9.3

8.064 reviews

English

EN

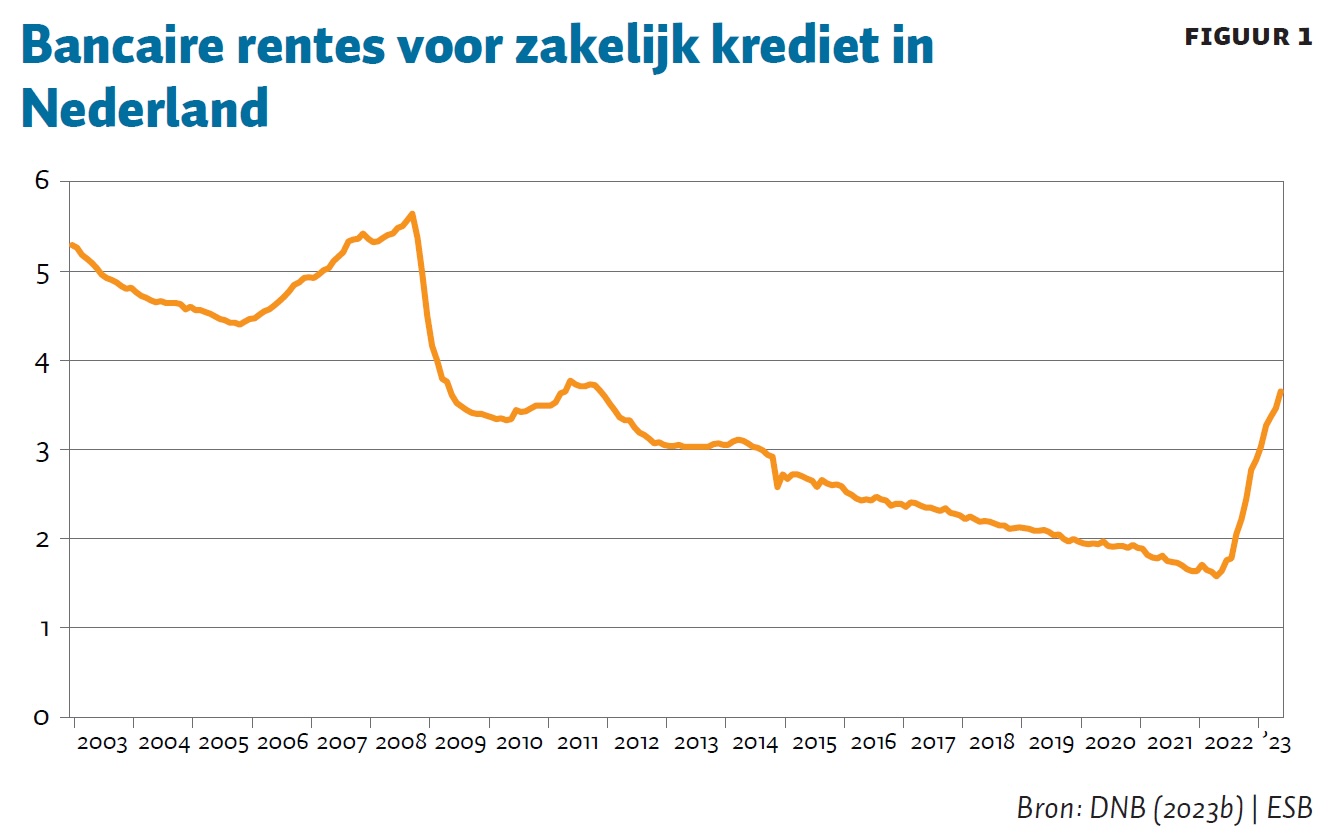

The Dutch economy has always had a complex relationship with interest rate fluctuations. Recently, a significant increase in interest rates has sparked a lot of discussion about the potential impact on both individuals and businesses. While private lending has already been extensively scrutinized, the impact on the business sector has not yet been fully explored. In this article, we will take a closer look at how Dutch companies may experience rising interest rates, especially with regard to business loans. Based on the current data, we will analyse the macroeconomic implications of this rise in interest rates and the resulting challenges for entrepreneurs in the coming year.

In April 2023, the interest rate on business loans was 3.65%, a significant increase from 1.6% a year earlier. However, the doubling of bank interest rates does not necessarily mean a doubling of the burden on companies. Factors such as the term of loans and the fixed-rate period play a crucial role.

Total loans to companies amounted to 296 billion euros in June, considerably less than mortgage debt, but still significant. After correction for cash pooling (55.5 billion euros), 240.5 billion euros remains as the actual loan value for companies. Small and medium-sized enterprises (SMEs) account for about 120 billion of this amount.

Of this amount, 92.4 billion euros (38% of total business loans) are at risk due to rising interest rates. This risk analysis is in line with figures from the Dutch Central Bank (DNB, 2023c). As a result, companies may have to deal with 1.85 billion euros in additional interest costs within the next year.

What is important is the concentration of debt. About 70% of loans above one million euros belong to only 6% of customers. Larger companies may be less affected by interest rate rises, but SMEs, which make up the majority in the Netherlands, may be hit hard.

In 2022, 16% of SMEs sought external financing, of which only 6.4% actually received funding. This can mean that many businesses are discouraged by high interest rates. In addition to interest costs, companies also face other financial challenges. For example, an increase in corporate tax and an increase in the statutory minimum wage. These topics were also discussed recently in Our Podcast together with Paul Buitink, Pim van Rijswijk and Ab Flipse.

Rising interest rates in the Netherlands are undeniably affecting both individuals and businesses. While larger enterprises may enjoy some protection, SMBs are likely to feel the biggest impact. In addition, rising interest rates combined with other economic factors can further burden business owners.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.

Source: ESB

Author: Edward Feitsma