9.3

8.064 reviews

English

EN

Inflation figures in the Eurozone continue to be high, according to Reuters. On Thursday, it was announced that inflation is still at 8.5 percent, which is higher than expected. As a result, the European Central Bank (ECB) seems to have no choice but to raise interest rates sharply again on 16 March.

The Netherlands and Germany

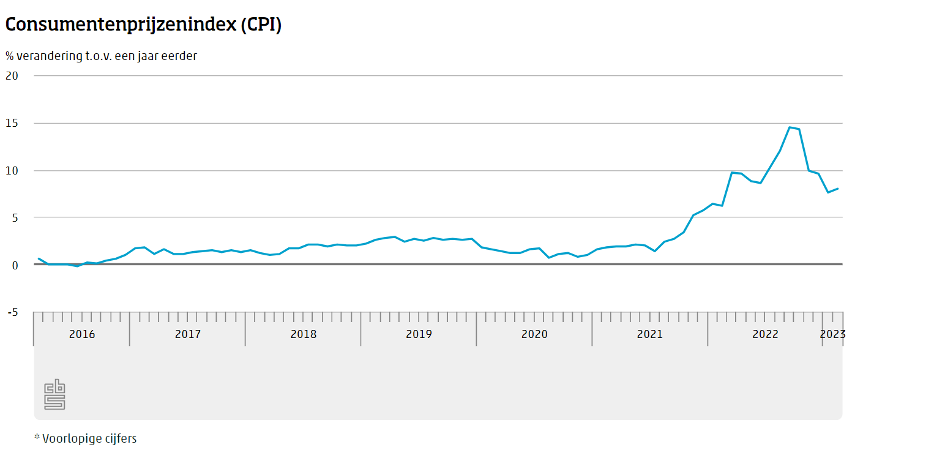

A year after the outbreak of the war in Ukraine, inflation is still significantly higher than the target of 2 percent. In September 2022, an inflation rate of 17,1 percent. Six months later, this percentage has fallen somewhat, but is still high. In February, products in the Netherlands were on average 8 percent more expensive than a year ago, according to a quick estimate by the CBS. In January, the inflation rate was 7.6 percent.

Graph of the inflation figures, which can be seen on the website of the CBS

Inflation also rose in Germany compared to January. Germans were 9.3 percent more expensive last month than a year ago, while that figure was 9.2 percent a month ago. Inflation was also higher than expected by economists at Bloomberg, according to Bloomberg Business Insider.

Energy prices have been falling for a while now. Last winter was relatively mild, which meant that countries only had to use their gas reserves to a limited extent. As a result, the price of gas is now back to pre-war levels, after prices reached record highs last summer. The higher inflation is now caused by entrepreneurs passing on the costs previously incurred to customers. Food and drink in particular have become more expensive as a result. According to the German statistical office Destatis, food prices were 20 percent more expensive last month than last year.

Euro area

If one looks at the inflation figures for the Eurozone as a whole, the figures are lower than in January. Although inflation in the Eurozone fell to 8.5 percent, inflation was still higher than expected. In January, inflation was still 8.6 percent, for February inflation was estimated at 8.2 percent due to falling energy prices. At 8.5 percent, the figure was higher than expected, according to the report Reuters.

Core inflation, i.e. the price increase excluding strongly fluctuating products such as food and energy, was also higher. Instead of the 5.3 percent core inflation expected by analysts, core inflation came in at 5.6 percent. In January, it was 5.3 percent. The costs of higher energy are therefore increasingly trickling down to the prices of other products and services.

Rate hikes on the horizon?

As a result, the ECB seems to be forced to raise interest rates further. The next rate hike of 0.50 percentage points is expected on March 16, but the question now arises whether this is enough. Core inflation tends to be a good indicator of longer-term inflation. Now that it is higher, the ECB seems to be forced to continue with its current path of interest rate hikes.

China's recovery could also further fuel inflation this year. Since the coronavirus restrictions were lifted, confidence in the Chinese economy has been growing and the Chinese economy is showing signs of recovery. This is how the Purchasing Managers Index, an index of purchasing managers' confidence in the economy, is based on 52,6. Indices above 50 mean that there is growth and are generally considered a sign of confidence. Should the Chinese economy grow stronger, this could lead to higher inflation figures later this year. After all, the increasing demand from China has a price-pushing effect on the prices of energy and raw materials.

The likelihood that the ECB will continue to raise interest rates sharply after March seems to be confirmed by Joachim Nagel, president of the Bundesbank. Klaas Knot, President of the Dutch Central Bank, seems to agree with this opinion.share. On the other hand, the governor of the Bank of France, François Villeroy de Galhau More restrained. According to the governor, the ECB would be wise to raise interest rates gradually. Italian Ignazio Visco, governor of the Bank of Italy, is also not keen on a sharp interest rate hike, as inflation is already showing a downward pattern in the long term.

Should the ECB opt for hefty interest rate hikes, the central bank will try to curb demand. However, the high inflation was caused by a supply-side problem, such as high container prices and energy prices going through the roof. Both causes are factors over which the central bank has little influence. As a result, the ECB is in a difficult situation, argues Frank Knopers, analyst at Geotrendlines. It is very difficult for the ECB to determine what interest rates are needed to slow down inflation without pushing the economy into recession. As a result, it will be very interesting to see how the ECB will react to the current inflation figures.

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.