9.3

8.064 reviews

English

EN

According to gold analyst Jan Nieuwenhuijs, it is quite possible that Poland, Hungary and the Czech Republic will continue to buy gold in the near future to be prepared for the adoption of the euro. In recent months, we have seen several central banks buying gold. But does every country follow the same strategy? And are countries that want to adopt the euro all building up a larger gold reserve?

According to an article by analyst Krishan Gopaul Also in October Bought gold by central banks. A total of 42 tonnes of gold were bought by central banks. The central banks of China, Turkey and Poland were among the main buyers. China added 23 tonnes, Turkey 19 tonnes and Poland 6 tonnes. In doing so, they continue the trend in which Central Banks Add Gold to their reserves. The price of gold reached an all-time high of 2135 dollars per troy ounce on Monday. The geopolitical turmoil, the high inflation of recent months, the expectation that interest rates will fall again and the weak dollar are causing a high gold price.

The fact that Poland bought more than 300 tonnes of gold in recent years is Jan Nieuwenhuijs a sign that it is preparing for the arrival of the euro. The analyst thinks that European countries will coordinate the gold supply among themselves in case gold plays a greater role in another system. Earlier we wrote on Holland Gold DNB still sees gold as an insurance policy. Yet, in that article, we did not go as far as Jan Nieuwenhuijs. If you take out insurance for a new car, it doesn't mean that you assume that your car won't work tomorrow. You mainly cover yourself in case something happens.

This is also the reason why the Netherlands holds about four percent of the Gross Domestic Product (GDP) as gold reserves. Should a new system be introduced, gold will count as an insurance because of its intrinsic value. However, this does not necessarily mean that the Dutch Central Bank (DNB) is of the opinion that the system is bankrupt. Aert Houben, Director of Financial Markets at DNB, explained in a podcast with the Financieel Dagblad more about DNB's position on gold: 'I think four percent is more than enough. Should a systemic crisis break out, the value of gold will skyrocket. Experience also shows that full coverage is not necessary,' says director Houben.

The amount of gold relative to GDP is comparable to other countries, such as France and Germany. Poland does not currently use the euro, but could join the euro area in the future if it meets certain conditions. And in such a case, it seems logical that the country also aligns the gold supply with European averages. While there are no requirements for countries in terms of the amount of gold to join the eurozone, countries do move some of their gold to the ECB.

Jan Nieuwenhuijs cites the Gold Standard as an example. At that time, countries also had to coordinate the amount of gold. After the First World War, the Netherlands had a very large gold reserve, but sold part of it to countries that had too little to make the distribution fairer, we wrote In another article. It must be said that a gold standard is very different from the current system. The money supply was then strictly controlled. A fall in the quantity of gold was accompanied by a fall in the price level. Now that link no longer exists. That is why there are countries with a large gold reserve, but there are also countries that have almost no gold.

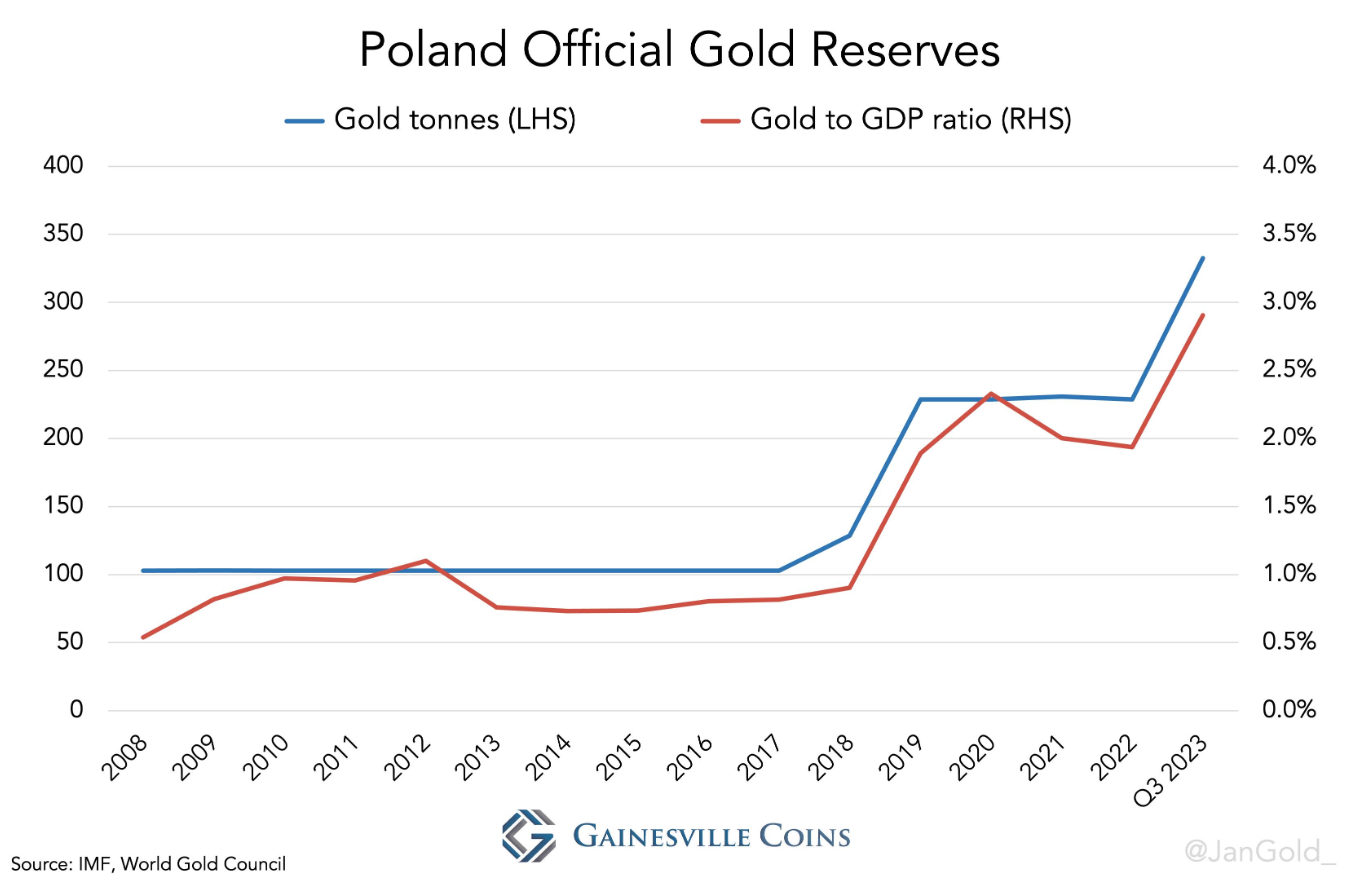

Previously, Poland did not hold much gold. In the years before 2017, the stock fluctuated around one percent of GDP, about 103 tons of gold. In recent years, however, Poland has bought a lot of gold. Poland's central bank now owns 334 tonnes of gold, about three percent of GDP. If Poland, like the Netherlands, also aims for four percent, it is quite possible that Poland will also buy some gold in the coming years. According to Nieuwenhuijs' calculations, this amounts to another 130 tonnes. Hungary has also strengthened its gold supply in recent years. In 2017 there were 3 tonnes of gold in the Hungarian vault, currently the stock stands at 94 tonnes, about three percent of GDP.

Poland has been buying a lot of gold in recent years. (Source: Gainesvillecoins.com)

Poland has been buying a lot of gold in recent years. (Source: Gainesvillecoins.com)

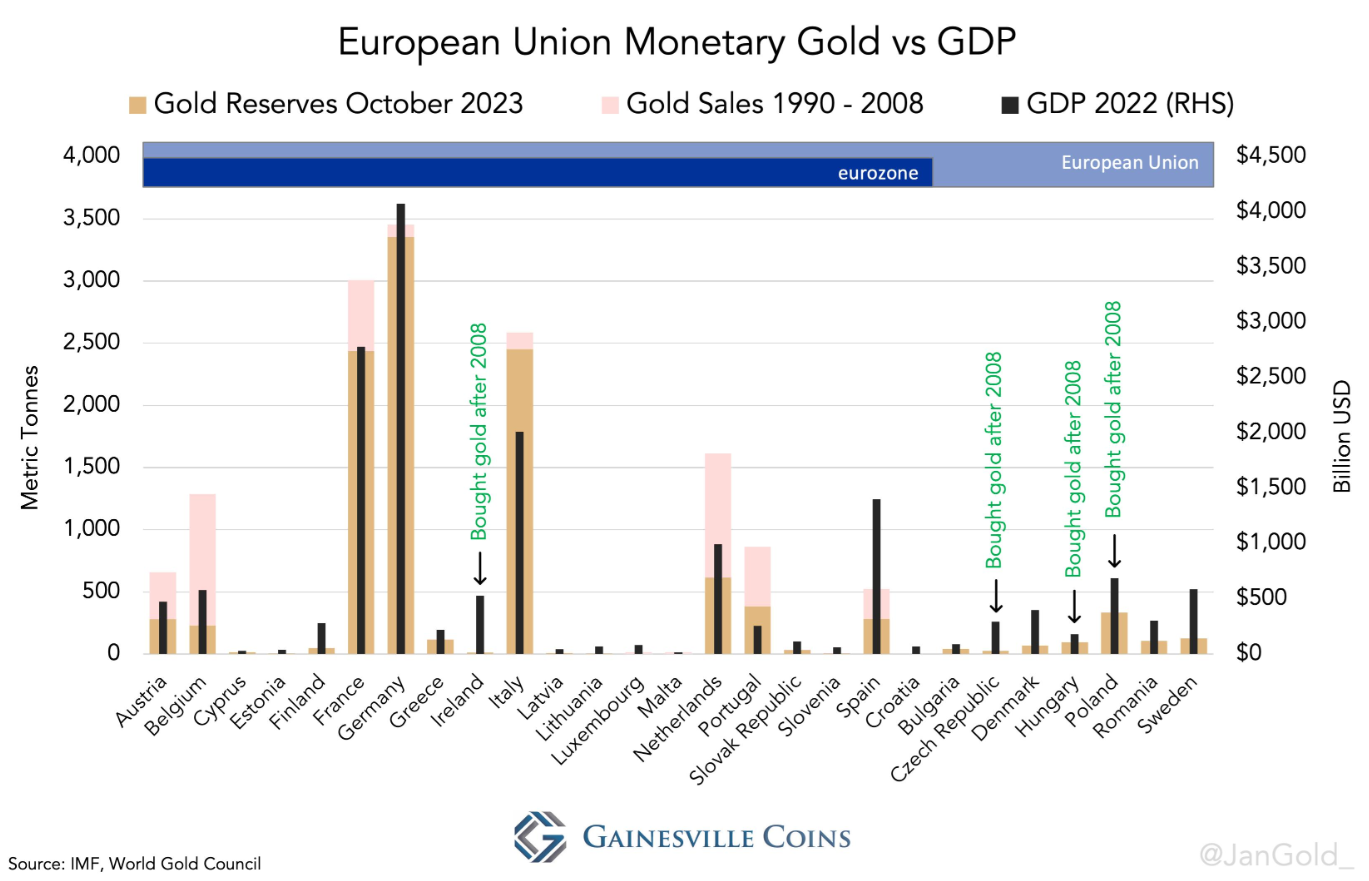

Nor can we say that all euro countries have built up a large reserve of gold. Although countries such as France, Germany, Italy, the Netherlands and Portugal have their gold reserves reasonably aligned with GDP, this relationship does not apply to all countries. Many countries hold much less gold than you would expect based on GDP. This applies not only to Belgium and Spain, but also to Scandinavian and Eastern European countries. This can be clearly seen in the figure below.

The gold stock of European countries in relation to GDP. (Source: Gainesvillecoins.com)

The gold stock of European countries in relation to GDP. (Source: Gainesvillecoins.com)

Croatia stands out in particular. The country swapped the krona for the euro in 2023, the path Poland also hopes to take one day. But Croatia no longer has gold reserves. After the fall of Yugoslavia, Croatia possessed 13.2 tons of gold. This stock was sold in 2001. In 2023, the Croats' first gold purchase in twenty years followed. That gold was then moved directly to the ECB, after which Croatia adopted the euro, according to the Kitco of time.

It is very interesting to compare countries with each other and see that the gold strategy differs from country to country. While countries such as the Netherlands and Germany hold on to precious metals, other countries attach little value to a large gold reserve. However, gold is seen as a safe haven and as insurance for when things turn around. That is also the reason why the big countries, such as the United States and China, are sticking to gold. That is also the reason why the price of gold experiences large increases during geopolitical turmoil. It is possible that Poland and Hungary will continue to buy gold in the near future, but that is not because that is a criterion for joining the eurozone.

Do you want toGold bars, Gold Coins, Silver bars or Buy Silver Coins? We are happy to help you with your order.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.