9.4

7.466 Reviews

English

EN

Banks don't really have much to fear from the digital euro, as I conclude in my thesis. My graduation research was about different designs for the Central Bank Digital Currency (CBDC) and the impact on banks and monetary policy. In theory, banks can be sidelined, but the effects on banks are easy to manage. How can the European Central Bank (ECB) prevent banks from seeing their position deteriorate?

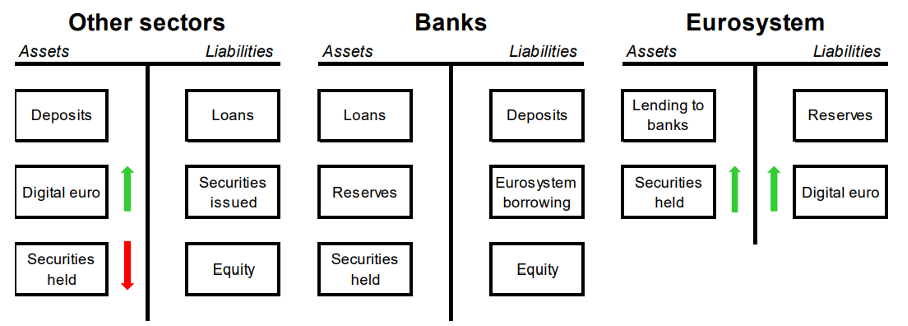

Since the digital euro is a debt of the central bank, it is fundamentally different from the digital money that is currently held in the account. Digital money in an account is currently still a debt owed by commercial banks to the customer, but the digital euro changes that. The introduction of the digital euro gives customers the opportunity to exchange part of their money to CBDC. Such a change will have an immediate impact on the bank's balance sheet, as shown below.

Source: ECB

The figure shows that the balance sheets of both households and the central bank (Eurosystem) does not change substantially. There is only one change visible on one side of the balance sheet, but the size of the balance sheet does not change. The balance sheet of the commercial bank, on the other hand, is changing. A decrease can be seen on both sides. So money flows out of the bank, because customers exchange a debt instrument from the commercial bank for a debt instrument from the central bank.

This can have negative consequences. Banks play a major role in lending. As an economistTeunis Brosens In a podcast on {{P3}} explained, banks actually create money out of thin air. This process is Mutual acceptance of debt and can continue as long as a bank has enough reserves. Thus, part of the coverage of the deposits must be liquid so that banks have buffers for any losses. The term Fractional Reserve Banking therefore refers to the degree of liquidity of the cover, not to the coverage of deposits.

Suppose depositors exchange money from the bank to digital euros in large numbers, this could have an impact on lending. Banks could have less room to create credit, reducing lending. This is also known as bank disintermediation said. Banks will be sidelined in this extreme scenario, which will have adverse consequences, as a large part of the investment depends on credit. The pros and cons of Fractional Reserve Banking have also been discussed in a conversation with economist Wim Boonstra.

The easiest way to avoid sidelining banks is to put a cap on the number of CBDCs one can hold. In the proposed design of the digital euro, this is likely to be a maximum of 3000 euros, but central banks can also opt for a flow-based maximum. In such a case, the number of digital euros that can be withdrawn or spent in a given period is limited. For example, people will only be able to withdraw and spend 200 digital euros per month or per year. As a result, people have the choice to build up larger assets in the long term, but the limitation is oppressive in the short term.

It is possible to design the digital euro in such a way that interest is paid on it. The digital euro could therefore be used as a monetary tool. For example, in another piece we already described the concept of tiered remuneration, a construction in which different interest rates apply to different brackets. For example, a different interest rate is charged on the first thousand euros than on the second thousand euros on an account. In such a case, the central bank can influence savings behaviour more precisely.

Critics are only afraid that the interest rate on the digital euro will turn negative at some point. That scenario is only possible if one no longer has an alternative in the form of cash. In another piece, We already know that a phase-out of cash is very unlikely in the short term. Minister of Finance Sigrid Kaag now even wants to enshrine the accessibility of cash in law.

Side effects can also be mitigated if banks borrow more from the central bank. When commercial banks borrow from the central bank, it becomesWholesale funding said. As a result, the decrease in deposits is offset by a loan from the central bank. In this way, commercial banks retain the scope to create credit, as the bank's balance sheet does not shrink. This process looks like this on the balance sheets of commercial banks, households and the central bank.

Source: ECB

Note that the commercial bank's balance sheet does not shrink in this scenario. Whereas in the previous scenario a bank had to draw on reserves, the central bank now steps in by providing a loan. This is the green arrow next to 'Eurosystem borrowing'. Also note that the central bank's balance sheet is growing as a result of this action. The balance sheet of households (other sectors) is not undergoing any significant change.

There are risks associated with this. A higher reliance on Wholesale funding means that banks have lost some of their cheap funding. This makes banks more fragile when interest rates go up.

The ECB may also choose to provide digital euro only if certain assets are surrendered for this purpose. If households then want to hold digital euros, they can only do so if they exchange them for bonds, for example. In doing so, the central bank's balance sheet grows, just as it did in the previous step.

Source: ECB

There are therefore several options for overcoming the side effects of the digital euro. The question arises as to what exactly is the point of the digital euro. You could say that the central bank thus provides a modern public means of payment. Cash doesn't seem future-proof in an increasingly digitized world. Perhaps it is commendable that central banks are already thinking about a successor to the banknote, before the payment system will soon run entirely on money from commercial banks. It is also fair to say that the digital euro may continue to evolve for a long time and may change dramatically at a later date. In later phases, therefore, the usefulness of the digital euro may increase if the limits are extended and interest may be paid.

Yet it is strange that central banks should also do their best not to make the new currency too attractive. That's because a reliable and secure alternative to bank balances can quickly turn into a Bank Run when there is turmoil in the banking sector. However, if the digital euro is underused due to its lack of attractiveness, the development and maintenance of the digital euro infrastructure will be very expensive. How much money are people willing to pay for such a means of payment?

Paul Buitink recently spoke Menno Broos, project leader of the digital euro at DNB, elaborated on the design and usefulness of the digital euro.