9.4

7.521 Reviews

English

EN

Under the leadership of President Charles de Gaulle, France withdrew its entire gold reserves in the 1960s. This is what Jan Nieuwenhuijs writes in his recent article on Moneymetals. The operation took place in the period before President Nixon lifted the peg between gold and the dollar. Repatriation turned out to be a good move, because gold rose sharply in value in the period that followed. Countries that held on to the dollar were much worse off as a result. How did the repatriation of the French gold reserves go?

After World War II, world leaders tried to restore the monetary system. Since the Gold Standard was used during the interwar period for had caused problems, a modified gold standard was chosen, with more flexibility. Since America was the absolute superpower in the post-World War II period, the dollar was pegged to the gold. All other currencies, in turn, were pegged to the dollar. As a result, the world basically transitioned to a Dollar Standard, making the dollar the world's reserve currency. The fixed price of $35 per troy ounce was maintained by the formation of a Gold Pool. A group of central banks would maintain the price by buying or selling gold in the open market.

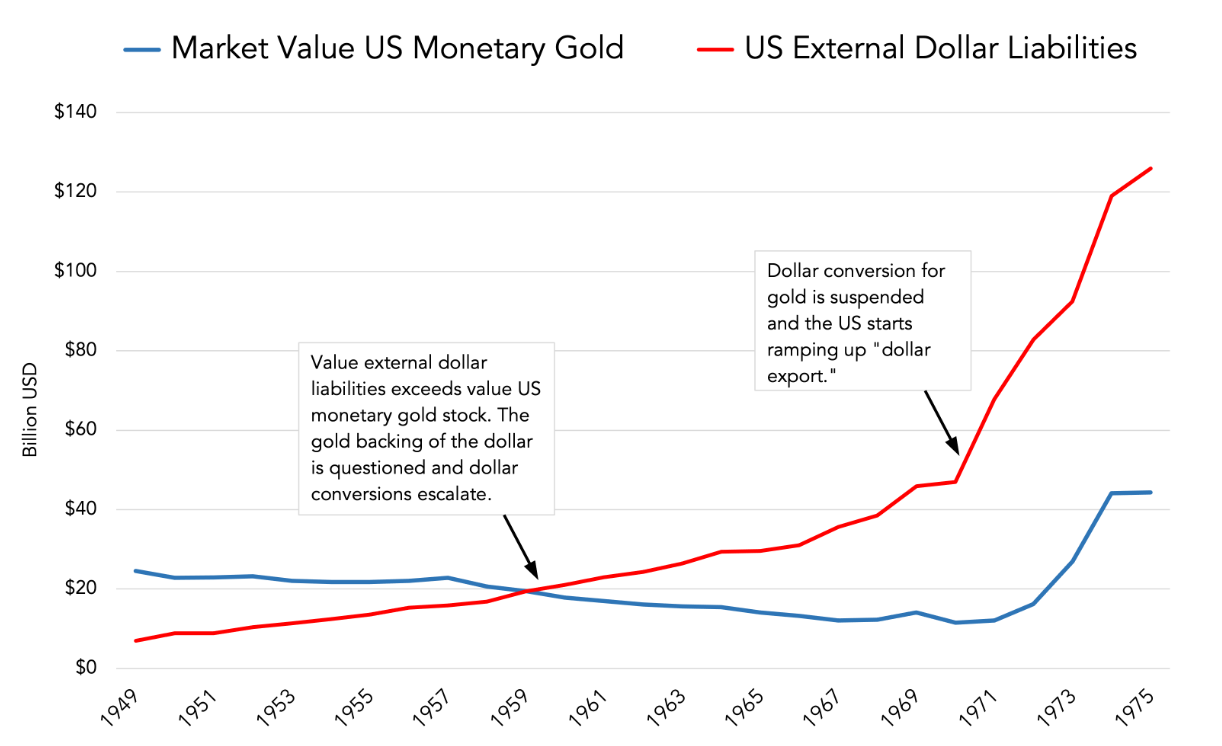

The system began to falter as America began to spend more and more money. The Vietnam War, a series of domestic reforms, and the space race created an ever-widening deficit in the U.S. balance of payments. As a result, countries with balance-of-payments surpluses built up large dollar reserves. From 1960 onwards, international dollar reserves exceeded the gold reserves of the Americans. This put pressure on the dollar's coverage.

From 1960 onwards, the amount of gold was no longer sufficient to cover the dollar reserves. (Source: Money Metals)

From 1960 onwards, the amount of gold was no longer sufficient to cover the dollar reserves. (Source: Money Metals)

The French said they thought the Bretton Woods system was unfair. In fact, America was able to finance the spending by printing dollars, and other countries were saddled with large dollar reserves as a result. Between 1958 and 1968, France had built up large reserves through strong economic growth. The French took into account that in the long run countries would not be willing to stick to the dollar and would opt for gold. In such a scenario, the Americans' gold supply would continue to dwindle and the system would not be sustainable.

It was therefore illogical that the prices of many products had risen since 1930, while the price of gold had remained constant due to the intervention of the Gold Pool. If the peg between the dollar and gold were to be lifted, gold would rise sharply in value. France, like the Netherlands, had suffered a major loss when the United Kingdom abandoned the gold standard. Such a debacle was not to be allowed to happen again. In addition, countries could only exchange their dollars if the Fed, the US central bank, agreed to do so.

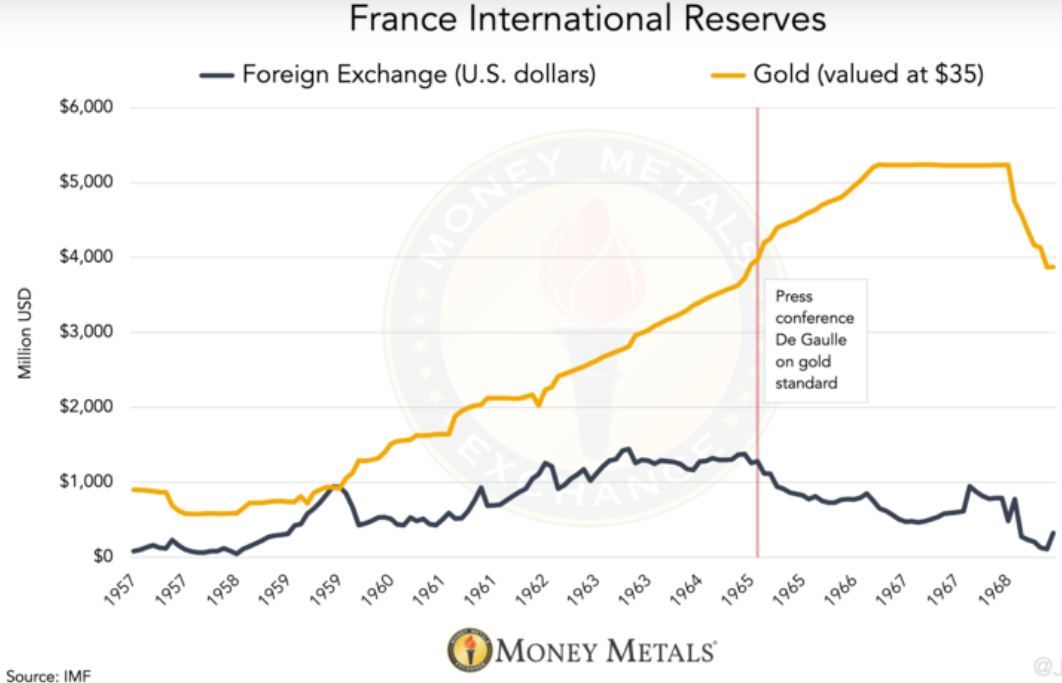

The above factors were reason enough for De Gaulle to take action. By 1961, France had already secretly exchanged dollars for gold stored in the vault in New York. From 1963 onwards, De Gaulle also began the physical repatriation of gold to France, out of concern that the Americans could use the French gold in New York as a means of geopolitical pressure. Remarkably, the French central bank advised against the movement of gold. According to the bank, the operation only led to high costs due to transport and insurance.

But De Gaulle stood his ground and in September 1963 400 tons of gold were shipped from New York. Since this operation took place in secret, the French Navy was not deployed, but the French used ocean liners of the Compagnie Générale Transatlantique, which were capable of shipping 25 tons at a time on two voyages per month. Some of the gold was stored in the United Kingdom, the rest disappeared into the vault of the French central bank.

The repatriation was accelerated after the British pound threatened to devalue in 1964. Britain, like America, was struggling with a balance of payments deficit. With the pound on the verge of devaluation, De Gaulle also considered the chance of a devaluation of the dollar increasingly likely. For this reason, the repatriation of French gold was accelerated. The gold that was stored in London was transported to Paris by Air France planes. France later also used planes to retrieve the gold from New York more quickly.

In a very short time, France brought all its gold reserves back to Paris. In 1965 and 1966 94 flights were carried out transporting 1175 tons of gold from London. From America, 35 flights and 24 boat trips brought 1638 tons of gold to Paris.

France held more and more gold in the 1960s. (Source: Money Metals)

France held more and more gold in the 1960s. (Source: Money Metals)

De Gaulle turned out to have prophetic gifts. Global financial stability came under increasing pressure in the years following the repatriation. France had joined the Gold Pool on the condition that America would eliminate the current account deficit. As the deficit remained, the French left the Gold Pool in 1967. Later that year, the British pound came under pressure and was forced to devalue.

The Gold Pool then had to sell more and more gold to maintain the gold price, until it had to suspend operations for two weeks. A two-tier gold system emerged. The official gold price was maintained, but on the free market the gold price could fluctuate. This meant that central banks could trade gold among themselves at the official gold price, but in practice no central bank would sell gold at this price. After all, the market price of gold was already far above the official gold price.

More and more central banks exchanged their dollars for gold, despite the necessary intimidation of the Americans. When the Dutch Central Bank (DNB) wanted to exchange dollars for gold in 1971, a delegation from the Fed travelled to the Netherlands to convince DNB not to exchange it. In vain, then-DNB president Jelle Zijlstra did not give in. In August 1971, President Nixon closed the gold counter, bringing the Bretton Woods system to an end.

Since the 1960s, the vast majority of France's gold reserves have been stored in Paris. The French have recently renovated the vault with stronger floors, more compartments and a modern IT system. In addition, the French central bank has upgraded all gold bars to the standards of the current gold market. This allows France to trade gold quickly and easily on the market. It's a sign that France is once again anticipating what may come. Gold has become increasingly important as a reserve in recent years. France's actions show that not only emerging economies, but also Western countries are holding on to precious metals.

Photo: Charles de Gaulle & John F. Kennedy in Paris 1961 (source: John Fitzgerald Kennedy Library, Boston)

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.