9.3

8.058 reviews

English

EN

Commodities and gold will outperform other investments this year as demand picks up as China's economy reopens. That Writes commodities analyst Jeffrey Currie of U.S. investment bank Goldman Sachs in a new market commentary. Rising interest rates put pressure on commodity prices in the second half of last year, but he expects a strong rebound this year. Why does he think now is the time to invest in commodities?

"I can't think of a more positive brew for raw materials. There is a lack of supply in all markets", that's how Currie summed it up in a presentation last week. "Inventories are at critical levels or production capacity is exhausted." The Goldman Sachs analyst sees parallels with the commodity boom in 2007-2008, when the prices of many commodities skyrocketed along with the price of oil. The U.S. central bank took its foot off the brake pedal, while the Chinese economy kicked into high gear. The oil price then shot up to $100 per barrel, before rising further to more than $140 per barrel in 2008.

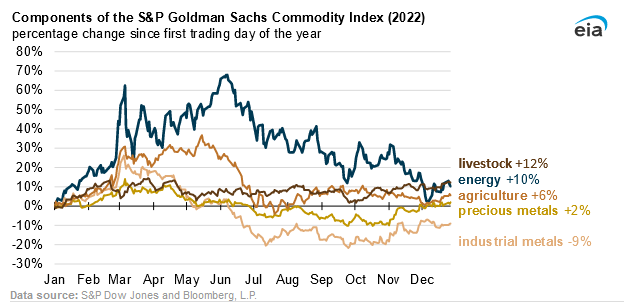

Commodity price developments in 2022 (Source: Goldman Sachs, via IEA)

Oil prices have been on a downward trend since June last year, but Currie says that decline is not a good reflection of the fundamentals in the oil market. "The oil market has not yet priced in a combination of rising demand and declining production in Russia. The reopening of China's economy is a game changer. Commodities such as crude oil, refined oil products, liquefied gas and soybeans will benefit the most from the tailwinds of the Chinese economy."

The Goldman Sachs analyst also has high expectations for various other commodities. According to him, there could be a shortage of aluminium if demand from Europe and China picks up again. The bank previously raised its price target on aluminium for this year from $2,563 to $3,125 per tonne. The bank has been positive on commodities since 2020, mainly due to the lack of investment in this sector. This is the result of years of underinvestment, which will not be made up overnight.

The bank expects the S&P GSCI Commodity Index to rise by 9.9%, 17.3%, and 31.2%, respectively, over the next three, six, and twelve months. For the next twelve months, Goldman Sachs foresees the largest price increases in energy (+46.9%), industrial metals (+29.6%) and precious metals (+5.7%).

According to the bank's analysts, Gold price rising this year due to a weaker dollar and the trend of deglobalization. "Gold, in particular, is on the verge of a long upward move because de-dollarization is very positive for the precious metal... especially at a time when the Federal Reserve is slowing down its pace of interest rate hikes due to concerns about economic growth. As a result, ETFs' gold stocks will stabilize. If the dollar falls further, there is significant upside potential for commodities."

Also Read:

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.

The image above this article is from Nick Youngson and is freely available under the Creative Commons 3.0 license