9.3

8.064 reviews

English

EN

The future shines towards the market for gold, that is the conclusion of the Preview Chartbook on the report of In Gold We Trust (IGWT) which will be published in May of this year. The preview of the report states that the price of gold could rise further due to macroeconomic factors. How does IGWT come to this conclusion?

According to the IGWT report, there are several causes for last year's high inflation. Not only geopolitical relations came under pressure, but also de-globalisation led to higher prices. Since the coronavirus pandemic, there has been a focus on shorter Supply Chains And that transition comes with higher costs.

Secondly, the energy transition is driving up prices. The accelerated transition to renewable energy is a cost that we will continue to have in the future. This corresponds to what Lex Hoogduin indicated in an interview with Holland Gold; 'We throw away old shoes before we have new shoes'.

On top of that, governments are also pressing the accelerator fiscally. The purchasing power package for 2023 costs in the Netherlands alone 17 billion, while the Dutch economy is already overheated. In other countries, too, governments are more than compensating for the loss of purchasing power. As a result, many countries are struggling with budget deficits. The Netherlands will remain within the EU norm of 3% this year, but Italy's budget deficit is 4,5% and France fell short by 5% last year. Besides Restore the Chinese economy is likely to tighten now that corona measures are being loosened, which could also have a price-pushing effect for the coming period.

Finally, the high prices are causing higher wage demands, which threatens a wage-price spiral, according to the IGWT report. It is striking that the Pre-Charter not a word about the expansionary monetary policy of central banks. Nevertheless, the analysts think that gold is facing a good time due to the high inflation at the moment. Gold has always been known as a stable commodity.

As a result of the above-mentioned factors, it is possible that the period in which we have seen mainly low inflation rates and we are heading into a period of high inflation will come to an end. Since the 1980s, we have seen a downward trend in inflation rates. Central banks have even struggled to raise inflation in recent years and feared deflation. Last year's high prices are therefore a break in the trend and perhaps the end of an era.

In addition, a severe wave of inflation has already been followed by a second, even more severe wave in the past. According to the report, the falling inflation that we are now seeing may therefore show a distorted picture. The report compares the inflation of the current period starting in 2013 with the period between 1966 and 1983, in which there was also high inflation.

The current inflation rate is almost identical to the course of inflation in the 1960s and 1970s. Therefore, according to IGWT, it is not yet possible to say whether the downward trend in the current inflation rate will actually continue, or whether a second wave of inflation is on the way, just like in the 1970s and 1980s.

Rather, IGWT expects inflation to remain well above the 2% inflation target for some time to come, also because core inflation is not yet decreasing. Core inflation is the price increase that excludes highly fluctuating products such as food and energy. Core inflation in the Eurozone for the month of February was already in line with 5,6%. High energy prices are now seeping into the products of other goods and services. IGWT compares this development with inflation in the 1970s.

The 1970s are known as a period of stagflation. At the time, there was high inflation that went hand in hand with a declining economy. At the time, central banks had great difficulty in bringing inflation down. It took Paul Volcker, then chairman of the FED, big interest rate hikes to curb inflation. These interest rate hikes then led to the Volckershock, the recession caused by the Fed's tight monetary policy.

There is no such stagflation now. Although we are currently facing high inflation, there is no recession. In the last quarter of 2022, the Dutch economy grew more than expected by 0,6%. There is talk of a recession after two quarters of negative growth rates, but that recession is still Failure to materialize.

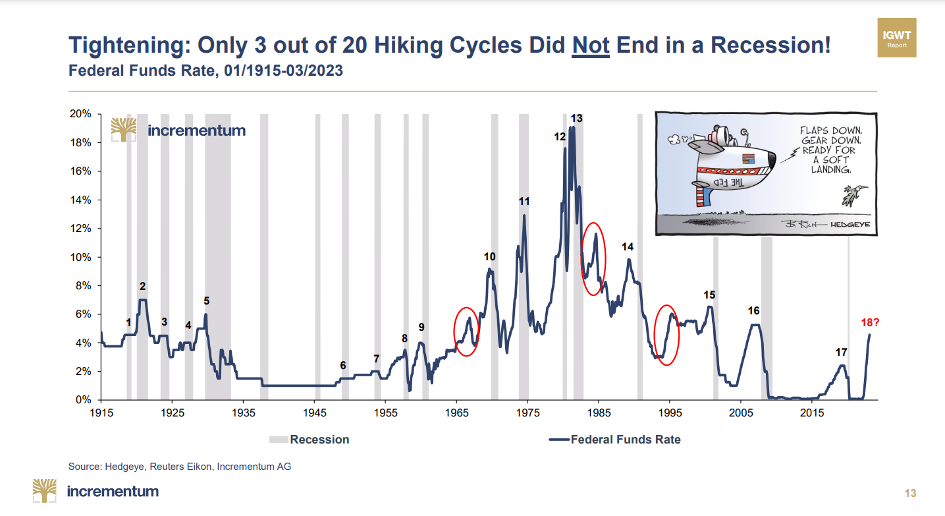

Although ABN-AMRO still expects growth in its forecast for 2023 and 2024, IGWT is less optimistic. According to the IGWT report, most of the periods in which interest rates have been raised have been followed by a recession. Between 1915 and 2023, only 3 out of 20 rate hikes, periods when interest rates were raised, not followed by a crisis.

The current policy of the central banks is now also very aggressive compared to previous periods. Although Paul Volcker's policy was much more aggressive in the late 1970s, the Fed's policy rate has risen relatively quickly over the past year. The European Central Bank could not raise interest rates so quickly. That's because in Europe Interest rate spreads, interest rate differentials between Member States, had widened faster due to the high debt burden, especially in southern euro area countries.

This rapid interest rate hike has already caused major problems in the banking sector in America. Due to the increase in interest rates, bonds that the bank owned quickly became less valuable. As market interest rates rose and more and more money flowed into money market funds and other investments, banks ran into liquidity problems and bonds had to be sold at a loss. These problems have already led to the bankruptcy of the Silicon Valley Bank. This bankruptcy was the largest bank failure since the banking crisis of 2008. The turmoil in the banking sector also gained a foothold in Europe. Credit Suisse already collapsed after it got into trouble. Debt, which made a profit last year, is also in trouble now that there are doubts about how healthy banks still are.

In addition, central banks will make losses in the coming years due to rising interest rates. While central banks have to pay more interest on bank reserves held by commercial banks and thus have to contend with higher costs, the proceeds of the bonds they buy will remain low in the coming years. As a result, DNB already recorded a loss of 2022460 million, but that loss could increase as interest rates continue to rise.

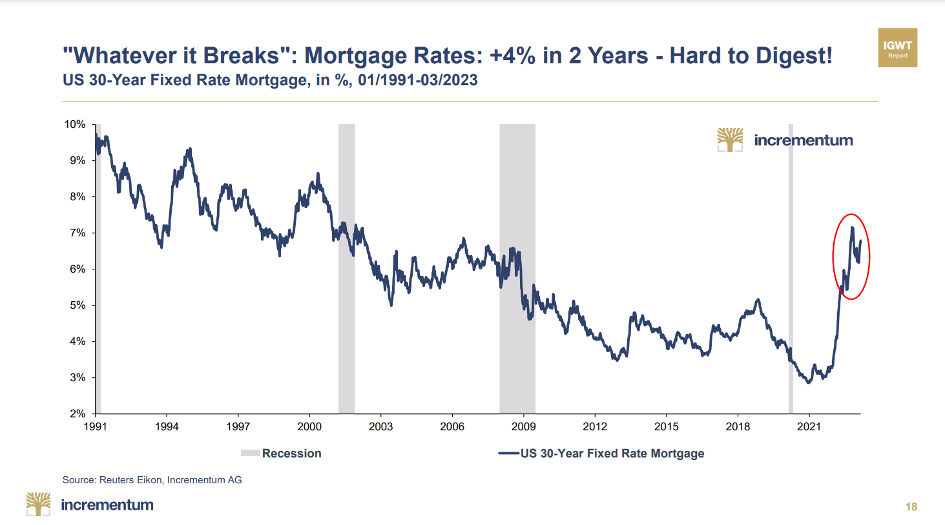

Private parties can also suffer from these high interest rates. Not only does it make banks where they store their money more vulnerable, mortgage payments are also rising now that interest rates in the market are rebounding. Average U.S. household mortgage payments are increasing rapidly and have seen a 100% increase over the past two years. The Dutch are now also payingconsiderably more when taking out a new loan.

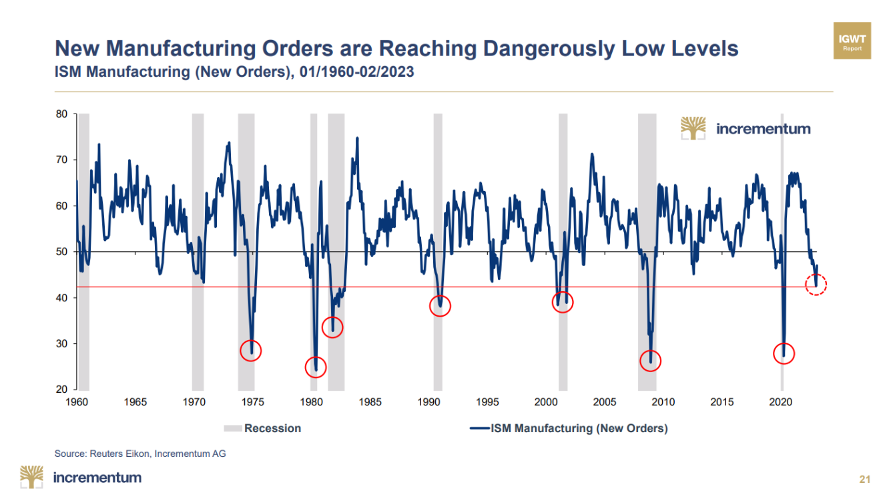

In America, overall confidence in the economy seems to be falling. For example, the number of people being laid off in the U.S. is rising. On the other hand, the number of new production orders is falling, a sign that confidence in the economy is declining. Especially in times of crisis, the number of production orders reaches very low proportions.

The report also writes about the United States' increasingly isolated economy. While world trade increased spectacularly after the Second World War, it has been declining in recent years. The U.S. is particularly aware of this in trade with China, which has been Trade war Decreases.

The report also provides a nice overview of countries that own and produce gold. The West still owns by far the most gold. The share of gold in the hands of the Shanghai Cooperation Organisation (SCO), a partnership of India, China and Russia, among others, has increased in recent years, but the West owns roughly three times as much gold as the SCO. In the last year, gold purchases from China already in the news. We also talk about that on Holland Gold repeatedly written.

The SCO is also the largest producer of gold. One of the five largest gold mines in the world is currently located in Russia. In addition, the population of countries in the SCO buys more gold than in Western countries. Since Russia invaded Ukraine, Russians have been buying gold en masse, especially when VAT on gold was introduced in RussiaAbolished.

According to IGWT, it is quite possible that the current geopolitical uncertainty is causing a so-called Renaissance for gold as an asset of central banks. Although central banks sold gold en masse between 1990 and 2010, they have been adding gold to their reserves for years now.

Non-Western countries in particular play a role in this, he wrote Frank Knopers at Holland Gold. Russia, China, India and Turkey have been the largest buyers of gold in recent years. Russia was by far the biggest player on this scene. The Russian central bank's gold supply stood at 450.3 tonnes in 2008, but rose to 2,298.5 tonnes in 2022, an increase of 1848.2 tonnes. China added a total of 1410.5 tonnes and India doubled its gold quantity. Interestingly, the gold added to these countries' reserves also came largely from domestic mining production.

Change in central bank gold reserves between 2008 and 2022 (Source; World Gold Council)

In times of geopolitical turmoil, the choice of gold is a logical one. For example, after the invasion of Ukraine, foreign exchange reserves of Russia were frozen, wiping out half of the central bank's foreign exchange reserves. Gold has been accepted as a means of payment for centuries and has been a stable product for centuries. Also, the precious metal has no counterparty risk. We have seen a steady increase in gold purchases by central banks over the past decade. Gold purchases even peaked in 2022.

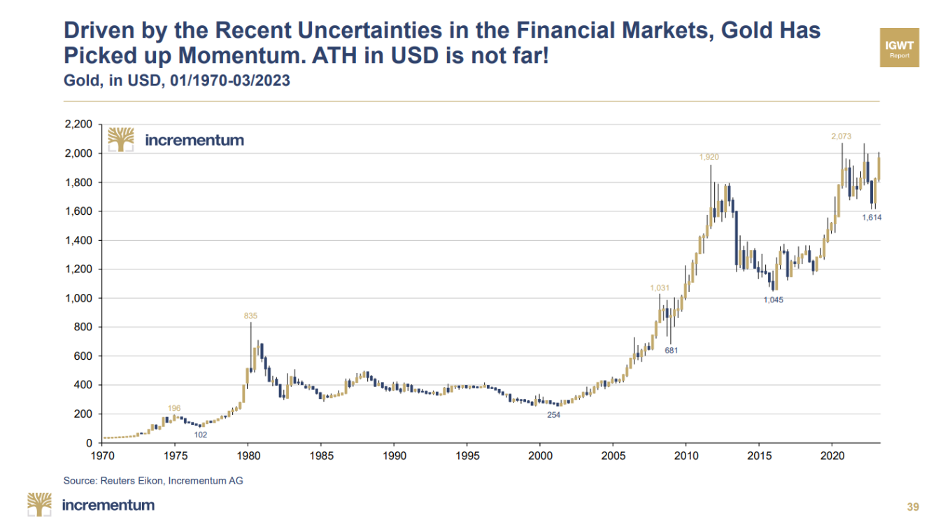

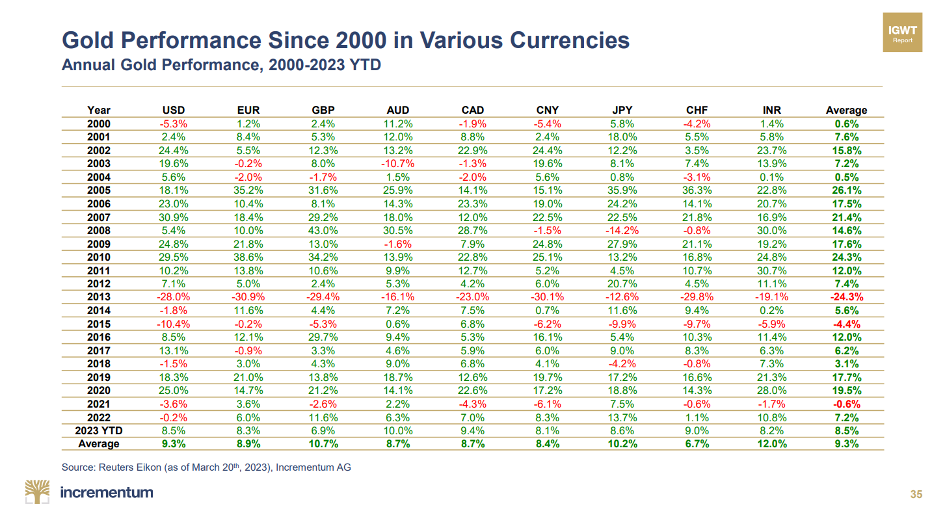

Gold has also proven strong compared to currencies and stocks. Gold is seen as a safe investment due to its low volatility. Gold is not going to fall or rise in value very fast any time soon. In times of uncertainty and inflation, the precious metal is attractive due to its value retention. When comparing gold to currencies, such as the US dollar or the Japanese yen, it is striking that gold has generally increased in value. Compared to the stock markets, gold has also performed well in recent years. IGWT's graphs confirm this picture.

It is therefore striking that it is precisely the moments of uncertainty that have driven up the gold price over the past ten years. For example, the gold price rose during the 2008 crisis, but we also saw that the gold price rose when the banks in theAmerica began to falter. Of course, it is difficult to say how the price will develop in the coming years, but according to IGWT, the prospects could be promising.

Do you want toBuy gold by means of Gold bars or Gold Coins? We are happy to help you with your order.

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.