9.4

7.525 Reviews

English

EN

The German Bundesbank has released the desired amount of gold ahead of scheduleRecalled from New York and Paris. After the repatriation of 300 tonnes of gold from the United States was completed last year, the last pile of 91 tonnes of gold from France is now back in Frankfurt. This means that the plan to keep half of its gold reserves in its own country has been completed three years ahead of schedule.

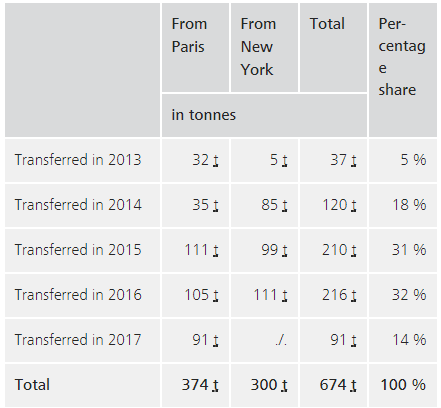

In 2013, the Bundesbank announced its plans to bring back a larger part of its gold reserves to its own country. The goal was to store half of the precious metal in Frankfurt again by 2020, for which 300 tons from the US and 374 tons from France had to be recovered.

Bundesbank has withdrawn gold from Paris and New York (Source: Bundesbank)

Germany has the second largest gold reserves in the world with 3,378 tonnes of gold spread over three locations. Only the United States, with 8,133 tonnes, has more precious metal in its vault. With the withdrawal of the gold stockpile, the central bank of Germany is responding to the criticism that it had too little gold under its own management.

After the Second World War, Germany rapidly built up a new gold reserve. In exchange for the export of goods, the country was allocated more and more gold that was already in the vaults of the Bank of England and the Federal Reserve.

Just before the introduction of the euro in 1999, the Bundesbank was already withdrawing a considerable amount of gold, mainly from London. Little happened after that, until Germany announced its plans to remove gold from New York and Paris in 2013. The following graph shows the development of the German gold reserve from 1951 to the present day.

Development of gold reserves in Germany since 1951

The Bundesbank says it has subjected all recovered gold bars to a thorough inspection, during which no irregularities were found. In 2015, the Bundesbank published a video showing how the gold bars are checked for authenticity.

With this repatriation, the more than thousand-page list of gold bars be updated. The new overview with the state of affairs on 31 December 2017 is expected next spring.