9.3

8.058 reviews

English

EN

This contribution comes from the Boon & Knopers Substack

House prices in the Netherlands have risen to Record and many analysts expect prices to rise even further next year. But the view on price developments is clouded by the fact that all prices have risen rapidly in recent years. For example, the prices of labour, food, oil, gold and art objects have risen considerably in recent years.

On Geotrendlines we recently published a analysis in which we argue that currencies are no longer a reliable reference point of value. Due to high inflation and increasingly reckless monetary and fiscal policies, it is becoming increasingly difficult to tell the difference between appreciation and currency depreciation.

Just as you need different perspectives to see depth, we can also come to a deeper understanding in the financial world by taking the currency out of the equation and comparing tangible value to other tangible value. Think, for example, of house prices measured in the number of kilos of gold, or the price of a barrel of oil expressed in liters of beer.

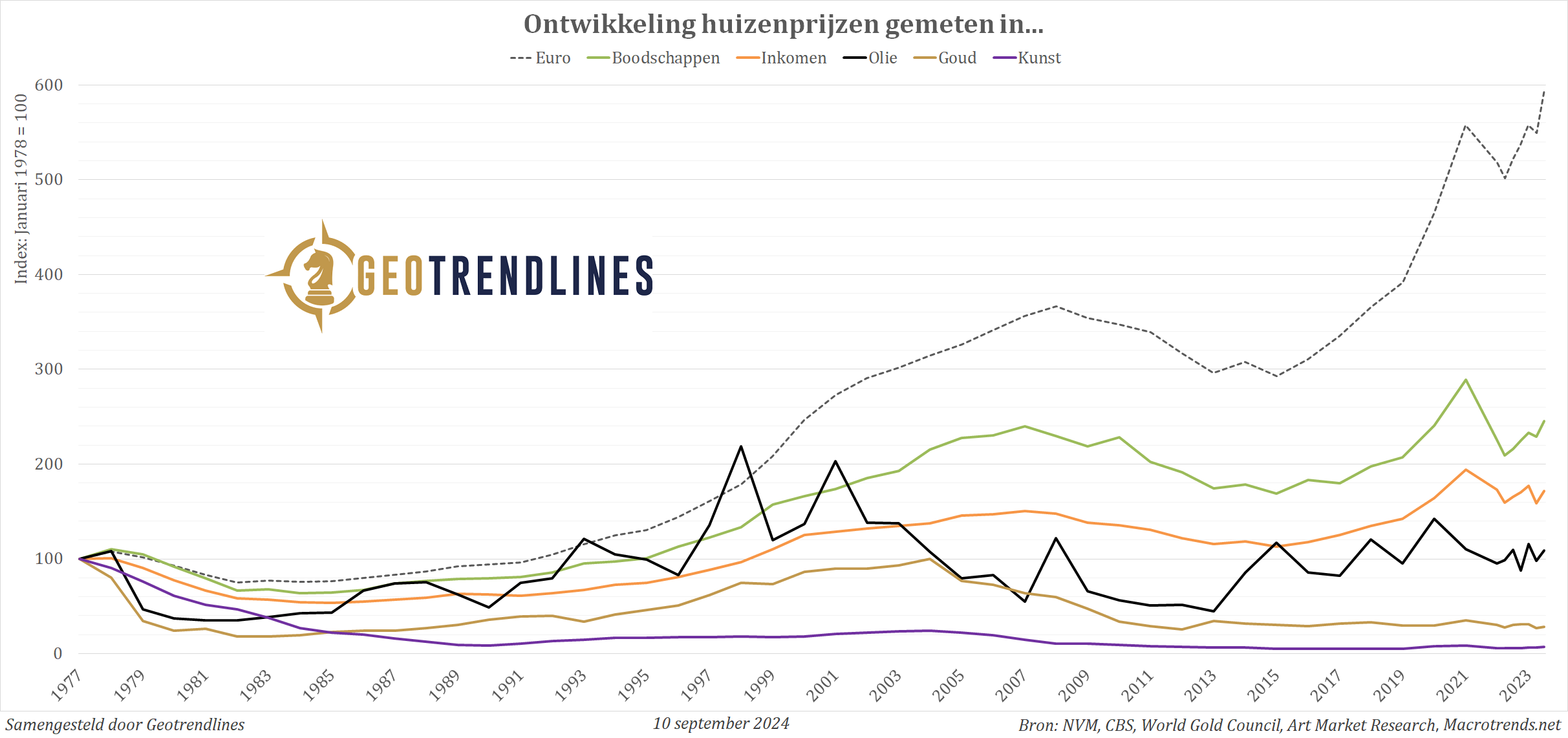

To illustrate this, we collected several datasets of the prices of groceries (according to the CBS), labour (expressed as the average income), oil, gold and the development of a Index of different types of art. The index for different types of art objects starts in 1978, so we took that as the starting point for all the data series.

The graph below shows how house prices in the Netherlands (median price of existing owner-occupied homes) have developed since then, but then expressed in euros, a basket of groceries, the average annual income, oil, gold and art objects.

Development of house prices, but measured in tangible things (Source: Geotrendlines)

Although the period from January 1978 to June 2024 has been chosen somewhat arbitrarily, we can come to a number of conclusions about this longer period of several decades.

It is immediately noticeable that house prices in euros have risen much faster than when measured in other tangible matters and that it is the most extreme outlier. This is in line with the thrust of our analysis that currencies are not an appropriate reference point of value. If you can only see value in terms of currency, you can't really see any value at all.

It is striking that houses have risen in value relative to groceries and incomes, about doubling. A significant increase, but it is not the case that the value of a house has gone upside down several times in recent decades. After all, other things also became more expensive. The ratio between house prices and oil prices has also not changed significantly during this period.

Finally, we can conclude that houses have decreased in value during this period relative to both gold and art objects. In June 2024, a typical home in the Netherlands was four times cheaper in terms of gold than it was in 1978. Art objects have increased in value on average tenfold compared to houses during this period. The fact that art does so much better than gold in this comparison is probably due to the chosen starting point, because at the beginning of 1978 gold was in a strong bull market and the gold price was already four times as high as in 1971. If we were to set the starting point a few years earlier, gold and art would perform in a similar way.

These conclusions not only confirm our theory that fiat money is not a reliable reference point of value, but also that gold and art objects have increased in value relative to houses. Our explanation for this is that wealthy people buy these objects as a means of parking their assets, giving them a certain amount of money. 'Store of value' premium.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.