9.4

7.585 Reviews

English

EN

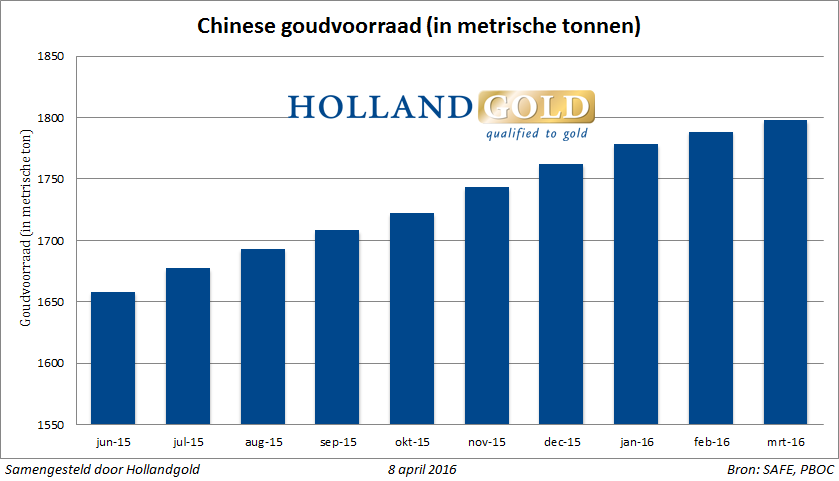

China's central bank added 9 tonnes of gold to its reserves in March, according to the latest Figures which were released this week. China's total gold reserves grew to 1,797.5 tonnes, which represents a value of $71.48 billion at the end of March. That's more than a month ago.

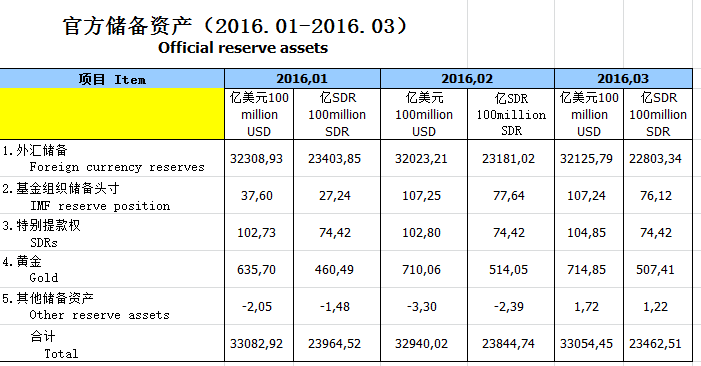

Since June last year, the Chinese central bank has been providing a monthly overview of all reserves, including the gold stock. The value of the gold stock changes monthly due to both the purchase of gold and the change in the Gold price. Since June 2015, the value of the precious metal on the central bank's balance sheet has risen from $62.39 billion to $71.48 billion, and a total of nearly 140 tons of the yellow metal has been added to its reserves.

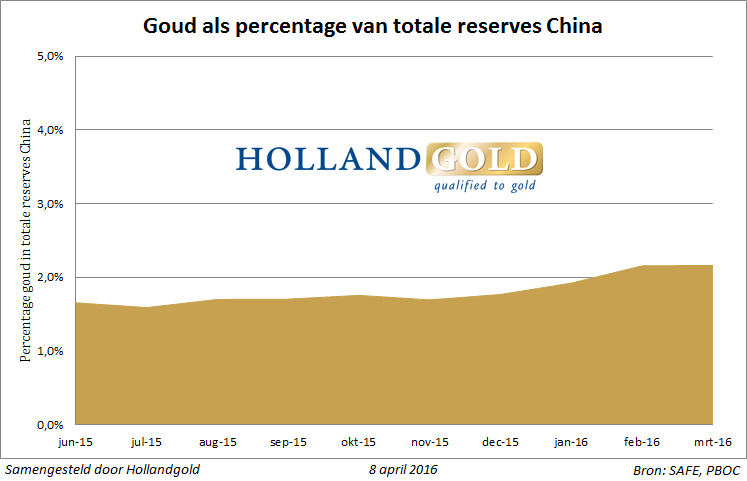

Because the Chinese central bank has simultaneously disposed of more than $400 billion in foreign exchange reserves, gold as a percentage of total reserves has increased slightly since the summer of last year. In June 2015, the central bank still had 1.65% of its reserves in the precious metal, but last month this had risen to 2.16%. That's still a fraction compared to other central banks. In Russia, for example, that percentage is more than 15%, while in the Eurozone even more than half of its reserves are held in the form of precious metals.

Despite the rise in gold and the rise in the price of gold, the percentage of gold on the balance sheet of the Chinese central bank remained stable at 2.16%. That's because, for the first time in five months, currencies are back in the reserves added. The foreign exchange reserve grew by $10.3 billion to $3.21 trillion last month. The decline was halted by a weaker dollar, restrictions on capital outflows, and an increase in fiscal and monetary stimulus in China.

Finally, a striking detail: China has recently started valuing its reserves not only in dollars, but also separately in SDRs! Are the Chinese already preparing for a new international monetary system?