9.4

7.650 Reviews

English

EN

A second term for Donald Trump could have far-reaching consequences for the Dutch economy, according to economists at the Rabobank, The. The outcome of the elections is still highly uncertain. While a Donald Trump victory over Joe Biden seemed like a likelihood a few weeks ago, Kamala Harris has significantly improved the odds for the Democrats. Nevertheless, a second Trump term is still quite possible. What would be the possible consequences of Trump's policy for the Dutch economy?

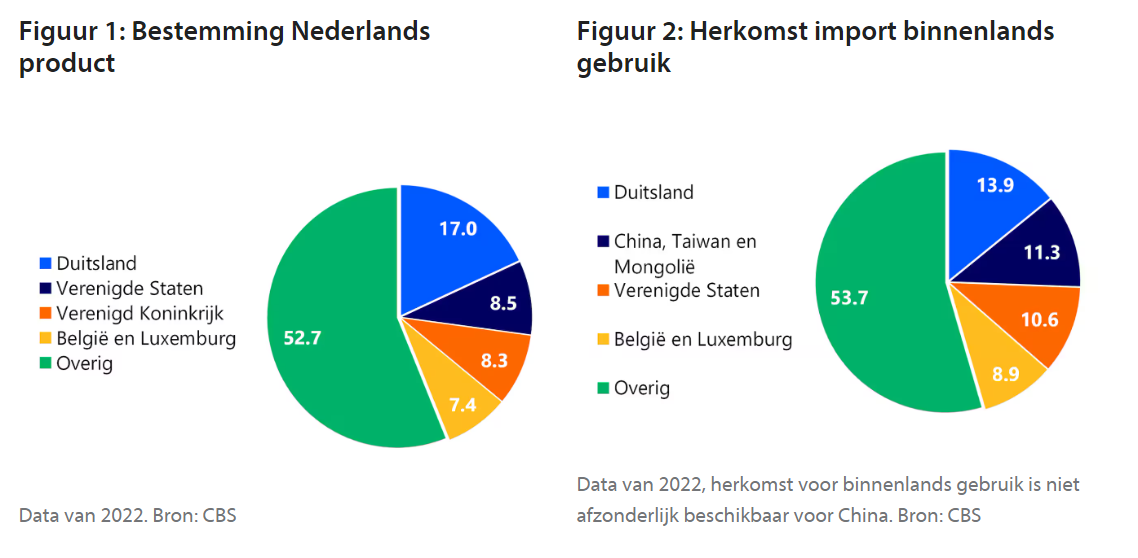

America is of great importance to the Dutch economy. In 2022, 8.5 percent of all exported Dutch goods went to the US, with only Germany accounting for a larger percentage at 17 percent. America also confiscates a large percentage of imported goods. 10.6 percent of imported goods into the Netherlands came from the United States. The Dutch only imported more from China and Germany.

The Netherlands does a lot of trade with the Americans. Possible trade restrictions therefore have a major impact on the Dutch economy. (Source: RaboResearch)

The Netherlands does a lot of trade with the Americans. Possible trade restrictions therefore have a major impact on the Dutch economy. (Source: RaboResearch)

Trade barriers can have major consequences. In the worst-case scenario, countries choose to stop exporting certain products. This is already happening for specific products, such as ASML's lithography machines. For example, America determines which machines ASML is allowed to export to China, as can be read in the book 'Focus: the world of ASML' by Marc Hijink. In this way, America wants to prevent China from getting its hands on the technology to produce advanced chips. The export of the new EUV machines has therefore been restricted. China has subsequently imposed restrictions on the export of metals that have important applications in areas such as aerospace, semiconductors and defence technology.

We also see these practices in products such as oil, gas and coal. Since the war in Ukraine, this trade between the EU and Russia has completely collapsed. In the worst-case scenario, these types of measures are more common. However, this is not very realistic. Above all, Trump wants to stimulate employment at home. Severe export restrictions are counterproductive and create fewer jobs. For the time being, export restrictions are therefore mainly conceivable if there is a shortage on the domestic market. For example, Biden has restricted the export of liquefied gas. This will prevent cost increases for U.S. citizens.

Rabobank considers a new trade war to be the most likely scenario for a second Trump term. Exact measures are still shrouded in mystery, but Trump has already indicated 60 percent to introduce higher import tariffs on Chinese goods. Other trading partners, such as European countries, are likely to face import tariffs of 10 percent. In this way, America wants to give its own industry a helping hand. After all, foreign products are becoming less attractive due to the higher price. Europe could also impose import tariffs on American products in retaliation, as happened during Trump's first term. Given the importance of trade with America for the Netherlands, such a trade war is a hard blow for both importing and exporting companies.

Should a trade war actually occur, it will have major consequences for the Dutch economy. To what extent depends on the products on which taxes are levied. Rabobank is mainly looking at crucial imports. This means that the Netherlands now mainly sources these products from America and that there are few or no alternatives available outside the US. A possible levy would directly make these products more expensive for European consumers due to the lack of alternatives.

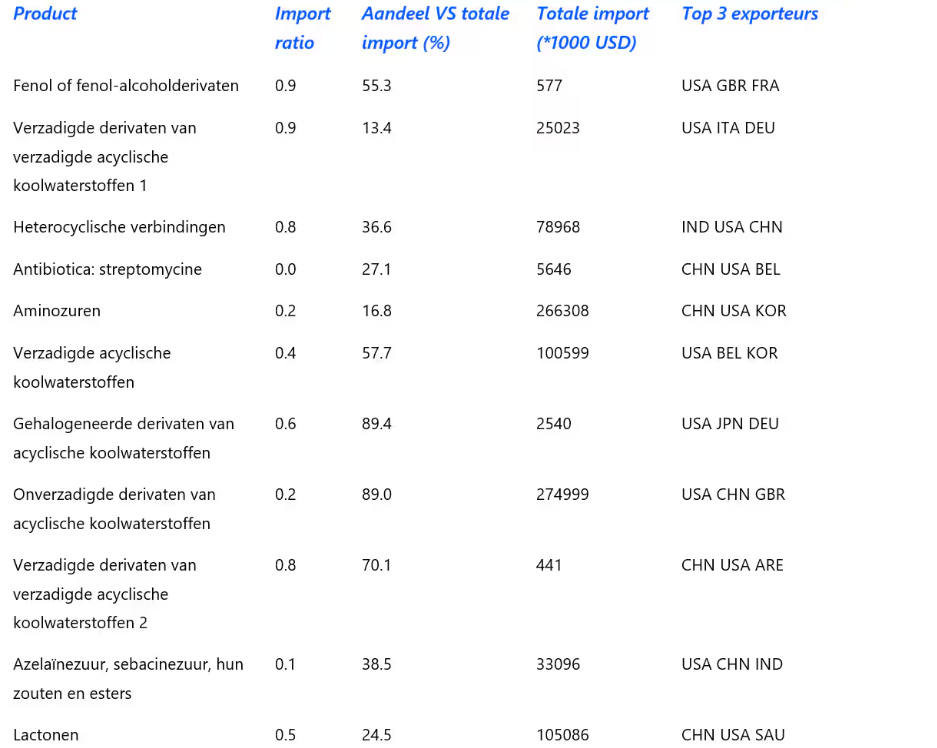

This applies, for example, to many chemical products, but also to minerals and metals. The Netherlands, for example, gets more than half of its phenol from America. Phenol is a substance that is used, among other things, as a disinfectant in soap or as an input in the production of, for example, plastic or some types of medicines, such as aspirin. Borate, a raw material used in the production of fertilizer, but also of electric motors and wind turbines, is also 60 percent imported from America.

There are many other means for which the Netherlands is dependent on America for supply. Whether you're looking for lip balm, deodorant, antibiotics or metals, chances are that several important raw materials can be traced back to America. In many cases, companies cannot easily switch to other suppliers. And if other suppliers are available, chances are that they are based in countries that are not allies, such as China. A trade war therefore has far-reaching consequences, including for the Dutch economy.

Some of the products for which the Netherlands is largely dependent on imports from the United States. The full list can be found in the article from RaboResearch.

Some of the products for which the Netherlands is largely dependent on imports from the United States. The full list can be found in the article from RaboResearch.

Until recently, a second term seemed a high probability. Biden's muddled impression made for favorable polls for Donald Trump. By the day Biden withdrew, his chances had fallen to 24 percent, he wrote The Economist. But after Kamala Harris took over and got her campaign off to a good start, the chances for the Democrats have risen to 52 percent. According to The Economist, the elections are another coin toss; it's about who will get into the White House next year.

How the economy develops will be important. In 2023, many economists had already Recession expected in America. That didn't happen for a long time. In fact, the US economy grew faster than in Europe. The US economy also grew by 2.8 percent year-on-year in the second quarter of 2024, very strong growth rates. However, the economic outlook seems less promising. For example, unemployment rose to 4.3 percent in July, the highest point since 2021. And although inflation is falling, it is still 2.9 percent.

In a previous article, I wrote The Economist that inflation was lower in the Swing States like Pennsylvania. That could work in favor of the Democrats. But it also turns out that the American citizen does hold the Democrats responsible for the enormous price increases of recent years. The general price level is 20% higher than in the previous elections. Inflation may not be entirely due to Biden's policies, but the purchasing power that voters experience just before the election is a good indicator of the incumbent's electoral success. So it will be very exciting to see which way the American economy moves in the coming months. A deteriorating economic outlook could be a big problem for Kamala Harris.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.