9.4

7.466 Reviews

English

EN

De Nederlandsche Bank (DNB) is likely to make a loss up to and including 2028 and will therefore not pay a dividend to the State in the coming years; its sole shareholder. This became apparent when the Bank The preliminary results of 2023. The central bank also stated that the buffers it holds are likely to be enough to absorb the losses, which is obviously a positive thing. Why is DNB making losses and what can we expect from DNB in the coming years?

Thomas Bollen explained in a podcast by Holland Gold that DNB is likely to make a loss in the coming years. The cause can be found in the monetary policy of recent years. Central banks bought government bonds on a large scale to stimulate the economy. By buying government bonds, central banks push down interest rates in the long term. Countries in a vulnerable financial position were also supported by low interest rates. The Dutch State saved an estimated 28 billion euros through lower interest charges. For many years, the State also benefited from a dividend paid by DNB. As a result of the purchase programme, the central bank made a profit for years and paid it out to its shareholder: the Dutch State.

This advantage turned into a disadvantage when inflation rose sharply and central banks raised interest rates. Central banks' costs are rising as commercial banks also receive more interest on the balances they hold with the central bank. On the other hand, revenues are not increasing as fast. DNB still has many bonds on its balance sheet that were issued at a low interest rate. This creates a loss for the central bank. For DNB, the loss in 2023 amounted to 3.5 billion euros. The last time DNB made a loss was in 1931 when England let go of the peg with gold.

So, when the central bank makes a profit, it pays it out to the State in the form of dividends, or uses it to build up buffers. If the central bank makes a loss, it can use those buffers to absorb this loss. In the event that these buffers are not enough, there can be a capital injection from the State to provide the central bank with more capital. This means that the taxpayer bears the loss. This is likely to lead to a great deal of dissatisfaction, as it will provide commercial banks with interest payments, banks that were also bailed out with taxpayers' money during the crisis.

A central bank could therefore also operate with negative equity for a while. Incidentally, the central bank is the only institution that can maintain negative equity because of the special function it fulfils. In addition, central banks have a gold stock that has risen sharply in value in the meantime. In a previous article we described that these revaluation reserves, the reserves that have been built up by the increased value of the gold held by DNB, can also be used to absorb losses.

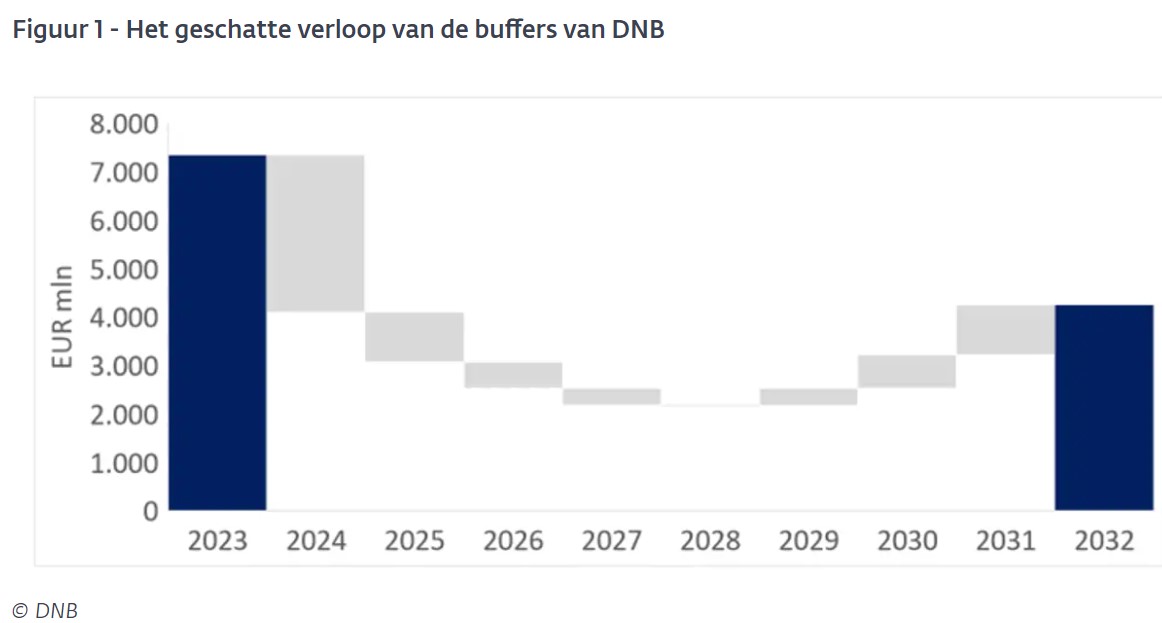

Since the introduction of the euro, DNB has 22,6 billion euros. Of this, 16.3 billion euros was paid out as dividends. The remaining 6.3 billion euros was used to strengthen buffers. At the end of 2021, i.e. before interest rates went up, the buffers amounted to 11 billion euros. After two loss-making years, more than 7 billion euros remained. This is expected to be more than enough to absorb the losses of the coming years. DNB does not expect to make a profit until the end of 2028. After that, the profit will be used to strengthen the buffers. If everything goes as DNB currently expects, it will not pay dividends again until after 2031. However, the developments are very difficult to predict. DNB's financial figures depend, among other things, on interest rates.

(Source: DNB)

(Source: DNB)

2024 promises to be an interesting year from an economic point of view. Although inflation has fallen, it is still above the policy target of 2 percent. In January, inflation in the eurozone was 2,8 percent on an annual basis. This was still 8.6 percent one year previously. The European Central Bank's sole mandate is price stability. Nevertheless, the pressure to stimulate the economy is also increasing now that the industry is struggling.

This is a particular problem in Germany. The German Purchasing Managers' Index (PMI) figure of S&P Global fell in February to 42,3 compared to 45.5 a month earlier. A value above 50 indicates expansion of economic activity, a value below 50 indicates contraction. It is clear that the German figure is very pessimistic. Production in Germany has been declining for quite some time. The high costs are causing a decline in production. Compared to the period before the corona crisis, the level of production is in the five most energy-intensive sectors 23,1 percent lower.

(Source: Cystalcleareconomics)

(Source: Cystalcleareconomics)

Klaas Knot recently said there is a credible prospect of inflation returning to the policy target in 2025. Wage moderation is particularly important for this. According to Knot, interest rates can only be lowered if wages also adjust to lower inflation expectations. The policy rate is currently at 4.5 percent and the next interest rate decision is scheduled for March 7. The expectation is that the ECB will leave interest rates unchanged at that time. The market seems to be the First rate cut in the second quarter of 2024 and estimates the interest rate at 3.75 percent by the end of this year.

It will be interesting to see how 2024 unfolds. 2023 went by without a major recession, contrary to what Economists had expected. Whether a recession can also be avoided in 2024 remains uncertain. Any interest rate cuts will only be noticeable after a year and a half. In the coming months, it will become clear what the ECB will do.