9.4

7.521 Reviews

English

EN

Next Thursday, bankers from the European Central Bank (ECB) will meet to discuss monetary policy and another decision will be made on the ECB's policy rate. Holland Gold spoke with Frank Knopers, market analyst at Geotrendlines, on inflation and the ECB's upcoming interest rate decision. We also asked him what the prospect is for precious metals. How does Frank Knopers view current developments?

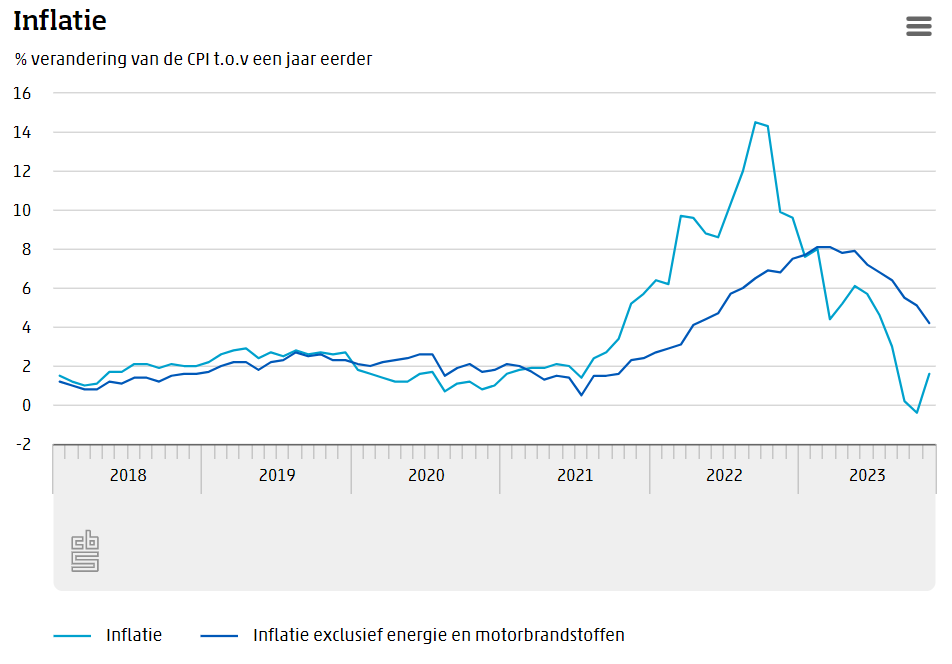

Prices in the Netherlands were according to the new calculation method of Statistics Netherlands in November 1.6 percent higher than one year previously. Although inflation has been falling for some time, the figures are still cause for concern, according to Frank Knopers. Different components of inflation react differently. While energy prices are falling and prices of luxury products are under pressure, grocery prices are still high. Inflation excluding energy came in at 4.2 percent and that is still well above the ECB's policy target. 'High inflation has led to a loss of welfare, because for many people the costs have risen faster than the income,' says Knopers.

Inflation figures from Statistics Netherlands (CBS)

Inflation figures from Statistics Netherlands (CBS)

According to Frank Knopers, the question is who should bear this loss of purchasing power; 'Workers can compensate for this loss of purchasing power by asking for higher wages, but companies will pass on those higher wages in the price, threatening a wage-price spiral. The government should actually break such a trend by ensuring that net wages in particular rise," the analyst thinks.

This could be done by reducing taxes on labour. For example, disposable income will go up, which is a good stimulus for the economy, according to Knopers. The national debt may well increase slightly, but ideally the state should also work on reducing spending. 'The government could cut back on a number of things. There are a lot of subsidies, there is a large climate fund, but the public broadcaster, for example, could also be smaller. The government is now so big that problems arise rather than solve problems,' says Knopers.

Frank Knopers does not expect interest rates to be raised again on Thursday. Now that inflation has been falling for some time, there is no need to raise interest rates even further, especially since the effect of an interest rate hike is always noticeable with a considerable delay. However, according to Knopers, it is important on Thursday that the ECB provides clarity about PEPP, the central bank's bond-buying program. As a result of the bond-buying programmes, there is now seven trillion euros on the ECB's balance sheet. And although the ECB halted the program in March 2022, the central bank is still reinvesting the income it receives from those bonds.

As a result, the balance cannot be reduced. According to Knopers, the ECB could start reducing its balance sheet due to falling market interest rates. A smaller balance sheet would also improve trust in the institute. Thus, the market analyst differs from the economist Wim Boonstra, who indicated in a Holland Gold podcast last year that these bonds have in fact become irrelevant and that these bonds could also be written off. Putting these bonds back on the market did not seem like a good idea to Boonstra.

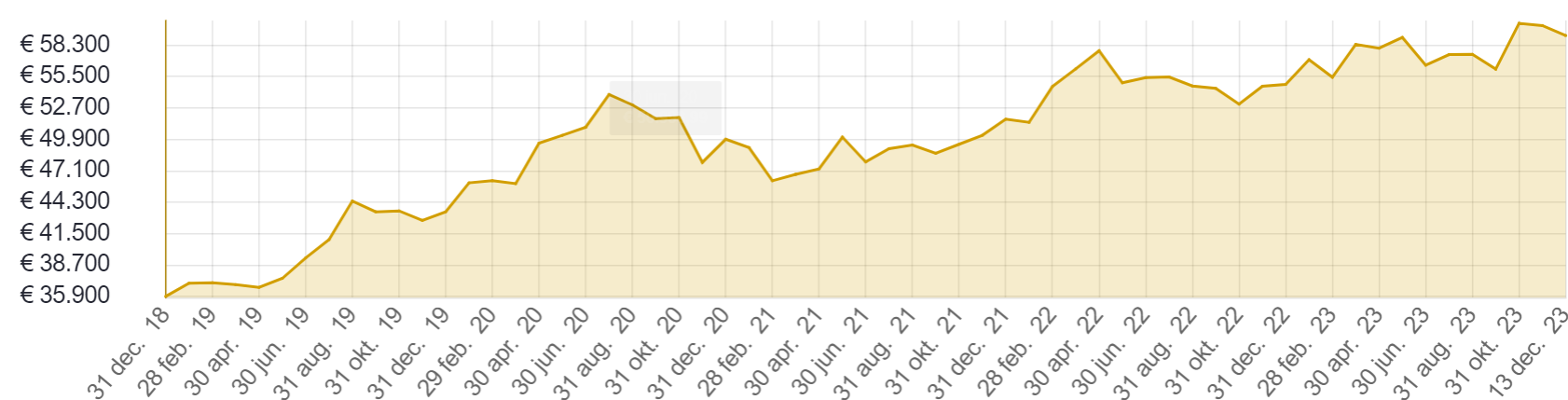

Frank Knopers is more optimistic about precious metals. He spoke Last week in the podcast with Holland Gold already about achieving a new all-time-high. After that, the Gold price Is. "We've seen gold ETF stocks fall for a while now. That means that big Western investors are selling. However, it is gold is still very popular in Asia, where the precious metal is still sold at a premium,' says the analyst. 'It's hard to say exactly what the price will do, because it depends on countless uncertain factors.'

Nevertheless, the outlook for precious metals in general is good, according to Knopers. Over the past ten years, interest rates have played an important factor behind the price of gold. It is quite possible that central banks will cut policy rates in 2024 and that could be good news for precious metals, Knopers thinks. "In November, we already saw that prices of precious metals, but also of shares, bonds and cryptocurrencies went up, and that was due to market interest rates falling," the analyst looks back. If central banks also lower policy rates, this will have a positive effect on the gold price.

Geopolitical factors also have a major impact on the price of precious metals, and geopolitical relations remain unsettled. Also, the conflicts in the Middle East and Ukraine are complex issues and there are no easy solutions. But even if Ukraine is no longer able to fight, or if it has to start negotiating, the uncertainty about what happens next could exacerbate the Gold price give a new impulse, Knopers thinks.

On top of that, countries are looking for alternatives to the dollar. Last summer, a possible BRICS coin was frequently in the news. Although this currency will not be introduced in the short term, a trend is visible. 'During Putin's last state visit to Saudi Arabia, the governor of the Russian central bank also went along. So we are not just talking about Hamas and Israel. That was a striking sign and it indicates that the BRICS countries are thinking about an alternative to the dollar,' says Knopers.

Should BRICS countries actually come up with an alternative, it will take a lot of time. In the summer, Knopers already mentioned a BRICS coin The future. Time will tell what alternative countries will come up with. 'Now we see that the BRICS countries mainly stimulate local currencies such as the renminbi. Russia now also pay with the renminbi, for example, but we also see that India wants to use its own currency. Oil-producing countries in the Middle East may have an ace up their sleeve in this discussion. But if the plans for a BRICS currency fail, then gold a good alternative', Knopers thinks.

Geotrendlines has recently published a new edition of the book 'From Gold to Bitcoin' and subjects such as the oil crisis of the 1970s and the geopolitical tipping point around Ukraine and the Middle East are described in detail. This book shows that capital is always looking for a safe haven and that gold and Bitcoin will play an important role in an economically and geopolitically fragmented world with increasing distrust of governments and banks. It will be interesting to see how these topics will develop in the coming year. So the outlook for precious metals remains good.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.

Do you want toGold bars, Gold Coins, Silver bars or Buy Silver Coins? We are happy to help you with your order.