9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

France is sinking deeper into debt and political chaos. Even the Finance Minister has floated an IMF bailout as a possibility. Is this shaping up to be a Greek-style debt crisis 2.0—only on a completely different scale: trillions instead of billions? Why does this French collision course seem so unavoidable? And will Dutch taxpayers ultimately be dragged further into the mess?

France is sliding ever deeper into both a debt and political crisis. In the Weekly Selection of August 15, we discussed the €44 billion package of tax hikes and spending cuts that Prime Minister François Bayrou called a “moment of truth” to avoid a repeat of the Greek debt crisis. That plan was meant to bring the deficit down from 5.8% of GDP in 2024 to 4.6% by 2026. It now seems he has definitively lost support for it.

French Prime Minister François Bayrou (source: Jacques Paquier)

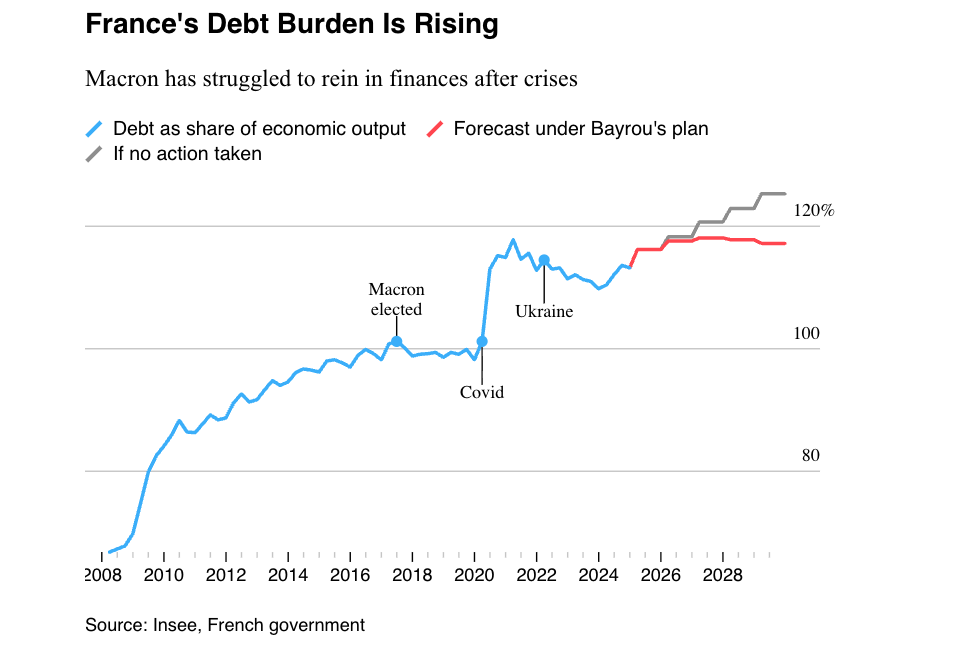

On September 8, Bayrou and his entire cabinet risk being ousted if he loses a vote of confidence. That would mean the second government collapse within a year, handing France its fifth leader in just twenty months. Finance Minister Éric Lombard has already warned that France may soon be forced to request IMF assistance. Public debt has risen to €3.3 trillion and, without the planned cuts, could reach 118% of GDP by 2026.

Growth of French government debt as a share of GDP (source: Bloomberg)

Since summer 2024, the government has lacked a parliamentary majority. The assembly is essentially split into three blocs: the centrist alliance around President Macron supporting the government, a coalition of left-wing parties, and the right bloc led by Marine Le Pen’s Rassemblement National. Le Pen has already declared her party will vote against Bayrou on September 8 and is pushing for new elections.

The left-wing parties have also said they will not back Bayrou and, in true French tradition, have announced a nationwide strike for September 10. Polls show that two in three French citizens now support the call to “shut down” the country, with overwhelming majorities among both left-wing and far-right voters. Politico notes that Bayrou’s likely exit just before the mass protests could take some of the wind out of the growing movement. Even among centrist politicians, there is doubt: heavier burdens on the middle class could only further strengthen Le Pen’s RN.

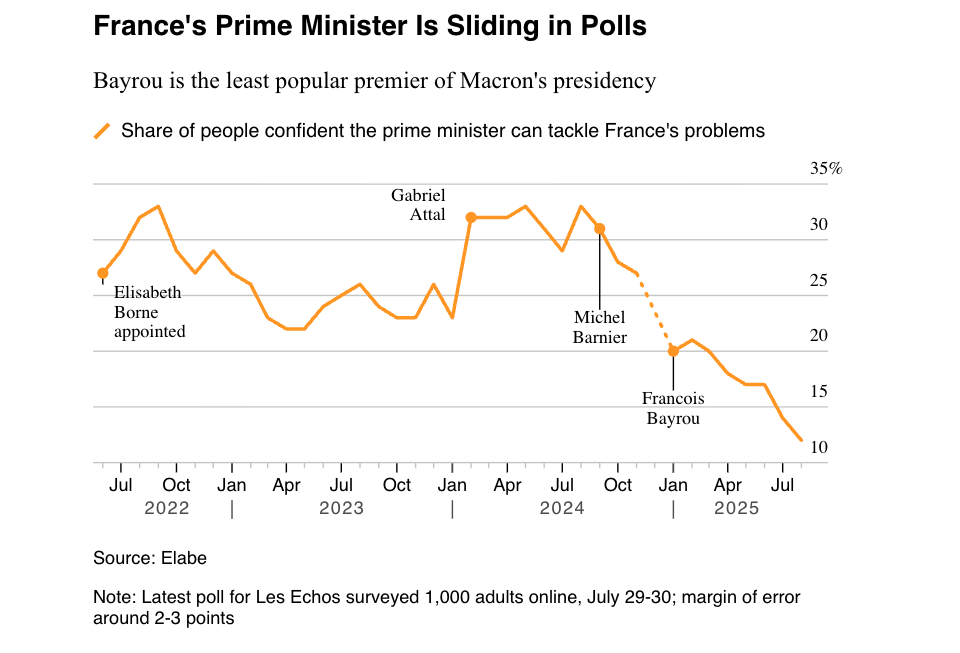

Trends in tenure and trust for French Prime Ministers (source: Bloomberg)

The French public has lost trust in politics—and they are not alone. Interest payments on France’s massive debt already consume tens of billions annually, and bond yields keep climbing. Bayrou insists it is his responsibility to preserve market confidence, but for that, spending cuts are unavoidable.

The spread between German and French government bonds has been widening for months, jumping again this week—a clear signal that investors see French debt as increasingly risky. Yields on 10-year French government bonds have climbed above 3.5%, while credit default swaps (insurance against default) have steadily risen for years. Without the ECB and Dutch taxpayers, French borrowing costs would likely be far higher—and real reforms would already have been unavoidable. Economist Robin Brooks argues that the ECB’s enabling role is itself part of the problem.

Rising spread between French and German bonds (source: Holger Zschaepitz)

Bayrou pointed out that annual interest costs now exceed France’s defense budget (€60.9 billion) and even education spending (€64.3 billion, excluding pensions). He also reminded French citizens that “not governments but people consume debt,” effectively shifting responsibility onto the population.

In an interview with TF1, he went even further, saying that French debt was built up to guarantee the “comfort of baby boomers” at the expense of the younger generation—stoking a simmering generational conflict we previously covered. “The truth is easily said when you are politically finished,” analyst François Valentin commented on X.

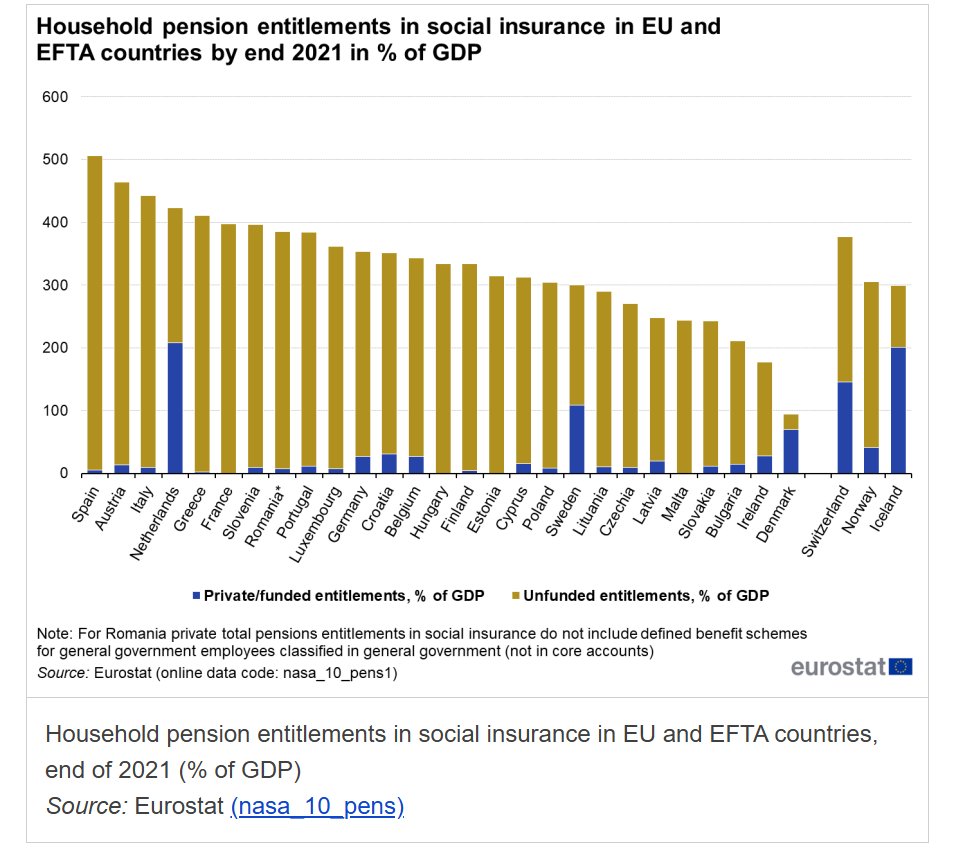

French pensions are unfunded by capital (source: Daniel Lacalle)

Bayrou’s statement is not without basis when it comes to pensions. In 2022, there were just 1.77 workers per retiree in France. The country runs a fully pay-as-you-go system, unlike the Netherlands where capital is built and invested. In France, today’s workers directly finance retirees’ pensions.

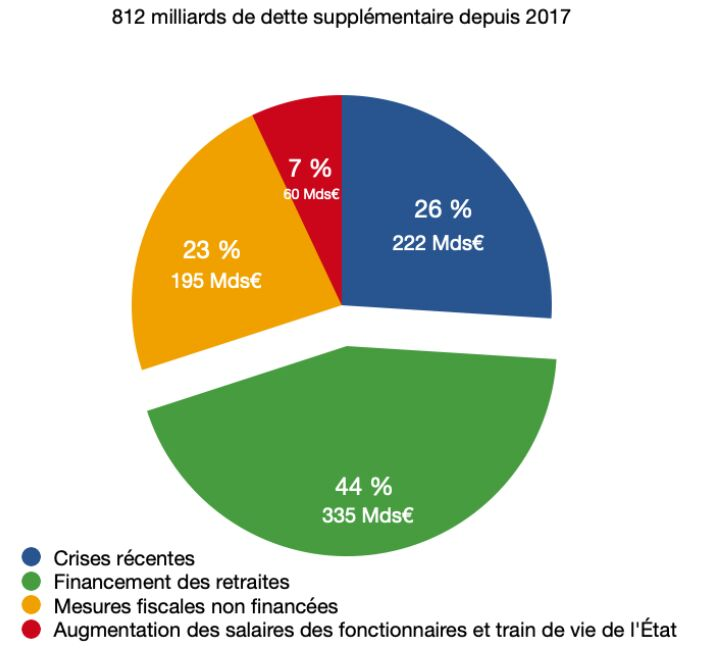

This is unsustainable, which is why the state borrows to cover pension costs. Ultimately, the bill falls on younger generations. Since Macron took office in 2017, public debt has surged by €812 billion, 44% of which went to pension payments. A full quarter of all government spending goes to pensions.

44% of new debt goes toward pension payments (source: Michael Arouet)

Economist Daniel Lacalle calls socialism the root of France’s problem. The state now consumes 58% of the economy—among the highest shares in the world. This has turned France into a state-driven economy where unions wield excessive power and block necessary reforms. The electorate dependent on public spending is so large that no politician promising, like Argentina’s Milei, to take a “chainsaw” to spending could ever win office.

“The promise of socialist redistribution leads only to stagnation,” says Lacalle. France, he argues, has the potential to be a global leader, but more and more of its brightest and most entrepreneurial citizens are leaving a stagnating, overregulated country. “Statist thinking” is, in his words, the greatest obstacle. Andreas Kinneging made a similar point this month in our podcast.

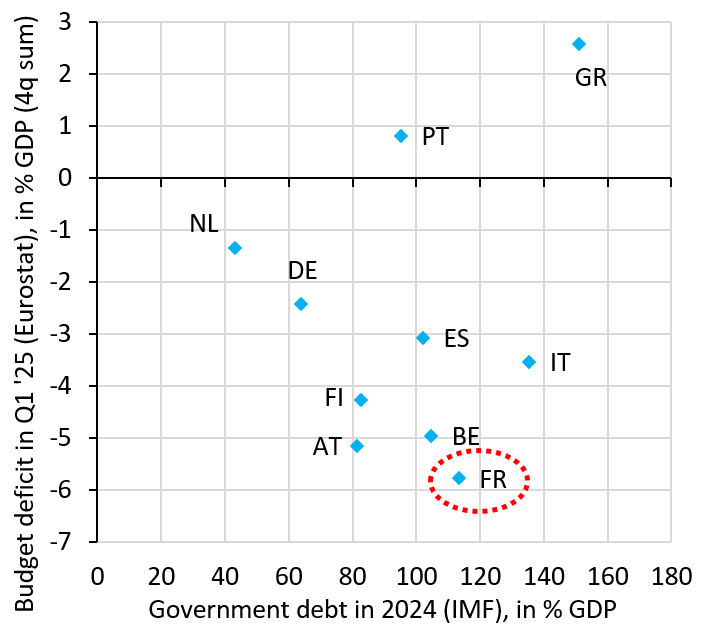

Budget deficits and debt levels in EU countries (source: Robin Brooks)

Mario Draghi, former ECB president, called this week for full European integration, including joint debt. France itself is lobbying hard for such debt mutualization. But Dutch taxpayers should ask themselves: is it really wise to share a wallet with France? I say this not only as a Dutchman but also as a French taxpayer.

Shouldn’t this be a central issue in the Dutch elections this October? Continuing to support France down this dead-end path is, after all, a political choice.

The potential reaction of the current French ECB president to France’s crisis, its impact on your portfolio, and the stock market bubble were topics in this week’s monthly update with Frank Knopers. Watch the episode here. To be continued!