9.4

7.521 Reviews

English

EN

China's economic growth could be disappointing in the coming years, economist predicts Han de Jong in his blog. The former chief economist of ABN Amro sees a number of major challenges for China. Linked to this are factors that determine whether the global economy is becoming more globalized or whether it emphasizes local production. Why could the growth of the Chinese economy be disappointing in the coming years and what factors determine globalization?

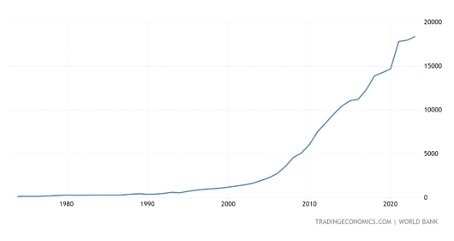

China began a liberalization policy in the 1970s that made the country very attractive to foreign companies. After China's accession to the World Trade Organisation, development accelerated. Foreign companies massively relocated production processes to the Asian country. China's Gross Domestic Product (GDP) has grown tremendously over the past 50 years.

China's GDP has exploded since the turn of the century. (Source: Tradingeconomics)

An important cause of the large growth in recent years has been the Chinese population. At the beginning of the twentieth century, the country had 400 million inhabitants, but by 2022 the population had grown to more than 1.4 billion. That growth now seems to be coming to an end. The country is aging and the population seems to be declining in the coming years. This also has consequences for the labour force. In previous decades, many workers moved to the city to work in industry instead of in the agricultural sector, where productivity is much higher. According to Han de Jong, the biggest steps in this migration have been taken.

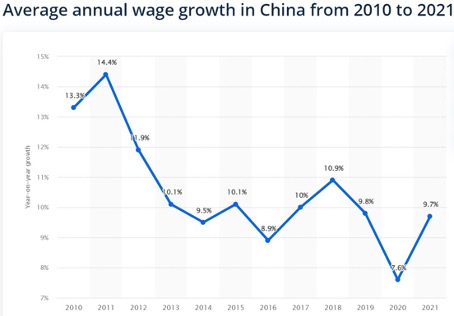

In the coming years, fewer new workers will move to Chinese cities, which may have an impact on labour costs. The minimum wage varies by province, but fluctuates between €2.08 and €3.30. As a result, companies still benefit from significantly lower labour costs than in developed countries. But wages have risen sharply in recent years, and as labor becomes scarcer, wages are likely to rise further. Other countries, such as India and Bangladesh, are copying China's business model and attracting companies looking for cheap labor.

Wages have grown rapidly in China. (Source: Statista)

In addition, China is facing problems in the real estate sector. For example, the real estate giant Evergrande has been in the news several times because it is in serious trouble. The company must now sell all assets to pay creditors. The Chinese government also has less room to stimulate. In the past, China invested heavily in infrastructure projects if the country wanted to boost economic growth, but now that its national debt is even higher than America's at 280 percent of GDP, there is less and less room for such stimulus.

China's inflation rates. Deflation is now looming. (Source: Tradingeconomics)

The recent problems in supply lines are also creating uncertainty about the future of the Chinese economy. In recent years, global networks have also proven to be very vulnerable. This was the case during the corona crisis when international trade took a hit, but the Suez Canal also appears to be a vulnerable link. For example, in 2021, a container ship caused a traffic jam after the ship got stuck and blocked the canal. Transport through the canal is now being troubled again, this time by Houthi rebels attacking ships out of solidarity with Palestinians. Ships are therefore now diverted via the Cape of Good Hope, which ten to fifteen days longer.

There is also increasing pressure on companies to produce responsibly. Not only do consumers demand that the products they buy are not associated with child labour, deforestation or exploitation, but also the European Commission has now come up with a legislative proposal. This bill has major implications for companies, as buyers now have to trace the origin of products. This requires transparent Supply Chains And it is precisely global supply lines that make such transparency very difficult.

Finally, it is difficult to say how geopolitical developments affect the situation. Under President Trump, the trade relationship between America and China was already under pressure due to the trade wars. The geopolitical situation has only become more turbulent since 2022 with a war in Ukraine and Gaza. Recently, Ab Gietelink the war in Ukraine. Geopolitical tensions also affect the ins and outs of the economy. Some companies are making changes to save their image. For example, Heineken withdrew from Russia after Russia invaded Ukraine. Other companies are affected by rules. For example, ASML has to deal with export restrictions. The Dutch government prohibits the company from exporting certain products to China.

The largest economy is still by far that of the United States. In 2023, the GDP of the U.S. was $27.94 trillion. China is in second place with a GDP of 17.5 trillion. Allianz trade predicts a growth of the Chinese economy of China in the coming years of 3.9 percent. That's high by our standards, but very low by China. India Last year, for example, it grew by 7 percent. The picture that Han de Jong paints could therefore be correct; the growth explosion in China seems to be over.

Japan was in the top three for decades, but has now been overtaken by Germany. Our eastern neighbors are now in third place with a GDP of 4.5 trillion. Japan follows in fourth place with a GDP of 4.2 trillion. It is expected that India will take over the third spot in the coming years. A large part of India's population is still under the age of 35. With a population of 1.4 billion people, India's economy can therefore be expected to grow greatly. Germany and Japan, on the other hand, are struggling with an ageing population and a shortage in the labour market.

Han de Jong has expressed his concerns about German industry on several occasions. The high costs are causing a decline in production. Compared to the period before the coronavirus crisis, the production level in the five most energy-intensive sectors is 23.1 percent lower. Reason enough for the former chief economist to call the developments in our neighboring country a disaster. The number of orders increased in December but according to de Jong, this increase was incidental. China's disappointing growth is also affecting the manufacturing industry here. All in all, therefore, the economic outlook is not yet very strong.

Production in Germany is decreasing. (Source: Cyrstalcleareconomics)