Trump says that the Fed is playing a political game so close to the election. Remarkably, Rabobank seems to agree with him. We also look at what this rate cut could mean for gold and inflation. Finally, we see what other major central banks have decided this week.

Last Wednesday, the Fed cut interest rates by half a percentage point. This was the first rate cut since the Covid pandemic. Such a large reduction normally takes place only in times of crisis as in 2008. Many Economists were wrong, but the expectation in the market was already shifting from a cut from 25 basis points to 50 basis points.

At first, the market seemed to be there barely The S&P 500 closed down 0.3 percent on Wednesday. However, on Thursday, Stock exchanges and the S&P 500 is now on Record. Lower interest rates are seen as positive for stock markets because they stimulate the economy, reduce corporate indebtedness, and encourage investment in riskier assets.

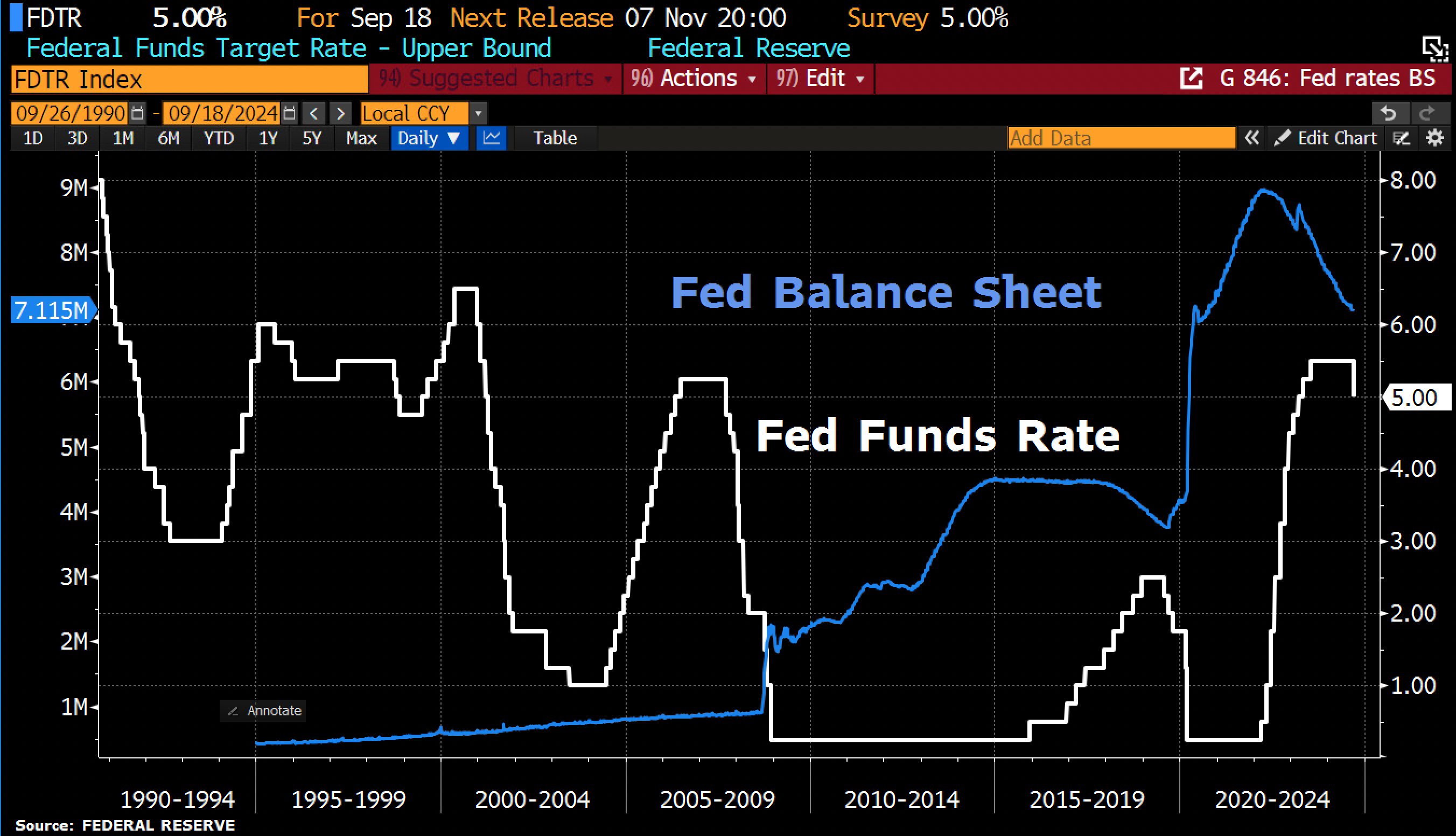

Fed Funds Rate & Balance Sheet (source: Holger Zschaepitz)

The decision lowers the federal funds rate to a range between 4.75 and 5 percent. This interest rate determines the short-term borrowing costs for banks, but it also affects various consumer products such as mortgages, car loans, and credit cards. The Fed communicated with the well-known "dot plot" which will follow another 50 basis points of cut by the end of the year. Further, expectations are for a full percentage point of cuts by the end of 2025 and half a point in 2026.

The Fed was able to make this decision because it has "become more confident that inflation is moving sustainably towards 2 percent, and judges that the risks to achieving its employment and inflation targets are roughly balanced." The decision comes despite the fact that most economic indicators look pretty solid. U.S. GDP grew by 3 percent in the third quarter. The unemployment rate has risen slightly but remains very low at 4.2 percent.

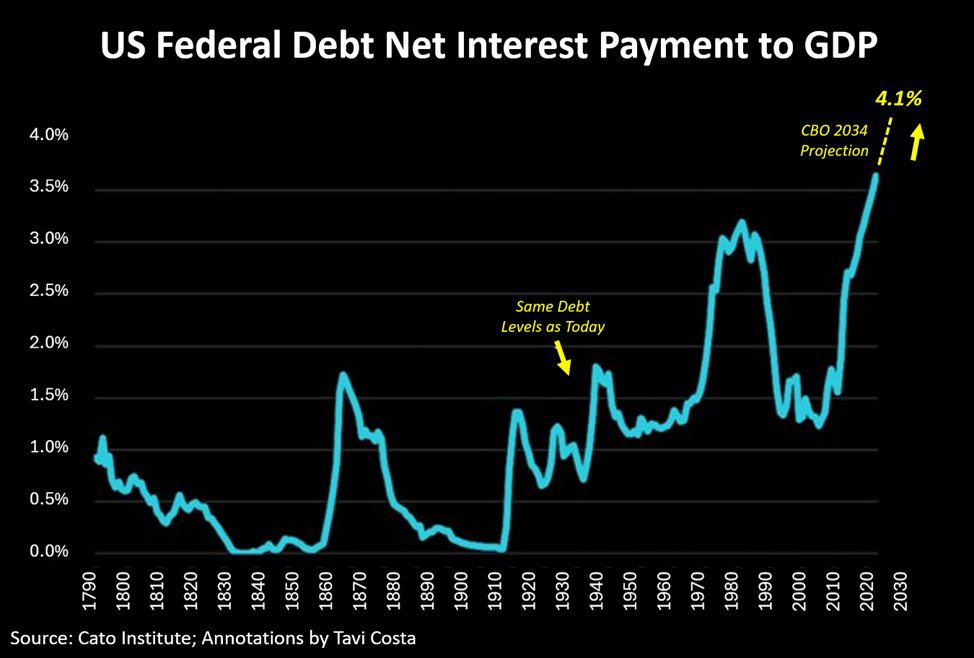

The Fed says the labor market solid to keep. In the Podcast This week we spoke with equity analyst Nico Inberg about a possible recession in the United States because the average consumer, among others, is having an increasingly difficult time. Both the consumer as the government in the U.S. have gone deep into debt. Nico called the national debt "the elephant in the room". It amount that the U.S. government is now interest is larger than the defence budget.

Net interest payments federal government debt as a percentage of the economy (source: Tavi Costa)

The economy and the stock market are doing relatively well. It is therefore not surprising that many critics suggest that the debt also plays a role in the decision to lower interest rates. Economist Daniel Lacalle writes: "The Fed is bailing out the Treasury". And in the attached video, he says, "They're basically lowering interest rates to make it easier for the government to increase debt." Also Tavi Costa of Crescat Capital thinks the most plausible explanation for the Fed's policy changes is the rapidly rising interest payments. Lawrence McDonald is louder: "... They MUST get short-term interest rates down, as this colossal mountain of debt is about to expire." Luke Gromen seems to agree with this.

Expiring US debt (source: Lawrence McDonald)

Donald Trump suggests that there may be politics being done by the Fed just before the election: "Either the economy is in very bad shape, or they are playing political games—it's one of the two." Trump had previously warned Jerome Powell, the chairman of the Fed, not to cut interest rates before the election and said in February that he wants to replace him if he is re-elected. He then predicted that Powell would cut interest rates before the election to Democrats to help.

Remarkably, Trump seems to be right about the Rabobank, The. This was done by Zerohedge of course eagerly copied in an article titled "Rabobank Goes Apeshit On Powell's Orwellian Rate Cut". Philip Marey, Rabobank's Fed watcher, concludes: "Powell had a clear motive for cutting rates by 50 basis points before Election Day, because Trump has already indicated that he would not reappoint him as Fed chair. In fact, Trump might even decide to remove him early. Powell's only chance for another term is to satisfy Kamala Harris and her Democratic colleagues in the Senate. In addition, three Democratic senators — Elizabeth Warren, Sheldon Whitehouse and John Hickenlooper — sent a letter to the Fed on Monday urging a 75 basis point cut."

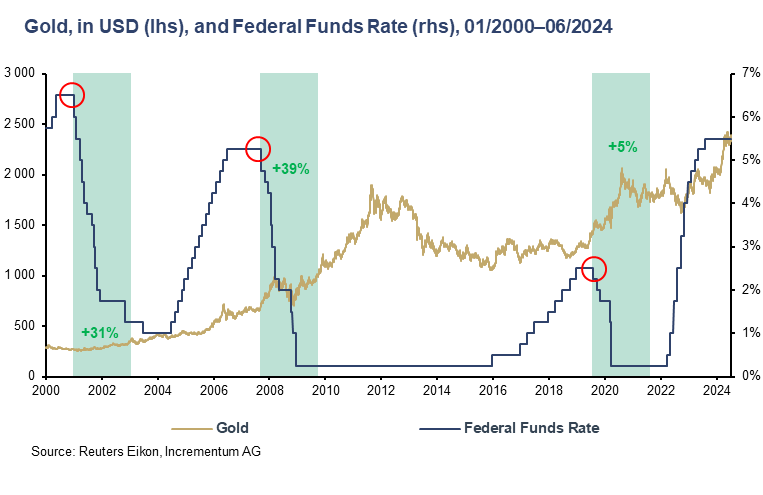

Regardless of the reason behind the rate cut, it is interesting to examine its consequences. Nico Inberg said in our Podcast that the policy change could potentially reignite inflation. He also says that the rising Gold price an anticipation of the upcoming inflation. Notorious goldbug Peter Schiff is of course a lot more adamant and calls for gold to be sold now. buy. It expects that the inflation will get much worse. Previously Wrote We already know that inflation tends to develop in waves that can last for decades. It will also be very interesting to see what will happen to house prices now that they are already at a high level. culmination stand.

Development of inflation rate in the US 1970s compared to today (source: Zerohedge)

Gold has an inverse correlation with real interest rates because it is a safe investment that does not earn interest. If interest rates go lower, the opportunity cost of owning gold will also decrease, making gold relatively more attractive. Historically, gold has outperformed during periods of interest rate cuts.

Gold's performance during periods of rate cuts (source: Ronnie Stoeferle)

Once again, the Gold price the weather is good. Once again, we are on new Record highs, well above $2,600 per troy ounce. Jeroen Blokland Writes that there is more to the current increase than just the Fed's rate cut and that the traditional media is paying little attention to it.

Last week Reduced the ECB has already lowered interest rates for the second time this year. This week, the Bank of England (BoE) announced that they will not change interest rates and will 5 percent hold. Andrew Bailey, the governor of the BoE, said they were to be "careful not to cut too quickly or too much" as inflation in the UK remains above target. Analysts expect that the BoE will cut interest rates in November. The British pound hit its highest level against the dollar in 2.5 years after this decision last Thursday.

The Central Bank of Switzerland (SNB) is going to probable follow the Fed's rate cut. Earlier we wrote that the SNB first Western central bank that lowered interest rates. Inflation in Switzerland is low and the appreciation of the franc against other currencies is now weighing on the competitiveness of Swiss companies. "The question for the SNB now is no longer whether to cut rates by 25 basis points or maintain them, but whether to cut rates by 25 or 50 basis points," said Sebastien Gyger, Chief Investment Officer of Banque Cantonale Vaudoise in Lausanne.

The Bank of Japan (BoJ) today with the message that they will not change the interest rate. In March and July, the BoJ raised interest rates for the first time since 2007. This eventually led to a crash on the stock market. The BoJ boss said that "the economy is recovering moderately, although there are some signs of weakness," adding that the bank will continue to raise interest rates as long as the economy continues to develop in line with expectations. "However, developments in foreign economies, particularly the U.S. economy, have increased uncertainty about the future," he said, according to the Nikkei business newspaper.

Photo by Trump & Powell (source: Trump Whitehouse Archive)

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.