9.3

8.064 reviews

English

EN

In Gold We Trust (IGWT), part of asset manager Incrementum, published the famous IGWT report last Friday in which the latest state of affairs in the gold market is discussed. Just like last year, IGWT is very optimistic about the gold price for the coming year. Over the past year, as IGWT expected in the earlier report, the gold price has indeed risen. The gold price is also doing very well so far in 2024. What does IGWT expect for the rest of 2024?

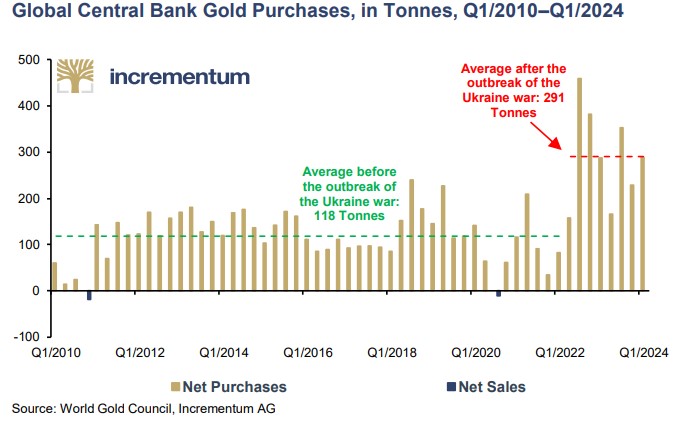

'Playbook' is the key word in the new report. One Playbook is a document with strategies, tactics, and instructions. IGWT applies it Playbook on the gold market. The precious metal is being revalued in today's changing landscape and will play a new role in the financial system. The reason for this is the conflict in Ukraine, because since then central banks have been buying gold on a large scale. The enormous demand for gold from central banks puts a floor under the gold price, as it were, according to IGWT.

Why is the demand for gold rising?

Gold is back in vogue due to the precious metal's neutral status. It has no counterparty risk, as it is not created on the basis of debt, but is actual ownership. On the other hand, fiat money, unbacked money issued by states, is increasingly being used as a weapon. After the war in Ukraine erupted, Russian assets in dollars and euros were frozen. The fact that gold is a beacon of certainty in times of turmoil has already become clear in recent years. Both after the invasion of Ukraine and after the Hamas attack, the price of gold rose significantly.

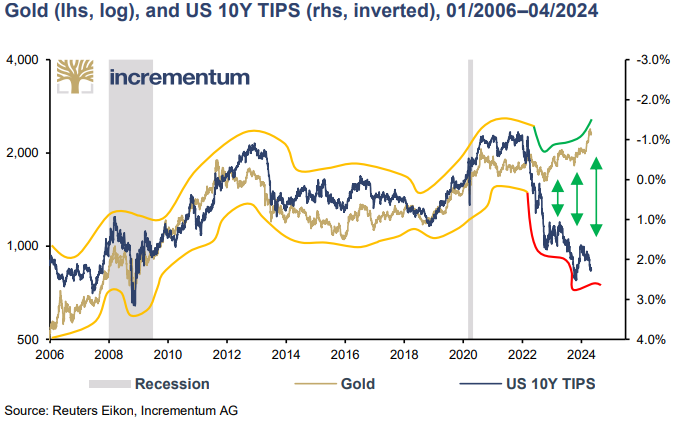

Interestingly, the inverse correlation between gold and bond yields seems to be a thing of the past for the time being. Normally, the price of gold falls when interest rates rise, because no interest is paid on gold and bonds become more attractive. This partly explained the falling gold price in a few months of 2023, according to we wrote in an article at the time. Nevertheless, the relationship between gold and interest rates has been out of step for some time, as can be seen in the report. In recent years, the gold price has risen due to high inflation, turmoil in the banking sector and geopolitical tensions, while interest rates have risen.

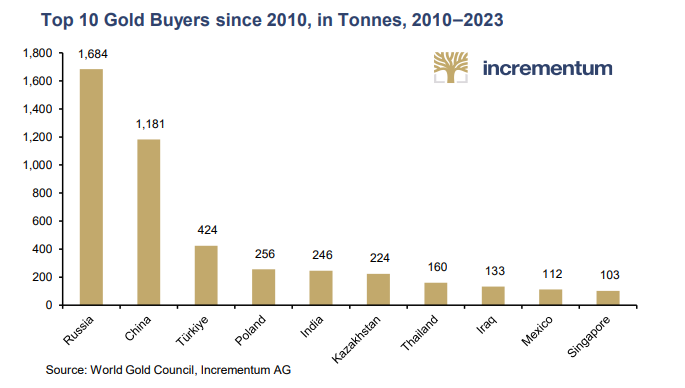

Interestingly, the buyers of the precious metal are mainly located in emerging economies. By 2024, emerging markets will account for half of global GDP. Among those countries are a large number of countries where the demand for gold among the population is higher than in developed countries. An example of this is India, where gold is a popular gift for weddings and important ceremonies. It is also held as savings because of its value retention. Since India still has a lot of growth ahead of it, a growing demand for gold is also to be expected.

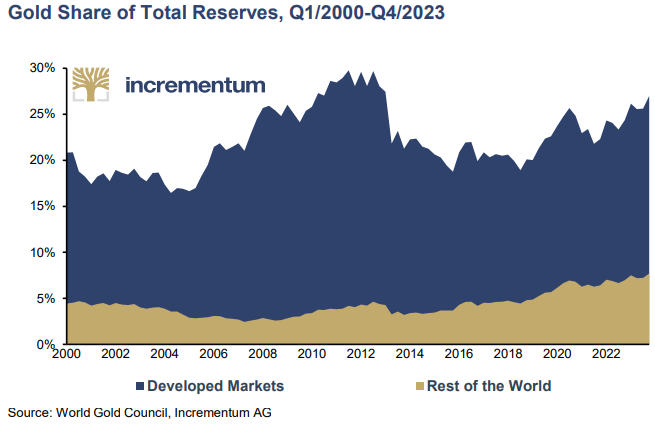

IGWT draws a comparison with the period after the Second World War, when European countries built up larger gold reserves and gold flowed from America. Now, stocks of countries such as Russia, China and India are increasing, and the share of gold reserves of emerging countries relative to developed countries is rising. Western countries, on the other hand, do not follow this trend and hold on to existing gold reserves. The Dutch Central Bank (DNB), for example, indicated that it would not be able to use the current gold stock of four percent of GDP currently considers it sufficient.

At the moment, DNB sees gold primarily as insurance. In addition, the value of the gold increases in the event that disaster strikes. IGWT believes that gold reflects the growing prosperity in emerging countries. The current account surpluses of emerging countries manifest themselves in the form of rising gold stocks, or so the thinking goes. We will discuss this statement in more detail in a future article.

The report also highlights inflation, which, according to IGWT, could be much higher than the target two percent in the near future. IGWT cites supply chain issues as the main reason. Prices of fuels and containers have already risen sharply in recent years. With increasing political tensions, inflation may continue to be higher for some time. The effect of base effects will also disappear in the near future, resulting in higher inflation rates. This happens when prices were high during the comparison period. This can result in a lower inflation rate in the current year because the price increase is compared to a higher base. Finally, there are other factors, such as the energy transition, which contributes to higher inflation rates.

The IGWT is also of the opinion that governments are responsible for part of the inflation. The report refers to a paper by an American economist, Charles W. Calomiris, who blames the high debt burden of several countries. According to the economist, there is a real chance that some governments, such as the US government, will no longer be able to find lenders due to the enormous debt burden. In such a case, the government proceeds to issue interest-free government bonds that are bought by the central bank, which in turn leads to high inflation.

However, there are also some caveats to this scenario. For example, it has never happened that the U.S. government has really been unable to find lenders. Due to the dominant status of the dollar, there is always a demand for US debt, especially since it is also is considered collateral in the financial world. In addition, open market operations have always been conducted through commercial banks. Even the extremely loose monetary policy of the years before the war in Ukraine led to not to inflation (let alone hyperinflation), since the central bank did not buy bonds directly from the government.

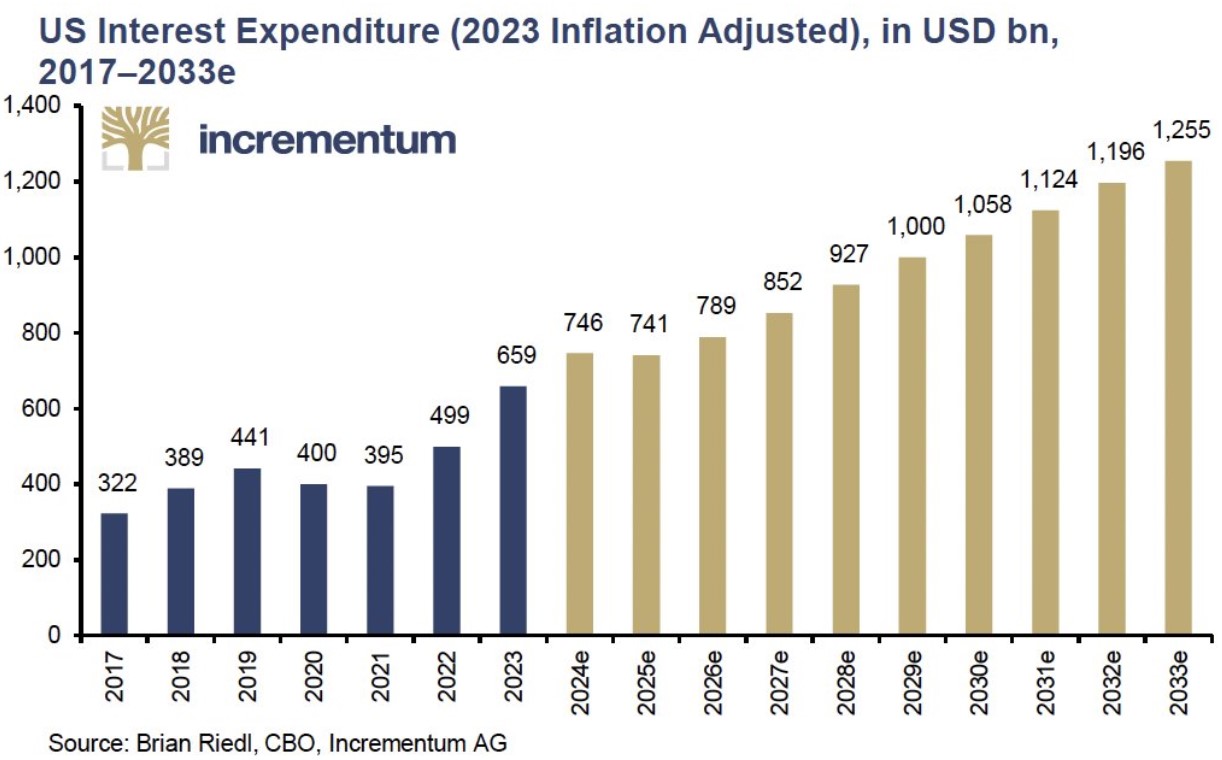

Nevertheless, it is certain that the high public debts are causing problems, especially now that interest rates have risen sharply. The debt now stands at $34,000 billion, more than 120 percent of US GDP. At the beginning of 2007, before the financial crisis, the debt was just over sixty percent. As a result, the costs that governments have to bear are rising, as can be seen in the graph below.

The new report is definitely worth reading. Gold's prospects for the coming year are good again, as central bank interest rates are falling and there is still a lot of uncertainty in the world. It will be interesting to see if IGWT gets it right again.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.