9.3

8.064 reviews

English

EN

Jan Nieuwenhuijs started his career as a sound engineer in the film world, but the financial crisis in 2008 caught his attention. He became obsessed with the monetary system and wrote about gold and the economy for various platforms. Now he writes blogs for Gainesville Coins, a U.S. dealer in gold and silver coins. A recent article van Nieuwenhuijs attracted attention. In it, he wrote about the plan of European countries to match gold reserves. Why do some central banks coordinate the gold supply and why do other European countries hold very little gold? Holland Gold asked Jan Nieuwenhuijs.

Why do countries coordinate their gold reserves?

'After the financial crisis of 2008, many people started to worry about the monetary system. Also in the Chamber, the then Minister of Finance, Jan Kees de Jager, Parliamentary questions about the situation with the Dutch gold. One of those questions was about why the Netherlands had sold so much gold between the 1990s and 2008. De Jager replied that this was done to bring the stock more in line with that of other important gold-bearing countries. Then we were also asked to whom our gold had been sold and it turned out to be mainly emerging economies. Later it turned out that China to have bought gold from the Netherlands in the 90s. China, on the other hand, did not have enough gold relative to GDP. Gold was therefore distributed in proportion to the Gross National Product (GDP).'

So the fact that the Netherlands sold gold was not because DNB no longer saw the usefulness of gold?

"No, I don't. Indeed; Europe was not at all happy with the decoupling of gold and the dollar in 1971. Gold has the great advantage that it has no counterparty risk and that it is scarce. In addition, Europe had the largest gold reserves. America wanted to get rid of gold because it would make the world switch to a dollar standard, but Europe didn't want that at all. Europe then started with the euro, in order to counterbalance the dollar.

How do central banks view gold as a reserve now?

'Since 2008, counterparty risk has become very real again, when countries got into financial distress. Since then, central banks have started buying more gold, and those gold purchases have already increased after the war in Ukraine, as gold serves as a neutral asset. China, in particular, has been a big buyer in recent months. It is not known exactly how much gold the country holds, but its gold reserves are probably well above the official figures. My estimation is that China now has about 5,200 tons of monetary gold possession. Countries in Europe are also buying a lot of gold, but these are mainly the countries that may become part of the eurozone, such as Poland and the Czech Republic. So those countries are already aligning their gold reserves with the eurozone average.'

And what is the position of the Netherlands?

Director of the Dutch Central Bank, Aerdt Houben, also recently indicated that DNB has been preparing for a new monetary system based on gold. I do not think they want such a system to be introduced in the short term, but they are preparing. Central banks do this, for example, by aligning gold stocks. This is also evident from statements made by other central banks. For example, the Bank of Italy know that gold, unlike national currencies, always retains its value and offers excellent protection during a financial crisis. I think it's quite something for a central bank to say something like that. For example, there are all kinds of quotes from central banks that show that they are holding on to gold.'

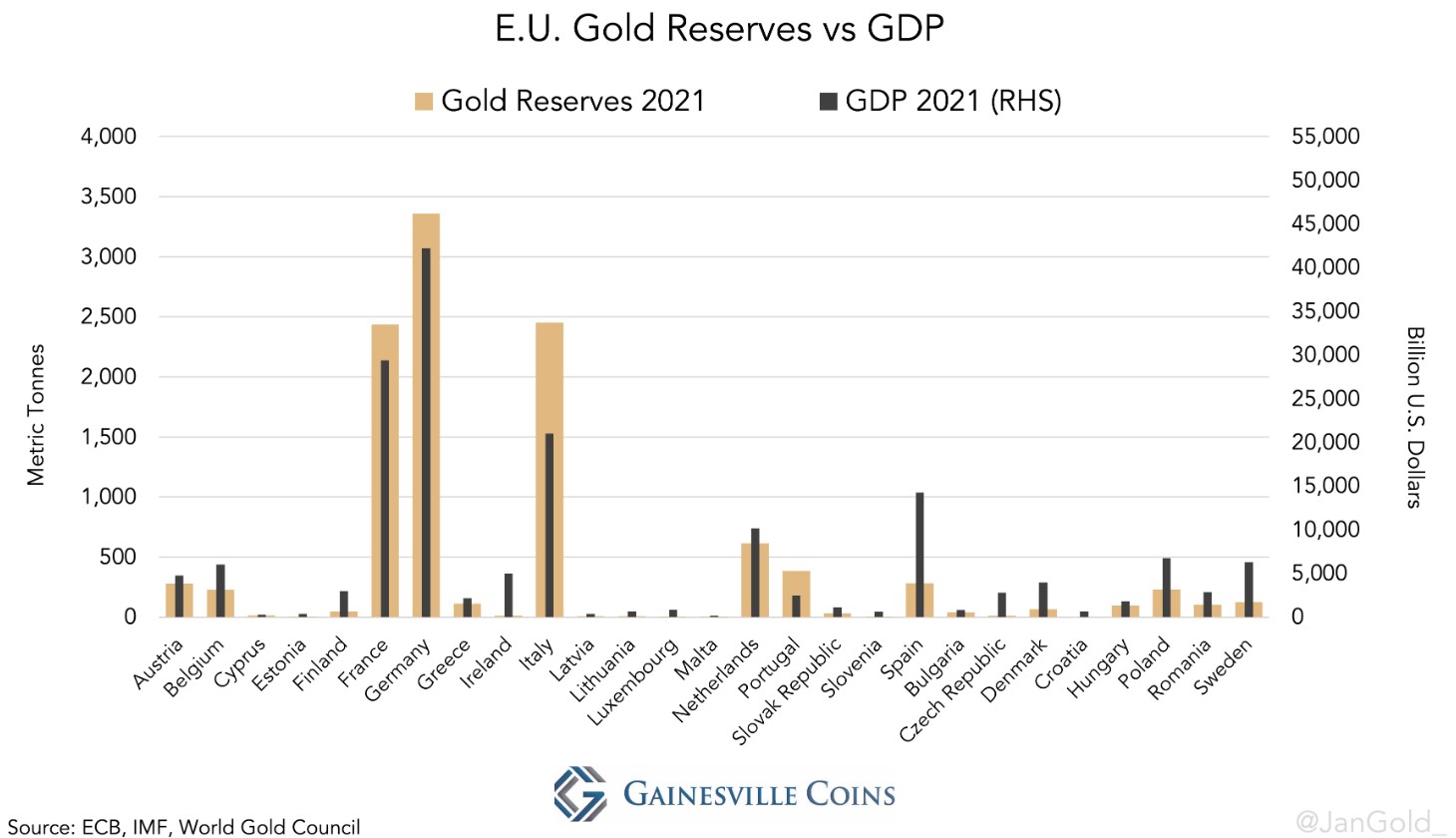

European economies and the amount of gold that the countries hold as reserves. (Source; Gainesville Coins)

European economies and the amount of gold that the countries hold as reserves. (Source; Gainesville Coins)

However, not every country is following the trend. Croatia switched to the euro this year, but stores almost no gold and Scandinavian countries also do not use the percentage that the Netherlands is aiming for. Why do these countries deviate from the average?

'No, that's right, the Netherlands now holds about four percent of GDP in gold. This is similar to other European countries, but there are exceptions. Denmark, Ireland and Sweden are among the oldest and most developed economies, and it is politically sensitive for those countries to buy gold. You can see that most major economies such as the Netherlands, France and Germany are at the average. Indeed, smaller countries, such as Estonia and Croatia, have almost no gold. That's not really a problem, because their total reserves are in order. If necessary, gold reserves can be balanced, because Italy, for example, has a relatively large amount of gold.'

But should countries such as Poland and the Czech Republic add gold to the reserves? They could also save money and only buy gold from Italy if unrest arises. Which countries do you expect to continue buying gold in the coming years?

'My theory is that the small economies can indeed do without large gold reserves, but the medium-sized and large economies, such as the Czech Republic, Poland and Hungary, must strive for a certain percentage. That is why these countries have bought a lot of gold in recent years and I think they will continue to do so in the near future. Countries outside Europe will also continue to strengthen their gold reserves in the near future. Countries such as China will have to add thousands of tonnes to catch up with Europe, and that applies to more countries. It will be interesting to see whether these countries will stop as soon as they reach European directives, or whether they will perhaps go beyond them.'

In your articles you talk about a possible gold standard, but do you mean a classical gold standard like before the First World War?

"No, I don't. During the classical gold standard , the monetary base was backed by gold. Now gold would be tied to GDP and therefore to the monetary aggregate M3, a broader understanding of the money supply. Indeed, the monetary base is now more volatile due to the monetary policy of recent years. The gold standard that then arises is one in which the gold price is stabilized. The central bank can then go into the market to buy or sell gold, but interest rates can also be adjusted.'

How realistic do you think such a scenario is? Society has become accustomed to a money system in which the money supply is flexible. A standard also means that pain has to be suffered, for example due to debt write-off. Is that desirable?

'It is indeed becoming a bit more Spartan and I think that a gold standard will only come about if there really is a systemic crisis. It is true that far-reaching measures will have to be taken, including debt write-off. Some of the debts can be cancelled with the help of the increasing Revaluation reserves of central banks. These are rising sharply due to a higher gold price. So in the first few years, the transition to a new system will cause problems, but it can also be positive in the long run. Companies that are not viable do indeed go bankrupt, but this also frees up resources for productive companies. And if we continue in this way, with a central bank that acts again and again, that could also have consequences, because soft healers make stinking wounds. So maybe we should bite the bullet to come out better', says Jan Nieuwenhuijs.

Do you want toGold bars, Gold Coins, Silver bars or Buy Silver Coins? We are happy to help you with your order.

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.