9.4

7.516 Reviews

English

EN

Over the past decade, gold has shown excellent returns, but in recent years there has been little pleasure to be had in the development of the Gold price. In dollar terms, the exchange rate is even at its lowest level in five years, despite Greece's debt problems and the persistently low interest rates of central banks.

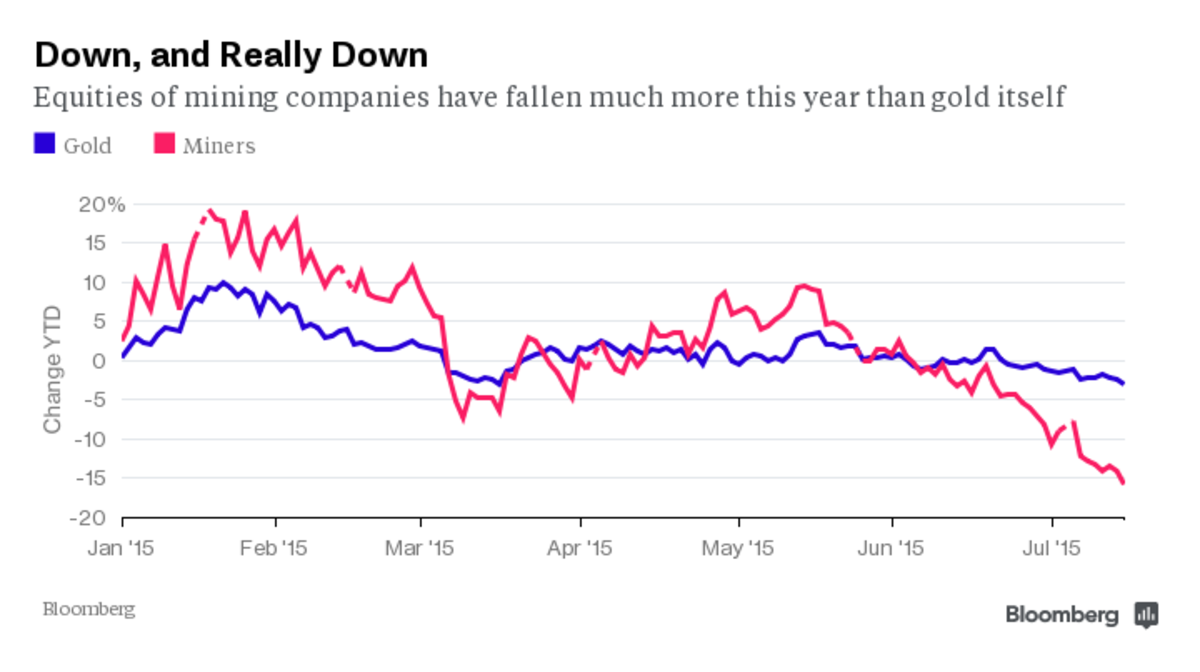

Since the beginning of this year, the Gold price In dollar terms, the gold mines did significantly worse. For example, the Philadelphia Stock Exchange Gold and Silver Index (XAU), a basket of sixteen major gold miners, has already lost 16% of its value since the beginning of this year.

Gold price versus gold mines (Source: Bloomberg)

The combination of declining yields and rising production costs is making the mining sector's profit margin ever smaller. The fall in oil prices eased the pain somewhat, but this advantage was partly offset by higher wage costs.

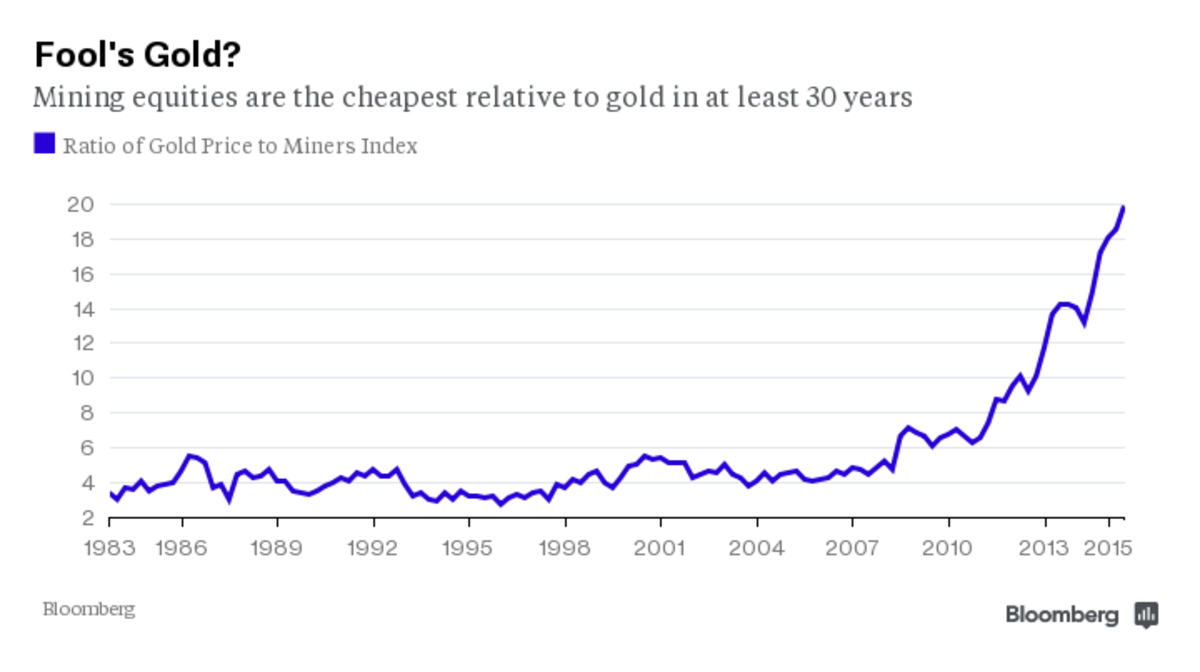

Due to the continuing decline in the price of gold miners, the shares are currently the cheapest compared to physical gold in more than thirty years. Is that a sign that the gold mining sector is undervalued again at the moment?

According to some analysts, the gold mines may show some recovery in the next six months. For example, Morgan Stanley took a larger position in Goldcorp stock this month, arguing that the stock is attractively valued at the moment. Also, according to a survey by Bank of America, fund managers are mostly positive about gold for the first time since 2009.

Gold mines relatively cheapest compared to physical gold in thirty years (Source: Bloomberg)

Gold mines are still considered by many investors as a kind of leverage on the gold price, because a small change in the gold price has a much larger impact on the net profit margin of the gold mining sector. Yet, according to the Bloomberg much less strong now than in the past.

Unlike in the bull market of the late 1970s, investors now have many more tools at their disposal to respond to the development of the gold price. In addition to gold mines, investors can also opt for, for example, over-the-counter swaps and exchange-traded funds.

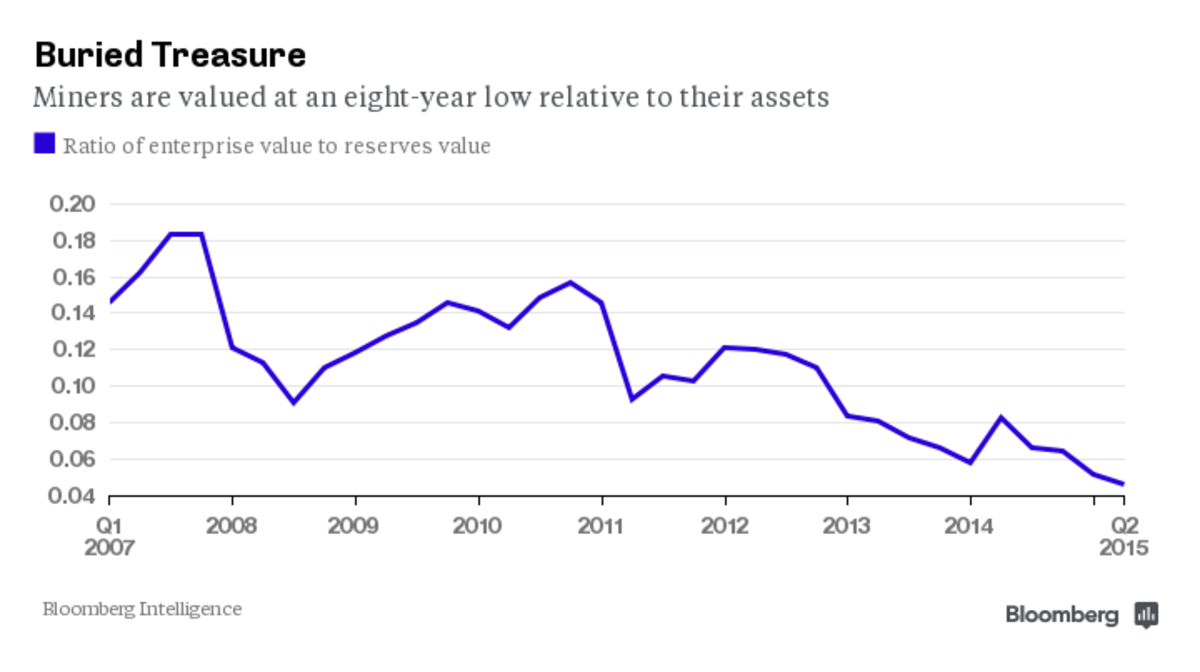

Not only have gold mines become very cheap compared to physical gold, but the market value is also relatively low compared to the gold reserves that the mines have on their balance sheets. The following chart from Bloomberg clearly shows that.

Gold mines cheap relative to underground reserves (Source: Bloomberg)

In our opinion, gold mining stocks are not an alternative to buying physical gold. An investment in the mines is highly speculative, while owning physical gold is a safe option. With the possession of physical gold you have no counterparty risk, while with gold mines that risk is very high. In addition to the normal business risk, a gold mine has the government as an important counterparty risk. The gold in the ground (or the proceeds of gold mining) can be claimed by the government in the extreme case.