9.4

7.629 Reviews

English

EN

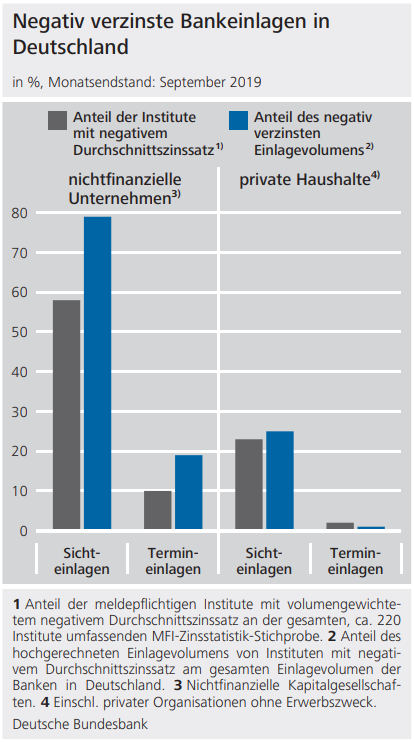

More than half of all banks in Germany already charge negative interest rates for large companies, while almost a quarter also charge for individuals. This is what the Bundesbank writes in its latest Monthly report. The central bank conducted a survey of 220 banks at the end of September, two weeks after the ECB's interest rate cut. In mid-September, it lowered the deposit rate to -0.5%, which means that banks pay even more money on excess reserves.

The survey found that 58% of banks already have negative interest rates for large companies. For consumers, that share is much lower at 23%, as the graph on the right shows. Several banks are already in talks with their wealthiest clients, because negative interest rates threaten to become a major expense. Among others, Deutsche Bank and Commerzbank intend to do so. Berliner Volksbank is going one step further by lowering the negative interest rate limit to savings deposits of €100,000 or more.

The survey found that 58% of banks already have negative interest rates for large companies. For consumers, that share is much lower at 23%, as the graph on the right shows. Several banks are already in talks with their wealthiest clients, because negative interest rates threaten to become a major expense. Among others, Deutsche Bank and Commerzbank intend to do so. Berliner Volksbank is going one step further by lowering the negative interest rate limit to savings deposits of €100,000 or more.

The ECB Relaxed In September, it will pursue its interest rate policy by exempting part of the excess reserves from negative deposit rates. As a result, banks spend less money on storing reserves, but not every bank benefits from this equally. German savings banks in particular are under pressure, because their business model is fundamentally affected by the ECB's policy. They have to pass the bill on to customers, but are reluctant because of the negative publicity.

The profitability of banks is under pressure not only due to negative interest rates, but also due to a lack of innovation and efficiency. According to the Vice-President of the ECB, Luis de Guindos, European banks need to do more to cut costs. The return on equity fell below 6% last summer. As a result, the European banking sector is doing significantly worse than the American one.

You may be wondering whether this negative interest rate is also passed on if you want to borrow money from the bank. This possibility can no longer be ruled out either, because the German state-owned bank KfW is legally obliged to pass on the interest benefit to its customers. If interest rates are to fall further in the future, the well-known slogan 'Borrowing money costs money' may be adjusted.

This contribution was made from Geotrendlines