9.4

7.756 Reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

The Dutch Central Bank (DNB) warned this week that the outlook for financial stability is troubling. “The question is not if, but when and where these shocks will occur,” said DNB’s president. Meanwhile, Japan is sliding deeper into difficulty due to its exceptionally high debt levels, France’s top general is urging the country to prepare for sacrifices — even of its own children — and Ukraine is facing a bizarre corruption scandal centred around a golden toilet.

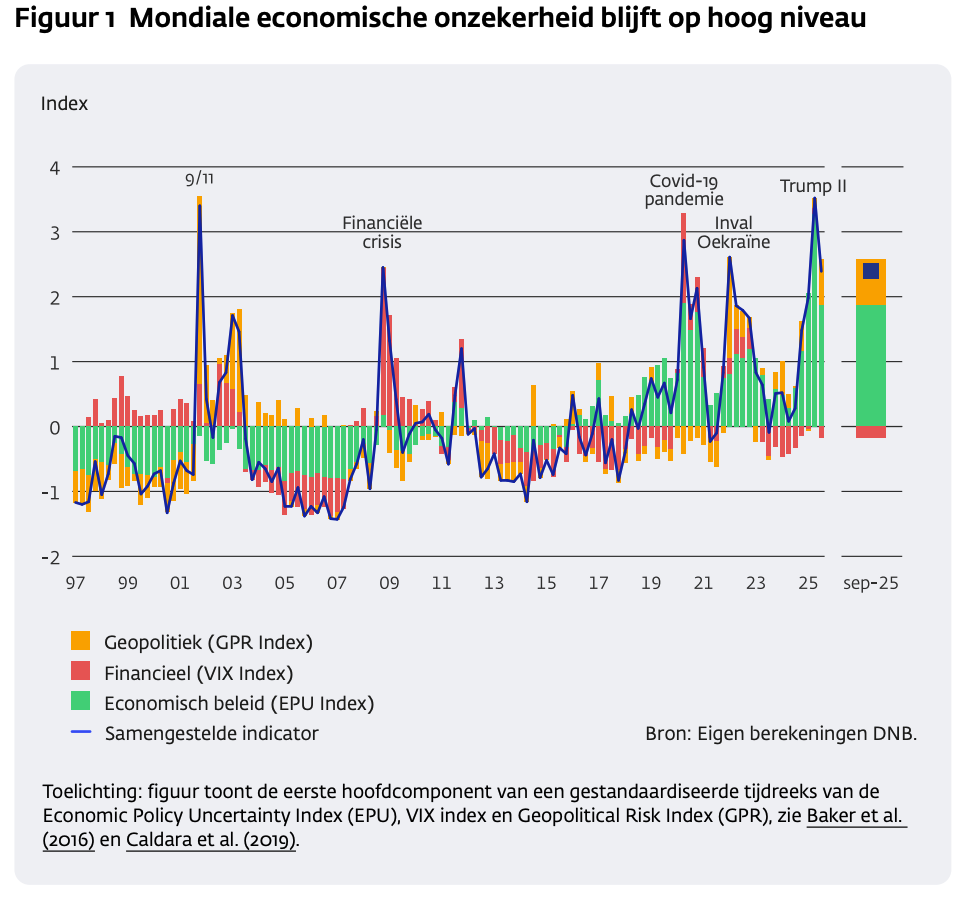

The Dutch Central Bank published its semi-annual Financial Stability Report this week. DNB writes that risks to Dutch financial stability remain elevated. In its press release, the bank even uses the term troubling. DNB president Olaf Sleijpen noted: “We have not seen this level of uncertainty in the world for a long time, on all fronts. The likelihood of economic and financial shocks remains high. The question is not if, but when and where these shocks will occur.”

Global economic uncertainty remains elevated (source: DNB)

So what exactly is so troubling? DNB identifies several threats to financial stability. At the top of the list is the uncertain international environment — particularly the unpredictability of U.S. trade policy, the trade conflict, and the war in Ukraine. DNB also warns of the risk of cyberattacks and sabotage from hostile or potentially hostile states.

High public debt levels are another concern. In the eurozone, average debt stands at roughly 90 percent of GDP, and the bank expects this to rise further due to sharply increasing defense spending. This will likely push interest burdens higher, and countries such as France could run into trouble as a result.

.png)

Long-term sovereign yields are rising (source: DNB)

“While uncertainty is rampant, equity market prices have never been as high as they are today,” the bank writes. They specifically mention the enthusiasm for AI and technology companies. U.S. equity valuations are now in the top 10 percent of their historical range. According to DNB, these high valuations increase the risk of abrupt corrections. The bank also notes that the safe-haven status of U.S. Treasuries is under pressure and highlights the risks associated with stablecoins.

DNB sees Dutch economic growth slowing. Productivity growth is weak, investments are low, export prices are rising, and economic policy is uncertain — all of which weigh on competitiveness. Structural reforms and investments will be needed to restore productivity growth.

Long-term Japanese government bond yields surged earlier this week and are now at their highest level in decades — levels not seen since the 2008 financial crisis. The yen also fell to a ten-month low against the dollar. Investors had long expected that the new government of Sanae Takaichi would need to borrow heavily to stimulate the economy, and today they were proven right.

Rising Japanese long-term yields (source: Financial Times)

On Friday, Takaichi approved a ¥21.3 trillion ($135.4 billion) economic support package — the largest stimulus since the pandemic. The package aims to boost growth and protect households from rising living costs. It is also intended to offset economic damage from U.S. import tariffs and stimulate investment in sectors such as artificial intelligence and shipbuilding.

Sanae Takaichi (source: Wikimedia Commons / Kantei)

The exact scale of the additional bond issuance needed to finance the package has not yet been determined, but it will likely exceed last year’s ¥6.69 trillion issuance.

“This is where the debasement trade comes from,” economist Robin Brooks writes. Japanese government debt is extraordinarily high at around 240 percent of GDP — with total debt closer to 400 percent. Due to years of ultra-low interest rates, interest expenses as a share of the economy remained manageable, but they are now set to surge. A January forecast projected a 50 percent increase in interest costs over the coming years, reaching more than $104 billion annually by 2028.

Brooks explains: “If Japan stabilizes the yen by letting yields rise, a fiscal crisis looms. But if it keeps rates low, the yen will spiral back into devaluation. Too much debt is a killer…”

Meanwhile, tensions between Japan and China continue to rise.

France’s highest-ranking military officer, Fabien Mandon, came under fire on Thursday after warning that the country must be prepared to sacrifice its children. General Mandon made the remark in relation to the Russian threat during a speech to a group of mayors.

According to Mandon, Russia is now preparing for a confrontation with NATO countries around 2030. “If our country falters because it is not prepared — let’s be honest — to lose its children, or to suffer economically because defense production must take priority, then we are at risk,” he said.

Mandon was sharply criticized by politicians from both the left and the right, who accused him of warmongering and argued that few French citizens are willing to sacrifice themselves for Ukraine.

According to Le Monde, French authorities appear to be preparing the population for the possibility of war or crisis. This week, the French government — like the Dutch government — launched a campaign with an informational booklet encouraging citizens to prepare for emergencies. The guide advises households to assemble an “emergency kit.”

Gold coins and bars are familiar to our audience — but have you ever heard of a golden toilet?

“A major corruption scandal is turning into the biggest crisis for Ukraine since Russian tanks stormed toward Kyiv in early 2022,” writes The Economist. Ukrainian president Volodymyr Zelensky now faces the deepest crisis of his presidency after a money-laundering investigation implicated members of his inner circle.

Close associates of Zelensky have been linked to a scheme to embezzle at least $100 million from Energoatom, the state nuclear energy company. A damaging development for a country known for corruption and heavily dependent on foreign aid.

The details are particularly painful. Investigators even found a golden toilet in an apartment owned by Timur Mindich, a former business partner and Zelensky confidant. He fled the country shortly before the raid — suggesting he had been tipped off. Some of the money was reportedly used to build villas, while another portion was transferred to Moscow. In wiretapped calls, one suspect complained about back pain from carrying heavy bags of cash.

A photo of the golden toilet and bidet is circulating on social media (source: x.com)

The scandal has already ended two ministerial careers and is damaging not only Ukraine’s image abroad. At home, it risks fuelling cynicism and driving more soldiers to desert. Many Ukrainians live without stable electricity and have family members risking their lives on the front.

“Ukrainians are losing the motivation to fight because of massive human rights violations and now also because of the corruption that is being exposed,” a source told Fox News. “People in this country see all this corruption — and this is just one piece of the swamp. Zelensky is part of the problem,” he added.

Rumours suggest Zelensky may have been aware of the scheme, although no hard evidence exists. He reportedly celebrated his birthday in 2021 in the apartment with the golden toilet.

Five people have been arrested so far, with more arrests expected. Suspects may seek plea deals in exchange for revealing additional damaging information. According to The Economist, Zelensky now faces difficult choices: either sacrifice senior figures in his own circle, or risk having the entire scandal bring down his presidency. As one source put it: “The choice is grim. Either he amputates a leg, or he gets an infection that spreads through the whole body and dies.”