9.3

8.064 reviews

English

EN

By: Frank Knopers

The gold price has fallen further in recent weeks and is currently back to pre-war levels. In dollar terms, the price fell below $1,700 per troy ounce at the beginning of this week, the lowest level in eleven months. A remarkable trend against the backdrop of all the geopolitical and economic turmoil. Why is the price of gold falling? And is this already a good time to get on board?

Gold is known as a safe haven in uncertain times and at the beginning of the war, the precious metal lived up to that reputation. At the beginning of March, the gold price reached new records of $2,070 per troy ounce and almost €60,000 per kilo. Since then, the price of gold has fallen again for various reasons.

Russia's invasion of Ukraine created great uncertainty in the financial markets. The first reaction of many investors was to buy gold, the safe haven in times of stress. But when it became clear that the Russian advance on Kiev had stalled and the focus was shifted to the south of Ukraine, the financial markets calmed down a bit. Russia also continued to supply oil and gas to European countries during that phase. As a result, the gold price also fell as a barometer of geopolitical turmoil.

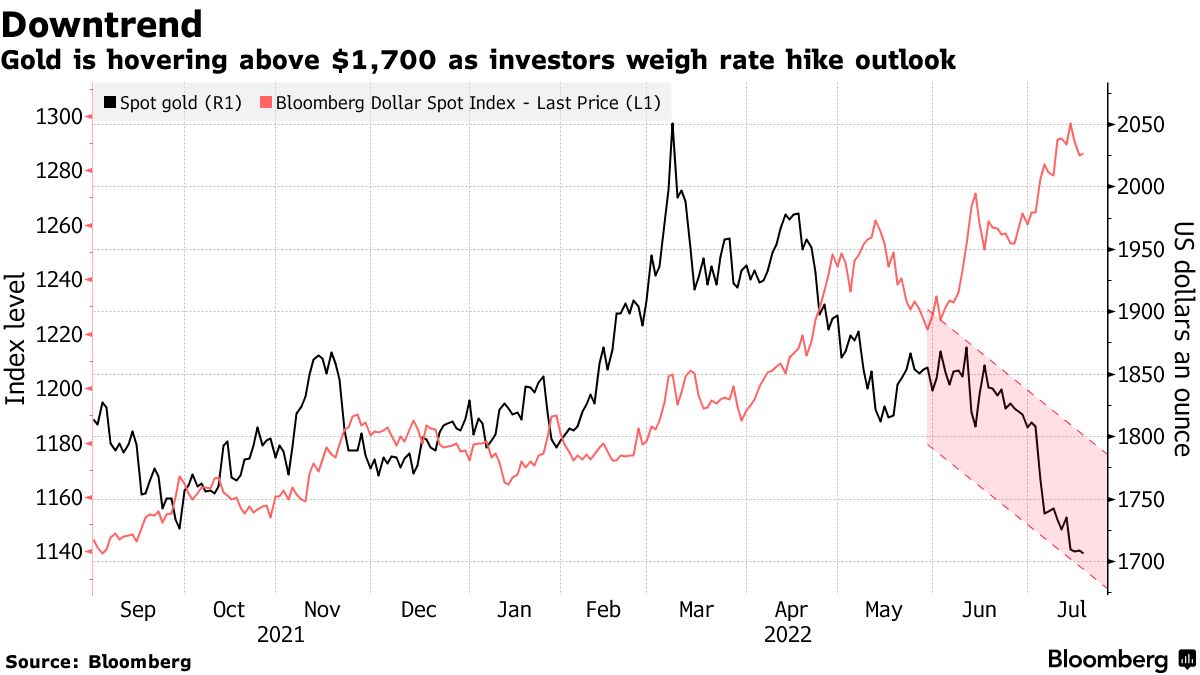

Since the beginning of the war, the exchange rate of the euro has been under pressure and investors have sought refuge in the dollar. The U.S. dollar has been strengthening in recent weeks with the prospect of more interest rate hikes by the U.S. central bank. The graph below shows that the rise of the dollar in recent months has been accompanied by a further decline in the price of gold. Due to the fall of the euro against the dollar, we see the gold price in euros fall much less. The exchange rate of the euro with the US dollar fell to parity last week for the first time since 2002, meaning that the euro currently has relatively little purchasing power.

Gold price under pressure due to strong dollar (Source: Bloomberg)

The gold price fell more in dollars than in euros

Since the war in Ukraine and the subsequent sanctions against Russia, energy prices have fallen up even more. And that also has an effect on inflation, because high energy prices are ultimately reflected in the prices of various goods and services. In fact, inflation is currently at its highest level in forty years. And while central banks can't influence high energy prices, they need to do something now to give the market the impression that they will bring inflation under control. And they're doing that by raising interest rates, even as the economic outlook worsens. This is a risky strategy, because it is not certain whether higher interest rates will also lead to lower energy prices.

Central banks such as the Federal Reserve and the ECB have already announced that they want to raise interest rates in several steps. The market has already prepared for this. The question, however, is whether those interest rate hikes will actually happen. The U.S. economy is already heading for recession, while the outlook for the eurozone isn't much better. According to Erik Nielsen, chief economist of Italian bank Unicredit, there is a good chance that the Fed will cut interest rates next year. has to lower again. The ECB also has little room to raise interest rates if that would make Italy's public debt unsustainable.

In recent months, the price of gold has fallen, but much less than most stocks and bonds. In an environment where the prices of all financial assets are falling, the precious metal is not doing so badly at all. As we mentioned earlier, Wrote On average, gold even yields a positive return during major stock market corrections. Also, interest rate hikes by the US central bank do not appear to be so bad for gold at all in practice. In the run-up to an interest rate hike, the gold price often falls, and then to rise again. So this could be a good time to buy gold. Especially if the geopolitical turmoil increases, Russia turns off the gas tap

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.