9.3

8.064 reviews

English

EN

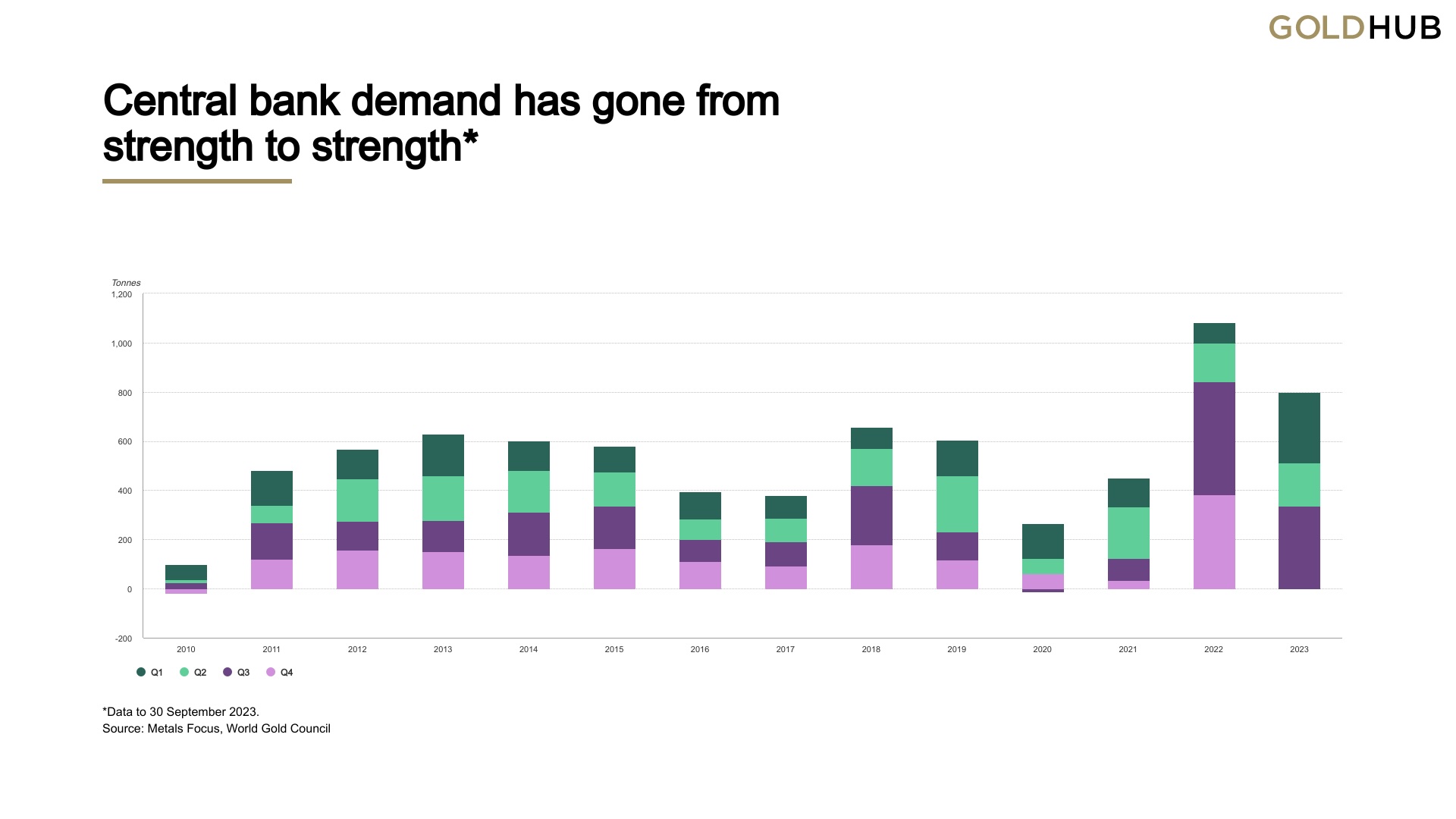

In the third quarter, central banks increased their gold purchases to 337 tonnes. This makes it the second-largest Q3 in history in terms of gold purchases. Total purchases for this year now amount to an impressive 800 tonnes. This data shows that 2023 could be a year with strong demand for gold by central banks.

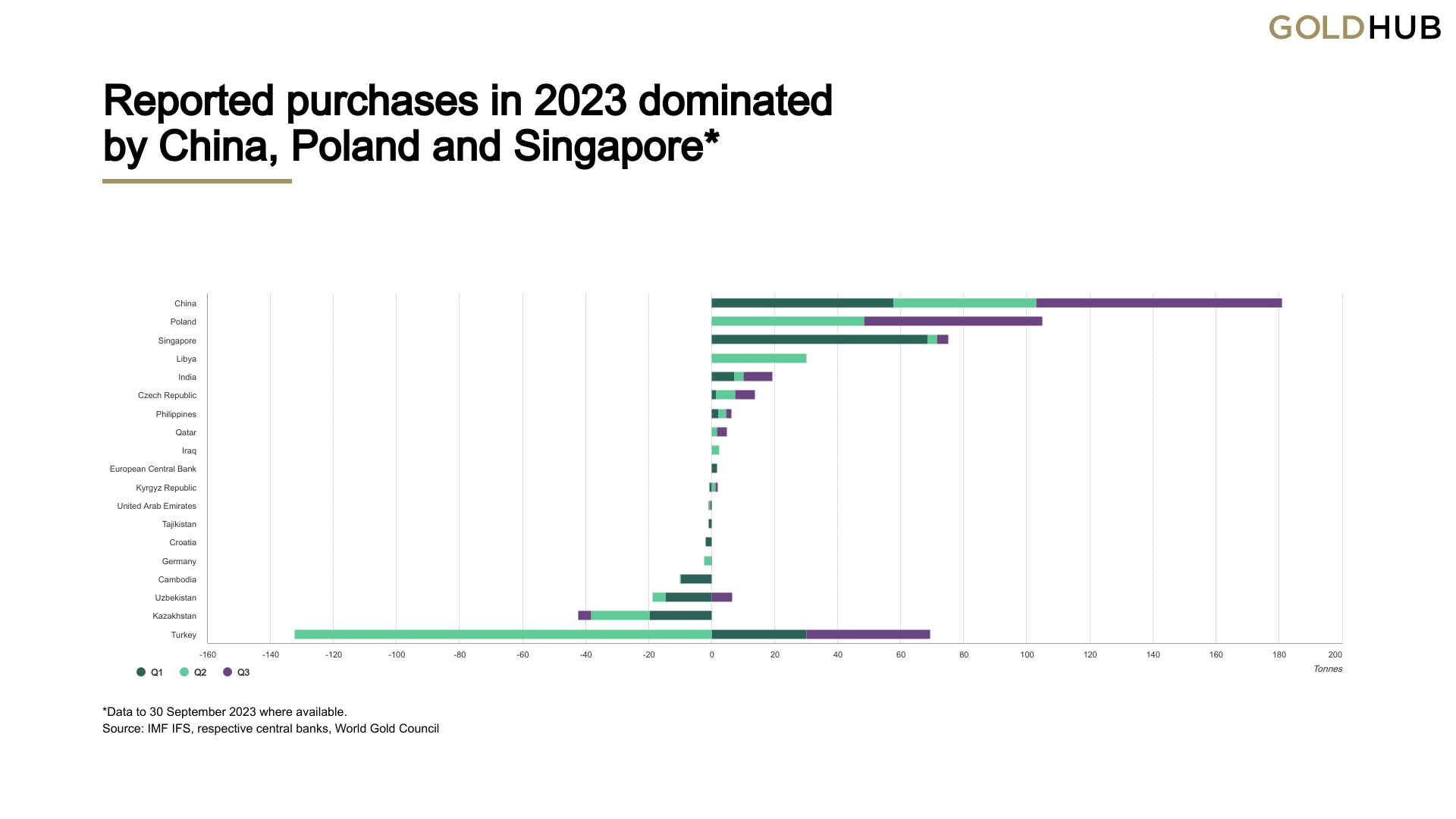

In the recent quarter, the People's Bank of China (PBoC) was the largest buyer by adding 78 tonnes to its gold reserves. For the year as a whole, the bank has now amassed 181 tonnes, bringing the total to 2,192 tonnes, or 4% of its entire reserves.

The National Bank of Poland (NBP) continued to buy gold at a high pace, adding another 57 tonnes in the third quarter. Their annual total now stands at 105 tonnes, already exceeding their target of 100 tonnes for this year. NBP President Adam Glapiński underlined the importance of this strategy and expressed the ambition to grow gold reserves to 20% of the total, a significant increase from the current 11%.

After an earlier decline this year, Turkey replenished its gold reserves with 39 tonnes in Q3, bringing the total to 668 tonnes. Despite this, this number is still 12% lower than at the beginning of the year.

Source: Metals Focus, World Gold Council

In addition to the prominent players in the market, eight other central banks have increased their gold reserves, indicating varied demand. India topped the list with a purchase of 9 tonnes, followed by Uzbekistan with 7 tonnes, the Czech Republic with 6 tonnes and Singapore with 4 tonnes. Russia has also indicated that it wants to resume its purchases of gold and foreign currency, but further details are not forthcoming.

Source: IMF IFS, Respective central banks, World Gold Council

The broad purchasing behaviour was offset by very limited sales. Kazakhstan was an exception with sales of 4 tonnes. A report by Bloomberg drew attention to the Central Bank of Bolivia. Evidence suggests that the bank may have converted 17 tonnes of its gold reserves into cash between May and August, which would represent a potential 40% drop. However, the concept of 'monetisation' is not yet fully understood; This can involve both direct sales and barter transactions. Furthermore, reports are circulating that Bolivia plans to buy 5 tonnes of gold from local production in the second half of 2023.

As 2023 unfolds, it appears that global central banks have a positive view on gold. The current buying intensity has even exceeded some previous expectations. Despite the net increase in gold purchases in 2022, 2023 may be able to match this pace, especially if the fourth quarter continues this trend. However, the record set in the fourth quarter in 2022 sets a solid benchmark to match.

Do you want toGold bars or Gold Coins buy? We are happy to help you with your order.