9.4

7.521 Reviews

English

EN

According to Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America, America's stock market could rise much further this year. For example, she expects the S&P 500, a stock index of America, to touch 5400 points this year. With this, she adjusts her expectations, because previously she assumed 5000 points for the index at the end of this year. Stock markets have had a strong year so far, but there are also analysts who expect a downward trend. What are the different perspectives?

With Subramanian's statement, Bank of America shows itself to be Bullish. Previously fit Goldman Sachs the expectations for the S&P 500 were already in line, although the bank assumed 5200 points by the end of 2024, slightly lower than Subramanian's expectations. Central banks are expected to cut interest rates in the coming year as inflation falls and the economy starts to falter. Lower interest rates tend to be beneficial for stock prices, as companies can borrow more cheaply. Stock prices have risen sharply in recent months. That was true of the S&P 500, for example. The index has risen in 16 of the last 18 weeks and that is since 1971 no longer occurred. In the weeks that the index rose, the growth of at least 0.2 percent was also historic. Never before has the index risen so fast every week that it has recorded a plus.

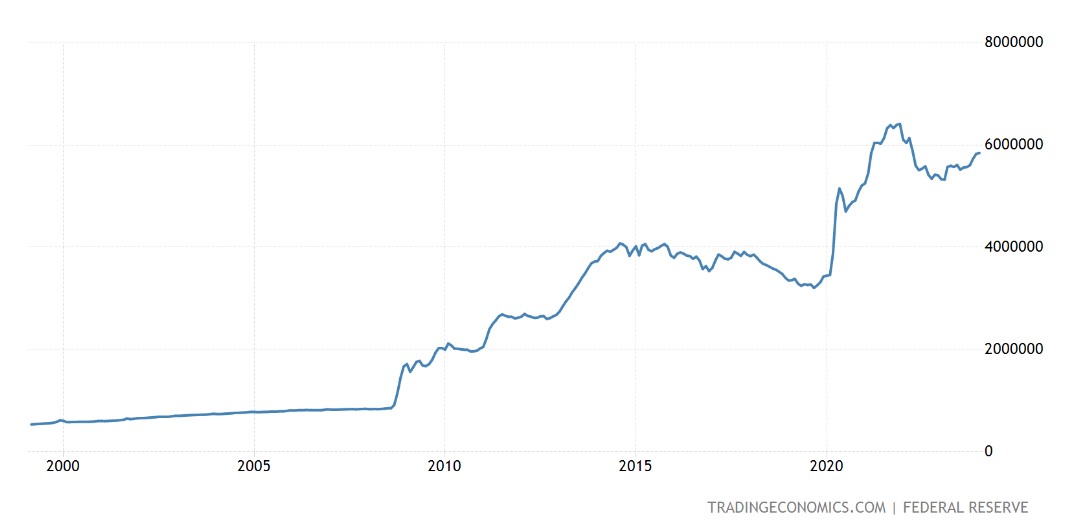

It seems strange that the stock market is reaching record highs, while the economy is not yet doing very well for the Americans. The accommodative monetary policy of recent years has manifested itself in partly on financial markets. As a result, the stock market no longer always accurately reflects the state of affairs in the economy.

Development of the money supply M0 (Source: Tradingeconomics.com)

Development of the money supply M0 (Source: Tradingeconomics.com)

In addition to the prices of shares, the prices of shares also increased gold and Bitcoin. Interest also plays a role for these assets. If interest rates fall, assets on which interest is paid, such as bonds, become less attractive. Assets such as gold and Bitcoin, on the other hand, are becoming more attractive.

Not everyone is equally optimistic about the outlook for equity markets. Analyst Don Durrett, for example, sees developments that point to a sharp decline in stock prices, as he recently wrote in a Tweet on X.

Although it is true that interest rates may fall in the coming months, the effects of previous interest rate hikes are not yet fully noticeable, according to the analyst. This is because the impact of interest rate hikes is typically experienced with a lag of one and a half to two years. This means that the interest rate hikes implemented by the FED, the US central bank, at the end of 2022 and in 2023 are not yet noticeable. According to Durrett, the economy will still have to endure a lot when the consequences do become visible.

Durrett also thinks the stock market is currently overvalued. In doing so, he relies on the Buffett indicator, a benchmark to assess the valuation of the stock market. When calculating the measure, one divides the total market capitalization of the stock market by the Gross Domestic Product. A low value indicates undervaluation of the stock market, but a high value indicates an overvaluation. The Buffet Indicator recently hit an all-time high, reason enough for Durrett to be more pessimistic about stocks than, say, Bank of America or Goldman Sachs.

On top of that, half of the growth of the S&P 500 is the result of the growth of the four largest companies. The Russell 2000, another stock index of smaller publicly traded companies, is down 15 percent from its high, indicating that the smaller companies have underperformed the largest companies. Many companies are suffering from higher inflation.

Since the coronavirus pandemic, governments have provided support in many areas. As a result, government deficits rose sharply. In the coming years, governments will have to tighten their belts to get their finances in order, and that will have consequences for the economy. Rising national debts, combined with rising interest rates, can also cause problems for governments. For example, interest payments for the U.S. government are $1 trillion (1,000 billion) in 2024 and likely $1.3 trillion (1,300 billion) in 2025. This means that the U.S. government will have to cut spending more if interest costs rise.

Finally, according to Durrett, there are also other macroeconomic factors that could hinder equity markets. For example, unemployment in the United States has been rising since June 2023 and the purchasing managers' index is below 50, indicating a decline in activity. The economy is also going badly in both Europe and Japan and growth rates in China Go back. Stagnant growth rates from other countries have consequences for the US, because American companies generate 40 percent of their turnover from abroad. If demand from abroad falls, sales in the US will also fall.

Finally, there was no recession in 2023, while economists had actually expected a recession at the time. This was mainly because families spent the corona support from previous years, Jack Hoogland said in an interview with Holland Gold. About 85% of Americans received $1,200 per person at the start of the coronavirus pandemic under President Trump, plus $500 per child. Later, under President Biden, individuals received an additional $1,400 and families received between $2,000 and $3,200 in additional child support. For a family with 2 children, the support in recent years amounted to an amount between $7600 and $8800. While economists had expected some of that money to be saved, Americans have actually consumed beyond expectations in 2023. As a result, a recession was avoided, but Hoogland does not expect a recession to occur again in 2024.

It remains very difficult to say who is right. Of course, there is something to be said for further growth. The accommodative monetary policy of recent years is partly manifested in financial markets, as a result of which the stock market reflects the state of the economy. doesn't always reflect anymore. On the other hand, there are also plenty of reasons to believe that stocks are overvalued. Should a downward trend actually become visible in the financial markets, it could be good news for precious metals. Investors are fleeing to certainty in turbulent times, and if the current geopolitical turmoil is accompanied by an economic crisis with financial markets tumbling, a rise in the Gold price perhaps in the offing.