9.3

8.058 reviews

English

EN

This contribution comes from the Boon & Knopers Substack

Russia will spend 172.9 billion rubles ($1.9 billion) on foreign currency and gold purchases this month. It equates to a daily purchase of 8.2 billion rubles ($92 million). This is significantly more than a month earlier, when an amount of 24.65 billion rubles was set aside for currency and gold purchases.

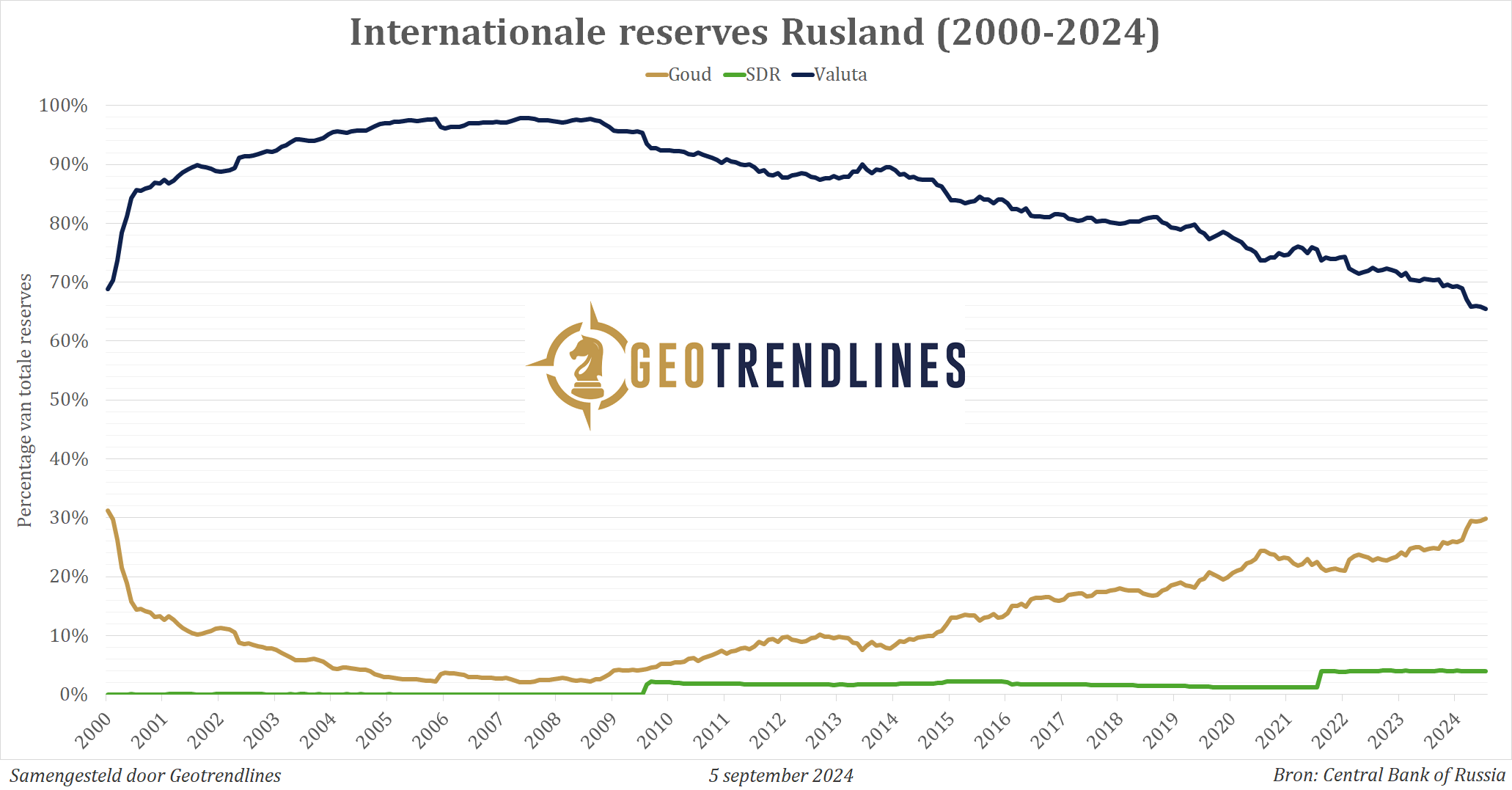

In recent years, we have written on Geotrendlines about Russia's strategy to further expand and diversify its reserves. For example, the country has significantly expanded its gold reserves over the past twenty years, from just 2 percent of reserves at the beginning of this century to almost 30 percent in 2024. It has also strengthened its foreign exchange reserves since the beginning of this century, by reserving revenues from oil and gas exports, among other things.

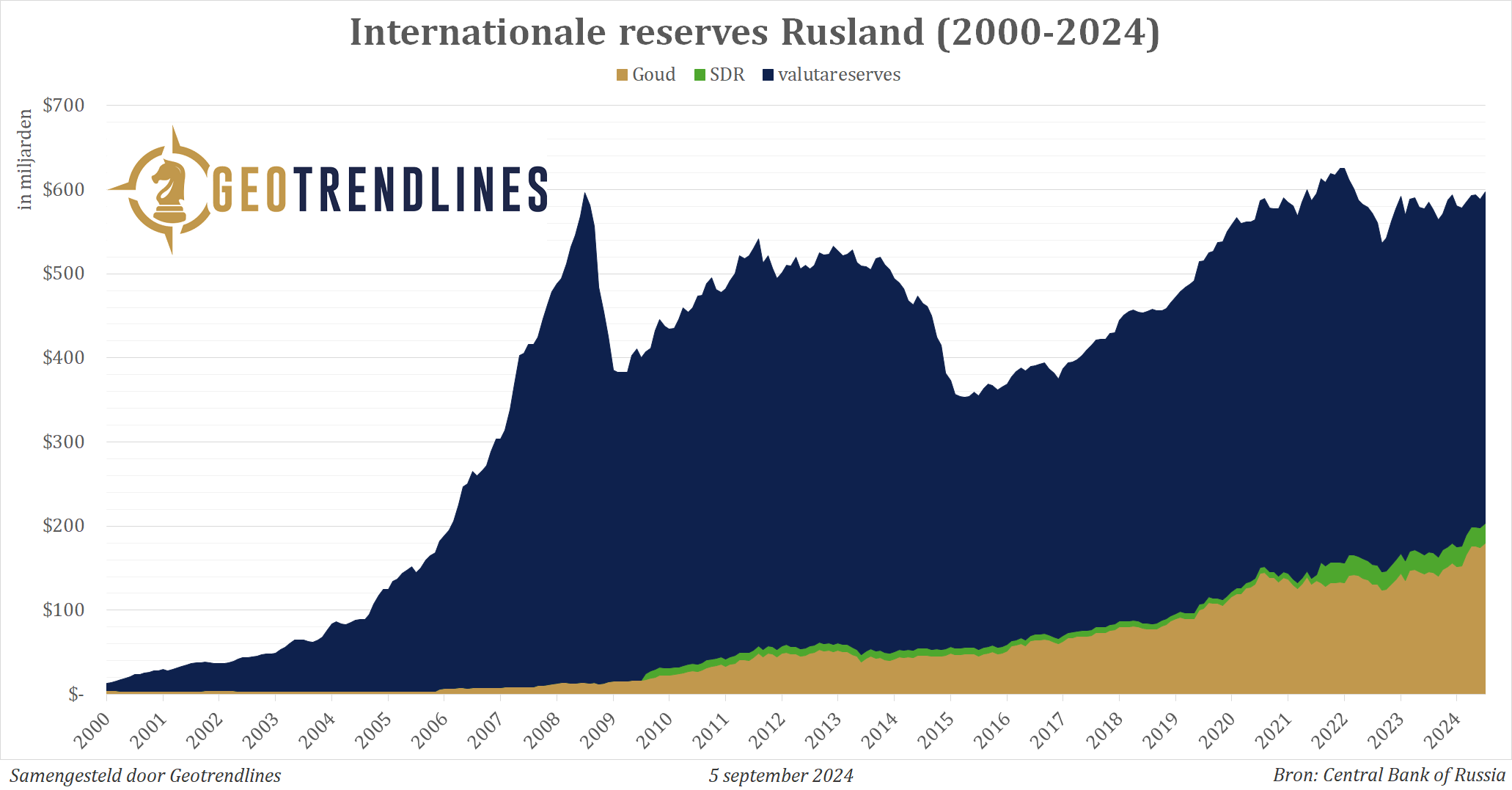

Russia has accumulated large foreign exchange and gold reserves

The chart above shows total Russian reserves, expressed in U.S. dollars at the market value of all assets. The value of the gold stock increased during this period not only due to structural gold purchases by the central bank, but also due to the increase in the value of the precious metal on the international gold market.

The graph below shows the same reserves, but in percentage terms. From this chart, we can clearly see that Russia has shifted the center of gravity of its reserves from foreign currencies (predominantly euros and US dollars) to physical gold over the past twenty years.

However, the center of gravity is shifting more and more from currency to gold

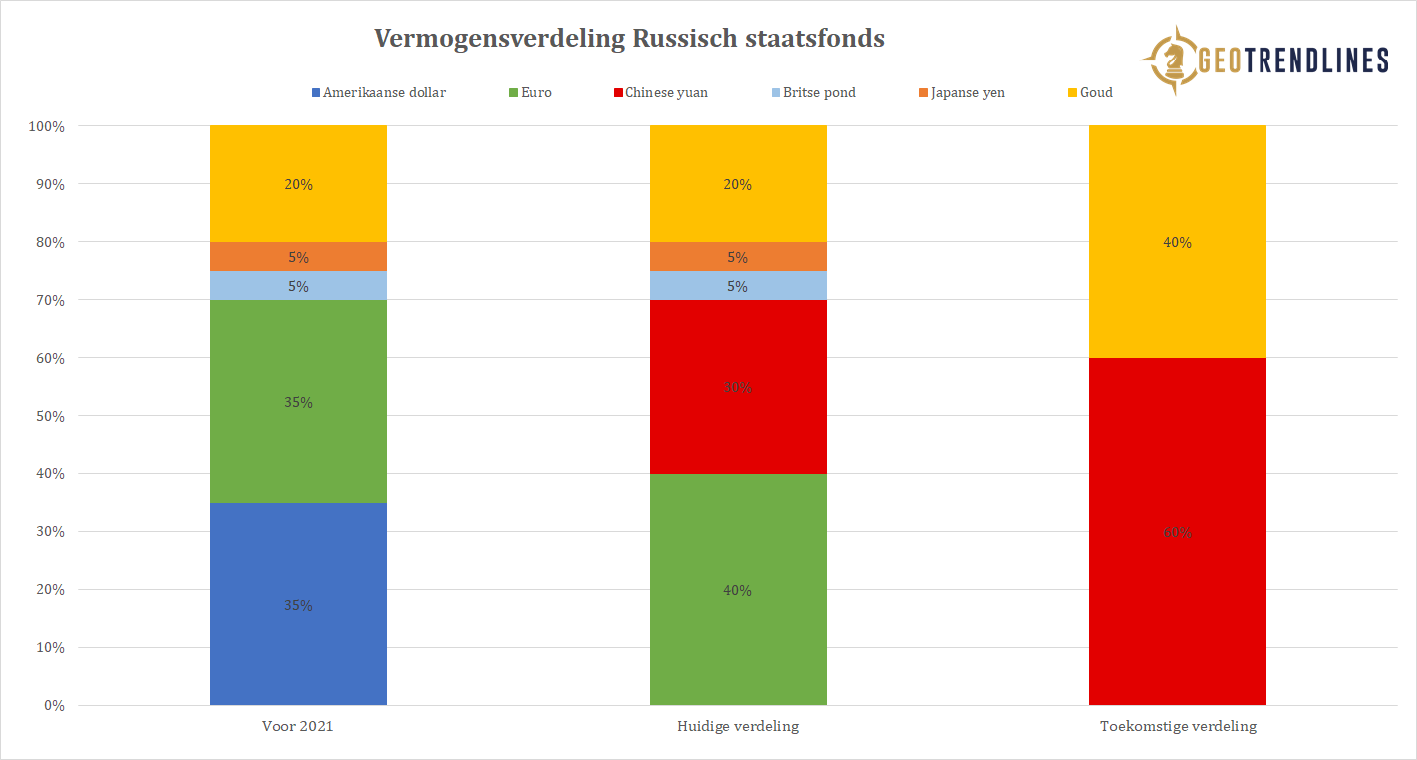

The latter is also in line with the strategy of both the central bank and the Russia sovereign wealth fund. These two mirror their investment policies and have reduced their positions in euros and US dollars in recent years, in favour of gold and the Chinese yuan. Russian President Vladimir Putin warned of the use of the dollar as a political weapon well before the war in Ukraine began. Since the West's freezing of foreign exchange reserves, Putin has labeled the euro and the dollar as "unreliable currencies."

Russian sovereign wealth fund reduces position in euros and dollars in favor of gold and yuan

(Photo Russian Central Bank: Moscow-Live)

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.