9.4

7.585 Reviews

English

EN

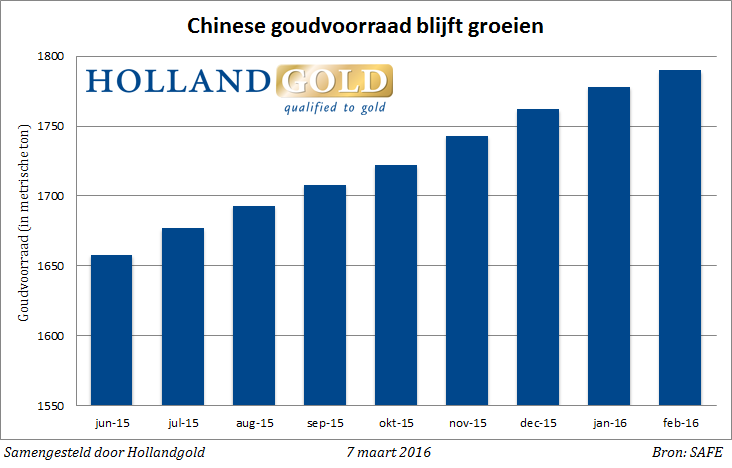

The total value of China's gold holdings reached a record level of $71 billion, up from $63.75 billion in January. The increase is largely attributable to the higher gold price, but precious metal was also added to the reserve last month.

Since June last year, the Chinese central bank has been publishing the size of its gold reserves and foreign exchange reserves on a monthly basis. It is clear from this Figures shows that the Chinese are constantly Buy gold, because every month we saw an increase of ten to twenty tons in the total gold reserve.

Gold was also added to the vault in February. If we convert the total value of gold to the gold price at the end of February, we arrive at a total stock of 1,788.5 metric tons or 57.5 million troy ounces. This is an increase of 10.5 tonnes compared to January.

China bought more than 10 tonnes of gold in February

The Chinese central bank, like the ECB and the central banks of Switzerland and Russia, uses a valuation method in which the gold stock is periodically revalued against the current Gold price. This is in contrast to the Federal Reserve, which has valued its claim on gold for decades at a historic rate of $42.22 per troy ounce of gold.

China added 120 tonnes of gold to its reserves in the second half of last year. According to Barclays estimates, the People's Bank of China will increase its inventory by 215 tonnes this year. Between 2009 and 2015, the central bank added more than 600 tonnes to its stockpile.

While the Chinese are adding precious metals to their reserves, they are reducing their currency reserves. In February, it decreased by $28.6 billion to $3.2 trillion, the lowest level in more than three years. As a result, the gold stock as a percentage of total reserves rises to 2.22%, compared to 1.97% in January.