9.4

7.521 Reviews

English

EN

At a time of rising geopolitical tensions, growing distrust in the monetary system and persistent inflation, the Gold price In dollars, key resistance levels have recently been breached. This development indicates that gold may be facing a period of significant appreciation, according to the report Jan Nieuwenhuijs in its Last article Both historical data and current economic indicators suggest that gold is currently significantly undervalued, with the potential to double in price in the coming years.

The last few decades have seen a massive expansion of the global financial system, mainly driven by a strong reliance on credit instruments. However, increasing Geopolitical tensions between major powers, coupled with concerns about Debt saturation and inflation, undermine this confidence. As a result, the preference is shifting to assets with no counterparty risk, such as gold, which are considered safer in times of uncertainty.

J.P. Morgan stated before the U.S. Congress in 1912 that "Gold is money, everything else is creditThis statement emphasizes a fundamental aspect of finance: all forms of money rely on trust. Although various goods and objects have historically been used as money, gold has maintained its status as a universally accepted form of money with no counterparty risk, providing a foundation of the global financial system.

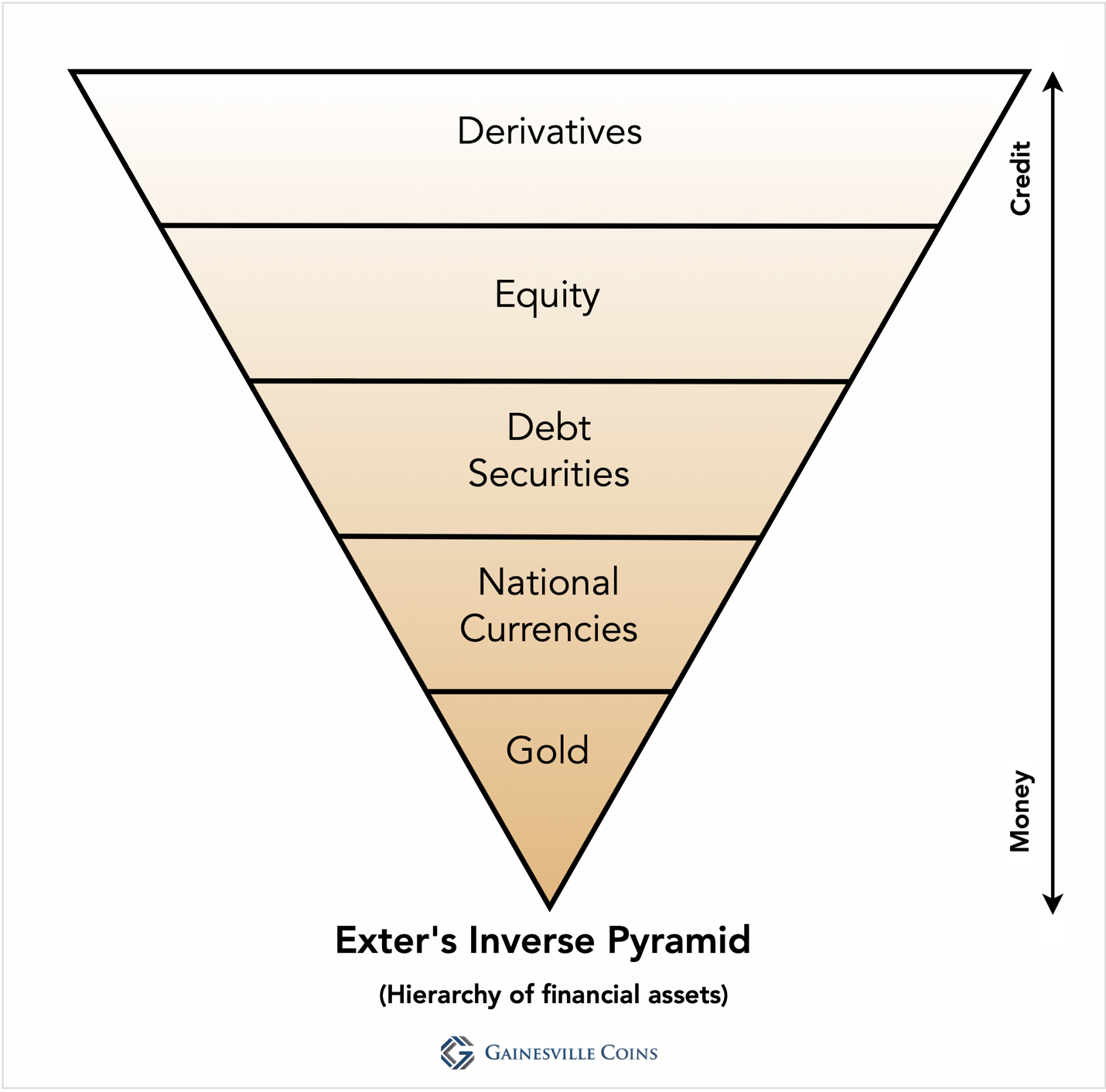

The Inverted Pyramid of Exter shows how gold supports all higher-risk financial instruments. According to economist Perry Mehrling, the quality of financial assets decreases as one moves up the pyramid, with gold as a stable base. This structure is especially important during economic downturns, when confidence in gold increases while other assets are scrutinized more critically for their ability to be "created out of thin air."

At the moment, gold's share of global financial assets is small, indicating a potential for growth. Previous periods of low reliance on credit, such as during the World War II and the late 1970s showed that the value of gold relative to other financial assets increased significantly. Historical trends suggest that we are on the cusp of another great bull market for gold, driven by declining confidence in traditional credit and currency systems.

The emerging bullish trend in the gold market is not only a reaction to the current economic pressures, but also reflects a broader recalibration of the financial system. As central banks and other financial institutions step up their Gold Reserves this shift could lead to a 'De-dollarization' of international reserves, influenced by geopolitical tensions and economic policies.

Given current economic indicators and historical patterns, it is likely that the Gold price significant increases. This would be consistent with past patterns in which periods of low valuation for gold, relative to other financial assets, were followed by sharp increases in value. Central banks, recognizing gold's stabilizing role, are likely to become increasingly Buy gold, which will drive the price up further.

The shifting dynamics in the global financial landscape indicate a growing role for gold as a stabilizing force. This transition, driven by declining confidence in traditional credit and currency systems, could usher in a new era in which gold not only ensures financial stability but also influences economic policy. Investors and policymakers are increasingly turning their attention to gold, recognizing its potential to protect assets from future economic uncertainties. With signals pointing to a continued rise, gold's strategic importance in the global financial system is increasing, marking a crucial shift to safer and trust-based assets.

On Thursday 16 May 2024, Holland Gold will host a event on Gold and world politics in the Georg Kessler Lounge at the AFAS AZ Stadium.

The event consists of three parts: one interview, one presentation and a Q&A session for the audience. For example, the gold rush is discussed in World Politics, the geopolitical tensions that are rising every day; in Ukraine, the Middle East, in West Africa and around Taiwan. What impact does this have on the financial system? Central banks seem to be caught in a gold rush. The yellow metal achieves a Record price. How long will the US dollar remain dominant?

Buy your tickets here: https://www.hollandgold.nl/evenement/

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.