9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

The precious metals markets experienced a historic week: both gold and silver reached new record highs. According to CNBC, gold is the clear winner in the battle for capital flows towards safe havens. What’s behind this spectacular surge, and what role do Trump and rising sovereign debts play? And where is the gold price heading?

It was a golden week for precious metals investors. On Wednesday, the silver price reached an all-time high in euros, climbing well above €1,130 per kilogram. Gold, too, broke out to a new record high after months of consolidation. On Wednesday, the gold price rose above €98,500 per kilo and $3,570 per troy ounce—getting ever closer to the €100,000 threshold we previously predicted in our podcast.

Gold price development in euros this year (source: Holland Gold)

A key driver of this price surge is growing global concern over rising sovereign debts and the associated fiscal and monetary policies. The ongoing political and debt crisis in France—extensively discussed in last week’s edition—is a prime example.

CNBC reports that investors worldwide are selling off their bonds while gold continues to climb. “In the battle for safe-haven capital flows, gold appears to be the winner,” the U.S. network noted, adding that more investors are adding gold to their portfolios as a hedge against financial instability. The debt crisis is not limited to France—it also looms in Japan and the United Kingdom. Market confidence in governments is eroding, reflected in rising long-term yields.

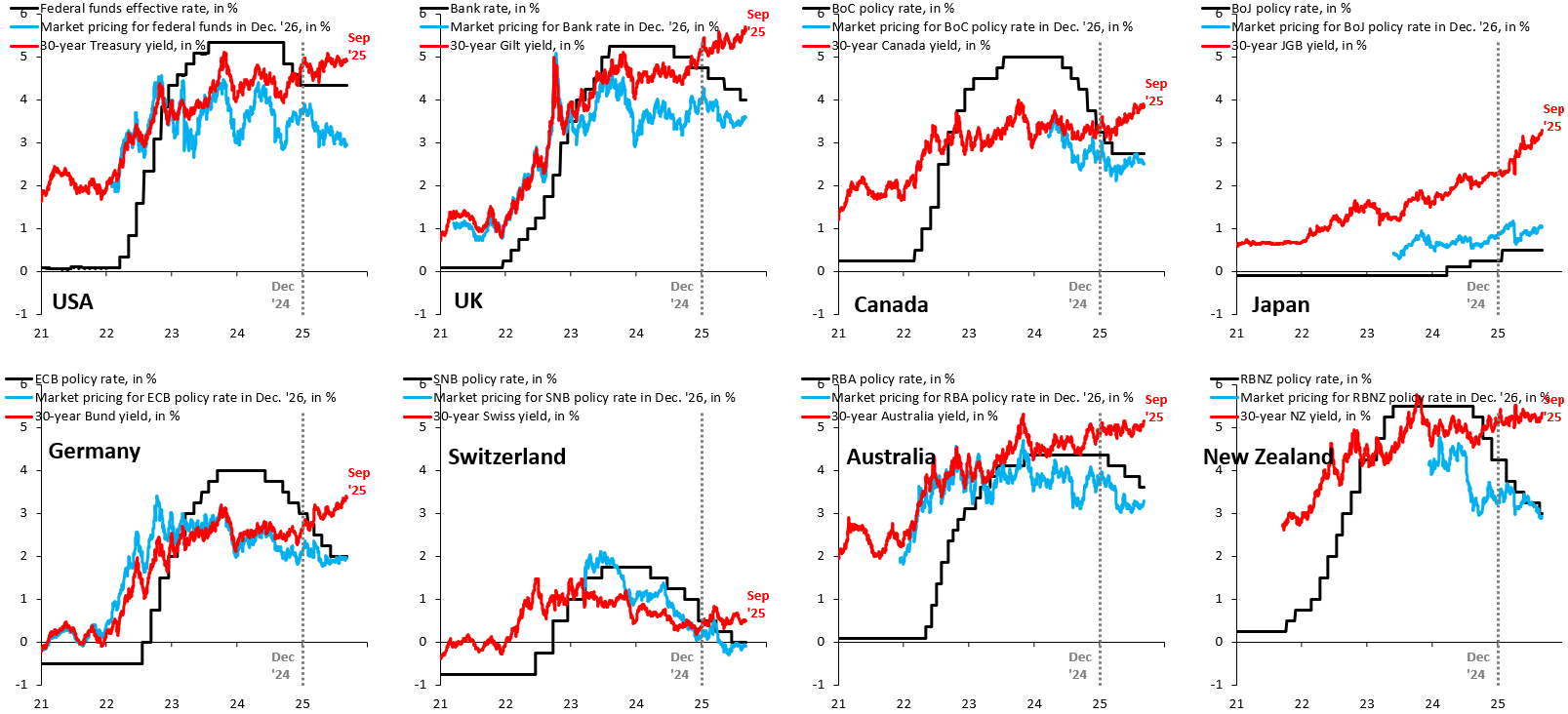

30-year bond yields across Western economies are rising (source: Robin Brooks)

In Japan, the 30-year government bond yield hit a record high, while in the UK, it rose to 5.70%, the highest level since 1998. Even German Bunds were caught in the selloff, with their 30-year yield reaching a 14-year high. In the United States, the government now pays around 5% on newly issued 30-year Treasuries.

Economist Robin Brooks points out that it’s highly unusual for 30-year Treasury yields to rise during a Fed rate-cutting cycle. Even more remarkable, he notes, is that long-term yields are rising even as all major central banks are easing policy. “This shows that monetary policy isn’t the problem. The runaway fiscal deficits are,” Brooks said.

Fellow economist Thorsten Polleit illustrated the issue using Japan as an example: “If your debt-to-GDP ratio is 250% and the interest rate is 1.6%, interest payments consume 4% of GDP. And if GDP growth is only 1%, you’ve got a serious problem.” That’s exactly why Dutch MP Silvio Erkens emphasized in our podcast this week that economic growth is crucial to keeping European debt sustainable.

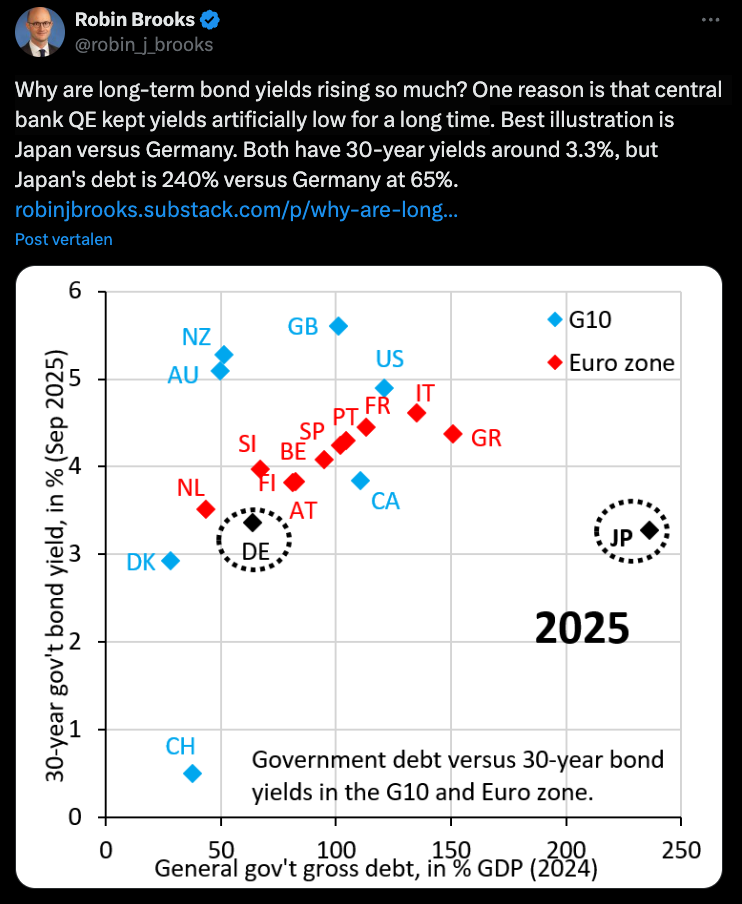

Germany and Japan pay similar yields, but Japan’s debt load is much higher (source: Robin Brooks)

Rising interest rates thus pose a serious risk to governments. According to Brooks, one key reason long-term rates are surging is the past decade of central bank intervention, which kept yields artificially low. He sees the current rise as a form of “catch-up.”

He compares Germany and Japan—both with 30-year bond yields around 3.3%—but with very different debt burdens. Japan had a gross debt of 240% of GDP last year, while Germany’s was just over 60%. Brooks argues that Japan’s relatively low yield is solely due to massive QE purchases by its central bank. As the Bank of Japan gradually steps back from controlling long-term yields, the risk of a further spike in Japan’s 30-year yield grows.

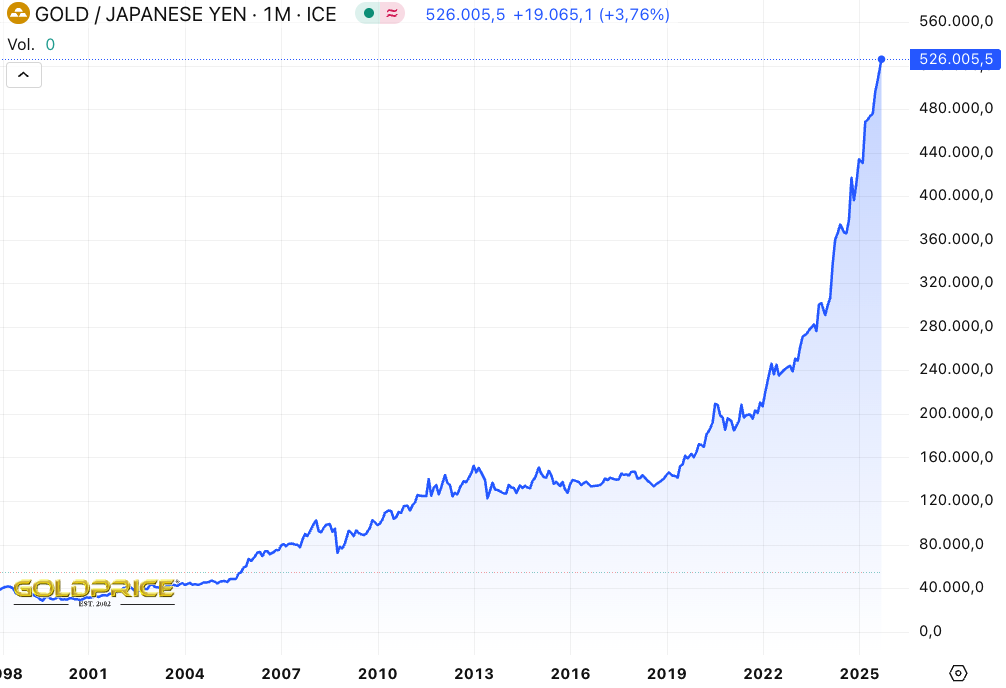

The hockey-stick chart below illustrates how this monetary policy has impacted the gold price in Japanese yen in recent years. Gold has clearly fulfilled its role as a store of value—those who kept their money in Japanese savings accounts fared far worse.

Gold price development in yen (source: goldprice)

Two other major concerns for European governments and their bond markets are unfunded liabilities—such as French pensions—and the reform of the Dutch pension system. We’ll cover those topics another time.

Jeroen Blokland notes that central banks are eagerly hoping for either falling inflation or clear signs of economic weakness, so they can loosen policy without openly admitting that debt sustainability and fiscal policy now outweigh monetary goals. Do truly independent central banks still exist?

Goldman Sachs stated this week that gold could climb to nearly $5,000 per troy ounce if Trump continues undermining the Fed’s independence. According to the Financial Times, growing doubts about central bank independence are fueling capital flows into gold. A central bank that’s politically compromised may be more inclined to accommodate poor fiscal policies through money printing, artificially low interest rates, or large-scale government bond purchases. This, in turn, could devalue the currency. Goldman now advises clients to diversify into commodities—especially gold.

Donald Trump (source: Gage Skidmore)

Trump has long interfered in the Fed’s policy direction under chairman Jerome Powell. His latest move is reportedly an attempt to fire Fed Governor Lisa Cook. CNN commented: “There is a rash of more complicated Fed narratives competing for your attention, but every single one goes back to the reality that Trump wants to call the shots at the bank.”

“A scenario in which the Fed’s independence is compromised would likely lead to higher inflation, lower stock and long-term bond prices, and an erosion of the dollar’s reserve currency status,” said Daan Struyven of Goldman Sachs in the Financial Times. Over the past three years, the dollar has already lost half its value relative to gold. This year alone, gold has returned more than 36% in dollars—almost four times more than the S&P 500.

Struyven argues that gold is a store of value that doesn’t depend on institutional trust. In his base case, he expects gold to reach $4,000 per ounce by mid-2026. But if just 1% of privately held U.S. Treasuries shift into gold, he believes the price could rise to $5,000.

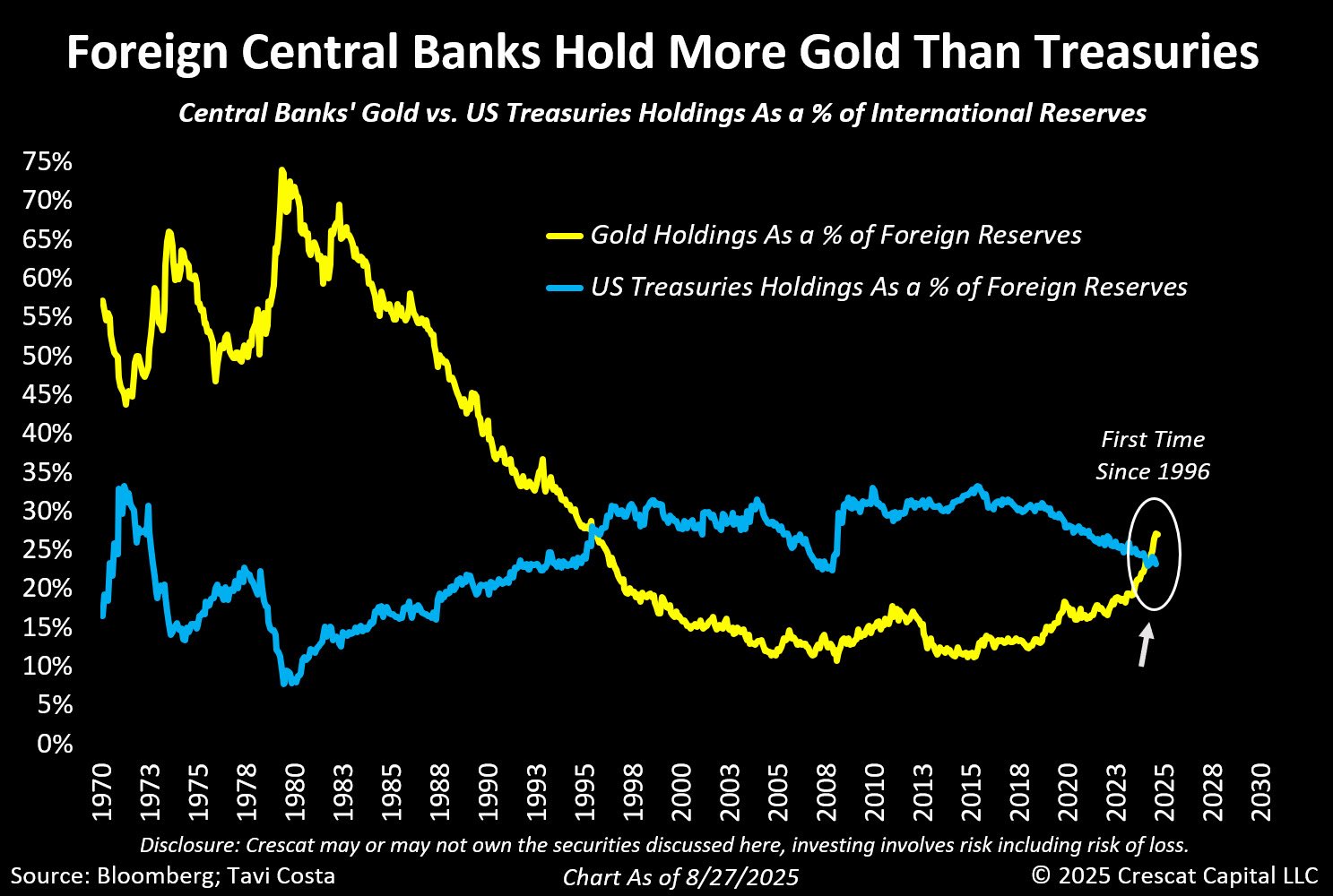

Central banks now hold more gold than Treasuries (source: Otavio Costa)

It’s also logical that Trump’s recent attacks on the Fed are encouraging other central banks to diversify their reserves further away from the dollar and into gold. Last week, for the first time since 1996, global central banks collectively held more gold than U.S. Treasuries. Poland’s central bank—one of the largest buyers in recent years—also announced plans to buy more. Governor Adam Glapiński said he intends to propose increasing the gold share of Poland’s reserves from the current 20% to 30%.

Meanwhile, some experts are pointing to the favorable gold-silver ratio and arguing that silver shouldn’t be overlooked, as it may offer even more upside potential. We’ll continue monitoring it for you!