9.4

7.521 Reviews

English

EN

Demand for gold in India has declined slightly over the past year, but the outlook is still positive, according to a report by Metals Focus. 2022 could not match the peak year 2021 and 2023 also shows a decline in demand for the precious metal in India. Still, the outlook for gold is certainly not bad. What were important factors for the gold market in India and what can we expect for the rest of 2023?

2021 was an absolute top year for gold in India. At that time, more than 55 billion dollar worth of gold bought by Indian individuals and that was twice as much gold as in 2020, when the world was weighed down by lockdowns and restrictions. 2022 could not continue the good trend of 2021. The market struggled with higher volatility. In dollar terms, the Gold price a high point just after the Russian invasion of Ukraine. After that, investors focused more on the interest rate policy of the US central bank, the FED, in particular. Higher interest rates put downward pressure on the gold price.

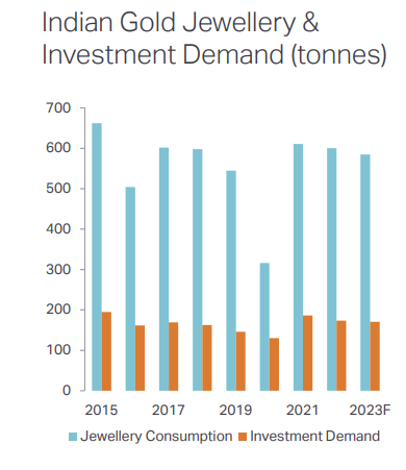

The demand for gold fell sharply during the corona crisis, but is now above the level of 2019. (Source; Metals Focus)

Still, the price of gold in Indian rupees has risen. The FED rate rose by 425 basis points in 2022. As a result, the international price of gold came under pressure. However, the local price of gold in rupees increased, as the Indian government increased the import duty on gold. As a result, importing gold became more expensive, which translated into a higher price. In addition, the rupee depreciated against the dollar. As a result, the price of gold in rupees rose by fourteen percent in 2022.

Nearly half of the total global demand for gold is accounted for by Jewelry. This market is especially popular in India and China. In India, gold is a popular gift for weddings and important ceremonies. It is also held as savings because of its value retention. During the corona pandemic, the market for precious metals collapsed due to the lockdowns, but now the market has largely recovered.

Due to the high gold price, the demand for gold for jewellery decreased by two percent in 2022. Due to the high price, people also switched to gold of lower purity. For example, the demand for 14 and 18-carat gold increased. That's a lower purity than 24-carat gold, which caused demand to fall. In addition, the demand for gold as an investment vehicle decreased slightly in 2022 compared to 2021. For example, the demand for gold coins and gold bars fell by seven percent. High prices played a crucial role in this decline, but the segment also faced structural challenges, such as growing awareness of other financial products and increasing government controls on cash transactions.

On the other hand, the Indian central bank, like Other central banks, bought plenty of gold last year. In 2022, the central bank made more than 33 tonnes gold. In doing so, central banks are responding to the geopolitical turmoil and relying on gold's status as a Safe Haven. Gold is also attractive because it has no counterparty risk. In addition, foreign exchange reserves were blocked by Western countries in 2022. Zoltan Pozsarindicated in an interview that a central bank with gold does have control. Jelena Postuma also gave in a podcast of Holland Gold BRICS countries are looking for alternatives to the dollar. It is therefore expected that emerging economies will continue to add gold to their reserves in the coming years.

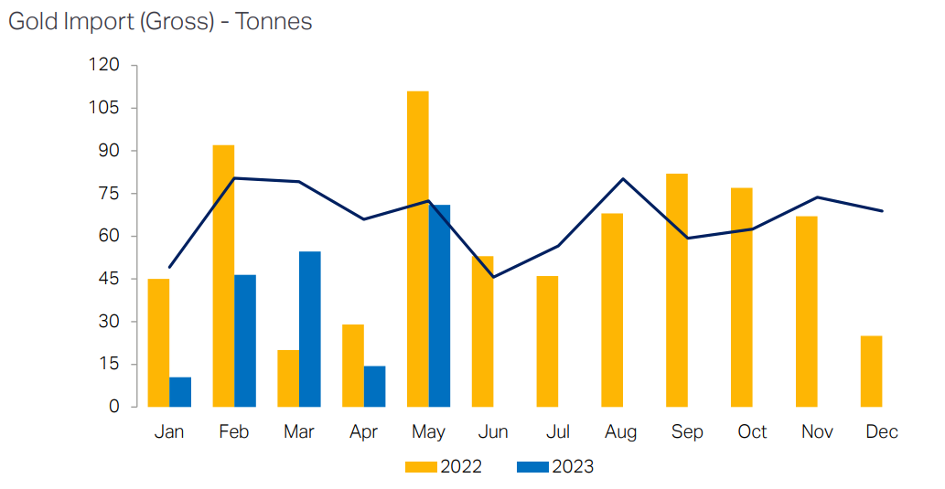

Metals Focus Above all, expect a big contrast between the two halves of 2023. Demand for jewellery showed a sharp decline of seventeen percent year-on-year in the first quarter. Gold imports fell due to declining demand. Only in March, the month in which banks in America got into trouble, was gold imports higher than in the same month a year earlier. In the other months, imports were lower than the same month in 2022, as shown in the chart below.

In the first months of 2023, India's gold imports were lower than a year earlier. (Source; Metals Focus)

Demand can still be dampened this summer if harvests are disappointing as a result of El Niño. El Niño is a climate phenomenon in which seasurface temperatures in the Pacific Ocean are warmer than average. That could affect global weather patterns and could cause lower precipitation levels in India. Since the agricultural sector is very important to the country, a disappointing harvest could have an impact on the demand for gold in India.

Though Metals Focus expects demand to recover in the last two quarters, this recovery will not be sufficient to avoid a year-on-year decline in demand. According to the report, the demand for jewellery will fall by three per cent in 2023. It also expects a nine percent decrease in the demand for gold from Central Banks, as well as a two percent drop in physical gold investments. Normally, investors step in when the price of gold rises. However, the price increase at the beginning of this year came as a surprise, making investors hesitant to get in. If the gold price falls slightly later this year, the demand for jewellery will increase again, according to Metals Focus.

Time will tell exactly what the gold price will do in the coming months. The fact remains that gold remains an attractive investment in times when inflation seems to remain high. For example, inflation in the Netherlands for the month of June was 5.7%, significantly higher than the inflation target of 2%. Also, the real interest rate, the interest rate adjusted for inflation, is still negative. Therefore, gold will remain attractive in the coming months.

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.