9.3

8.064 reviews

English

EN

During the panel discussion at 'The Gold Event 2024', I was asked whether the United States, China, another country or perhaps a central bank will push for a reintroduction of the Gold standard. In other words, whether we go back to a system in which euros and dollars, as well as all debts issued with that currency, are 'backed' by the value of gold.

My answer to this question is that we don't have to look so much at a country or central bank, but rather at the market. The market can provide a new, implicit form of a gold standard without interference from governments or central banks.

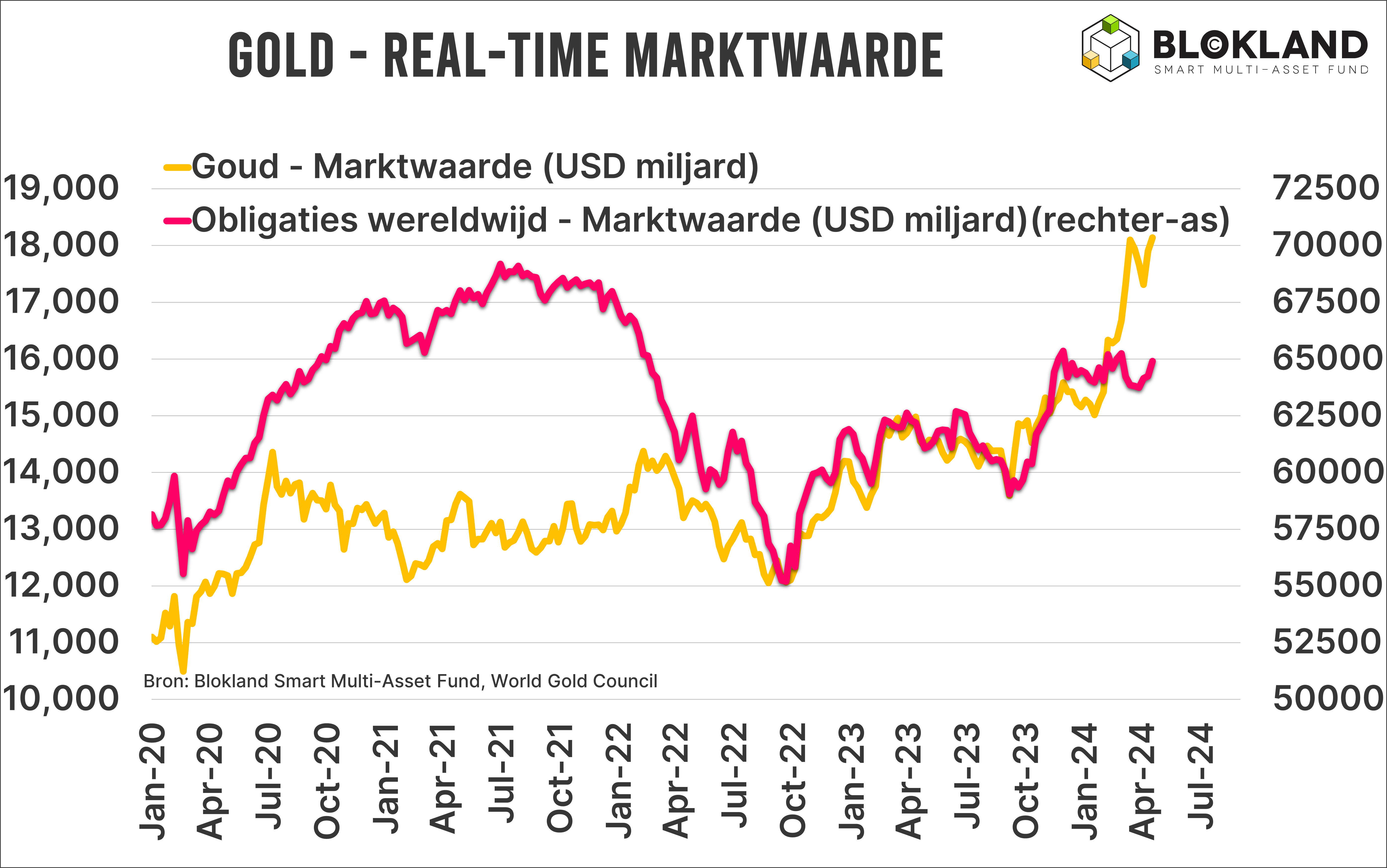

How does that work? Take the total market value of all bonds included in the Bloomberg Aggregate Bond Index, one of the leading bond indices containing a wide variety of bonds worldwide. It currently amounts to something like 65,000 billion. Incidentally, this does not include all bonds that have been issued, but it does include the most common and liquid bonds. The market value of bonds is offset by a current market value of gold of almost USD 18,000 billion. In other words, the value of gold is about a quarter of the market value of all the bonds in the Bloomberg Index.

Now suppose that the market value of gold doubles – something I don't rule out in the next, let's say, five years – and that of bonds remains unchanged. Then for every dollar of debt, there is not a quarter, but half a dollar of gold. This relative increase in the value of gold can be seen as a kind of market-driven, implicit form of a gold standard.

Of course, I have to substantiate this supposed doubling. But that's not that difficult at all. The following are a number of important trends that are structurally increasing the demand for gold:

Finally, there is the 'Western' question, such as my Blokland Smart Multi-Asset Fund, which does not go through gold ETFs but does take place. This question is part of the large-scale rebalancing of traditional investment portfolios from fiat and debt-related assets to scarce assets.

The overview above shows that 'out-of-control geopolitical tensions' are not necessary for a further rise in the price of gold. The latter argument implies that gold is not the only asset class to benefit from this rebalancing. And that's right. With a portfolio with only one asset class, you run unnecessary risk. After all, you don't make use of spreading benefits. Moreover, there are even more interesting scarce assets available in both traditional and alternative markets.

The Blokland Smart Multi-Asset Fund therefore also invests in quality shares and Bitcoin. Quality stocks are shares of companies that are the boss in their sector, have structural competitive advantages, have little debt and also pay dividends when the economy is down. Those companies are special and scarce. Bitcoin acts as a form of digital gold in which both 'old school' gold and digital gold have their own attractive characteristics. What's more, if you put these three scarce assets together, you can achieve a huge diversification effect. Free of charge.

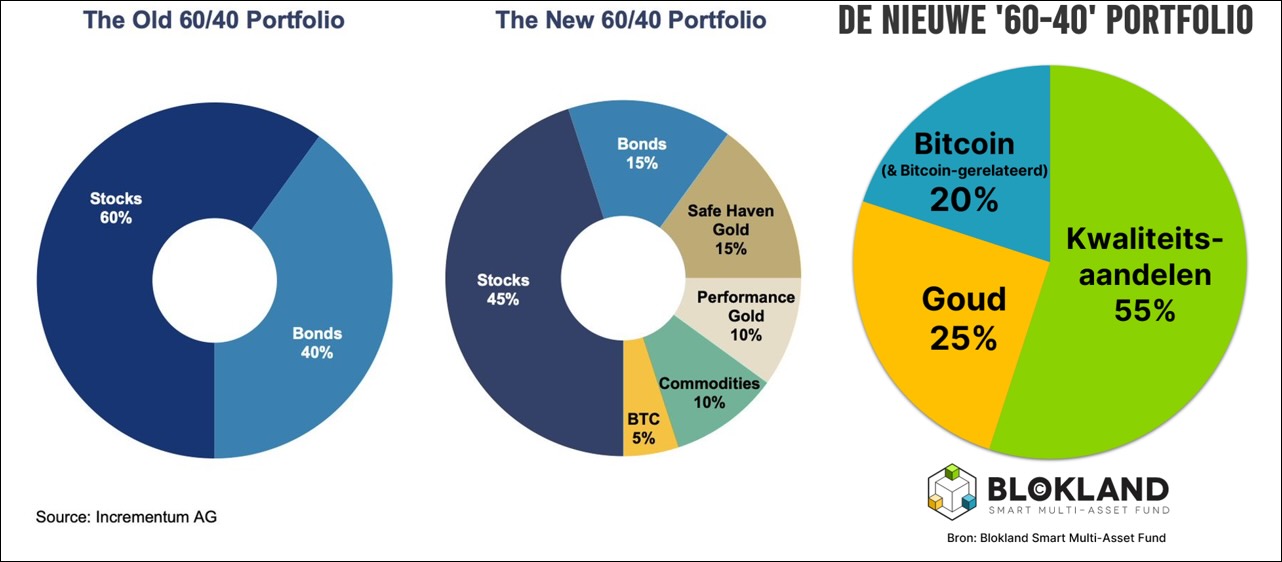

Recently, the 2024 edition of the 'In Gold We Trust' report was presented. This is a very beautiful work (of more than 400 pages) that I can recommend every investor to read. It also proposes a 'better' distribution than the outdated 60-40 (60% shares, 40% bonds) portfolio.

However, I do have a few questions about this. First of all, given the huge mountain of debt, why would you invest in bonds at all? Especially if you take into account that the volatility of bonds has structurally increased and that the spreading effect has actually decreased. I also have my doubts about what they call 'Performance Gold'. This mainly concerns gold mining companies that are not scarce and are also very sensitive to the economy and the rest of the stock markets. Finally, raw materials are not intrinsically scarce and extremely diverse, making it more difficult to assume that they will do well in the long term. Under the guise of 'keep it simple', I therefore stick with a combination of quality stocks, Bitcoin and physical gold. The expected increase in value will allow gold, from its vault, to regain a similar role it has played for so long until the end of the official gold standard.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.