9.3

8.064 reviews

English

EN

China and Russia are already using almost no dollars in mutual transactions, according to Russian Foreign Minister Sergei Lavrov. Both countries have been taking action for some time to reduce their dependence on the American currency. What does dedollarization look like and what can we expect from the gold price?

According to Lavrov, Russia is now almost completely rid of the dollar for trade with China. Local currencies such as the Chinese renminbi and the Russian ruble are now used in 90 percent of mutual transactions. Several countries are therefore looking for an alternative to the dollar. The U.S. currency used to be used in the vast majority of international transactions, but now that the dollar is increasingly being used as a weapon, countries are looking for alternatives. We see that central banks are holding more and more gold instead of currencies as reserves. For example, China's central bank added in the past few years. 17 months gold to the reserves. By diversifying its reserves, the country wants to reduce its dependence on the dollar.

A similar development is taking place in the foreign exchange market. In 2022, 63 percent of the currency demanded in the Russian foreign exchange market consisted of dollars. This is logical, because the dollar could not be ignored for many international transactions. Now, however, a change is visible. By 2023, the percentage had already fallen to 39.5 percent. On the other hand, the share of the Chinese renminbi has grown significantly and has overtaken the dollar last year. In 2022, the renminbi still accounted for 13 percent of the Russian foreign exchange market. A year later, this was up to 42%.

The growing share of the renminbi is in line with the current development, in which Russia and China are growing closer together. At the end of last year we wrote on Holland Gold all that Russia circumvents Western sanctions with China's help. Initially, Russia used Dubai as a major trading hub for gold, where the gold could be traded and melted down before being transported to Europe. However, due to tightened supervision of the gold market in Dubai, this route has come under pressure. As a result, Russia has increasingly focused on the port of Hong Kong for the export of gold. In 2023, 68 tonnes of gold were already traded through the port of Hong Kong, four times as much as in 2022.

The trade relationship between Russia and China is also intensifying. In 2023, the two countries were already acting for $200 billion with each other and that is a larger amount than ever before. China, for example, is buying more agricultural machinery from Russia. Other projects are also being launched: 'Cooperation in the energy sector is developing steadily. Joint projects are being carried out in the areas of investment and industry. Both countries benefit from such cooperation, both China and Russia," the Russian foreign minister said.

Now that almost 300 billion dollars in Russian assets have been frozen, the plan has also arisen to use these assets for Ukraine, he wrote Reuters last week. But exactly how this can be done is still a subject of debate. America is supporting the complete confiscation of the financial assets, and then handing them over to Ukraine. European officials expressed doubts about the desirability of such actions. Should the financial assets be confiscated, it could lead to a fierce legal battle. It is true that such confiscations have occurred before, such as in Iraq and Germany, but in both cases these confiscations took place after the wars of the respective countries. In America, too, experts point to the fact that such confiscations are not allowed if America is not in a direct armed conflict with Russia.

Ursula von der Leyen, President of the European Commission, recently indicated that it is possible to distribute the profits from Russian financial assets to Ukraine. The majority of the assets are bonds on which profits are made. These profits could reach twenty billion until 2027. This year, three billion could already be transferred from this year's profits. The European Commission is now proposing to use 90% of the money for military aid. The remainder will be spent on other aid for the Eastern European country.

But in Europe, people are wary of the consequences that such measures will have on the position of the euro. It is possible that other countries will therefore say goodbye to euro reserves as a precautionary measure. Some form of confiscation should therefore be done in consultation with other G7 countries, the thinking goes.

The outlook for gold remains very strong. In recent months, the gold price has risen enormously. Nevertheless, the gold price could rise much further now that geopolitical tensions seem to be rising further. Any escalations in the conflicts could be extremely inflationary, it warned James Lavish, Managing Partner of the Bitcoin Opportunity Fund. The U.S. government is already struggling with severe deficits, while America is not even in recession yet. Should any conflict escalate further, these deficits will increase even more, which could lead to rising inflation.

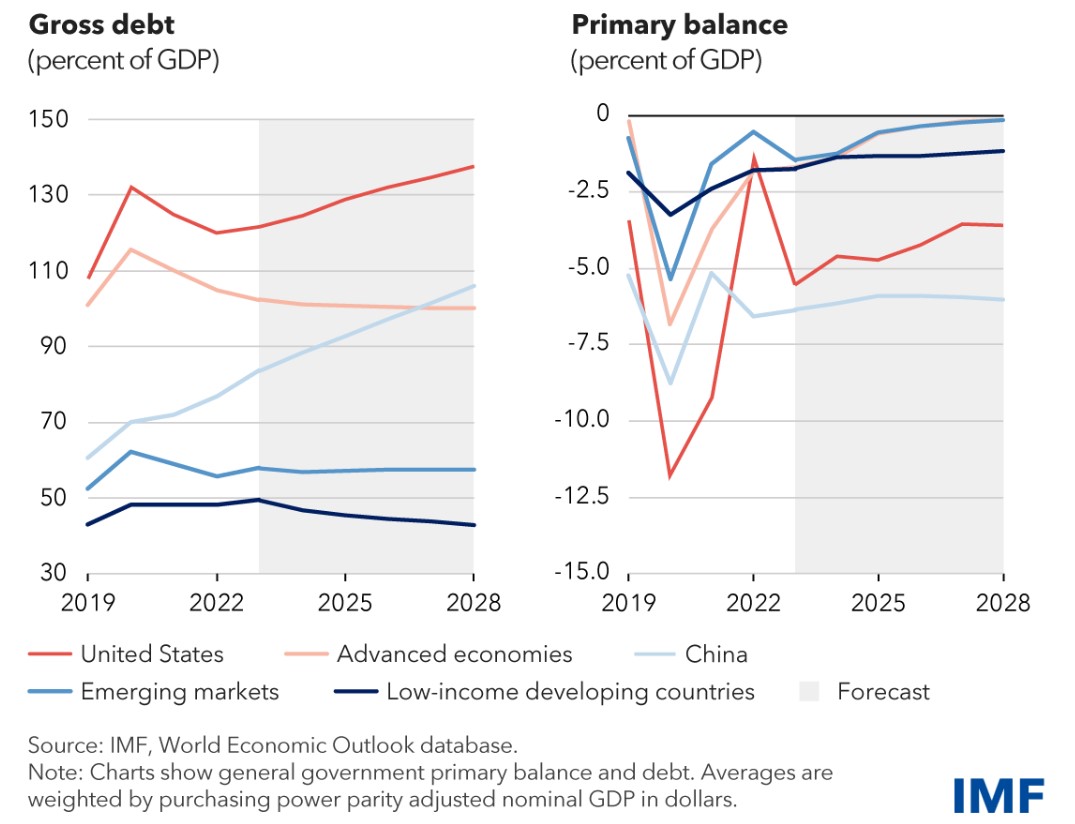

Also the IMF warned of rising government deficits. In 2023, global public debt rose to 93 percent of global GDP, mainly due to increased public debt from America and China. In 2024, elections are scheduled for several countries and that is likely to lead to greater spending and lower taxes. Although there are also countries that are tightening their belts in the near future, according to the IMF, this will not be enough to really keep public debt under control.

Rising public debt is cause for concern, the IMF said. (Source:IMF)

Rising public debt is cause for concern, the IMF said. (Source:IMF)

Recently, it appeared on Holland Gold An article that explains the relationship between debt and gold: When uncertainty increases as a result of higher debt, gold emerges as a robust alternative. Gold is not susceptible to devaluation due to the risk of default or inflation. At the Event of {{P3}} On Thursday, May 16, the role of gold in the current uncertainty will also be discussed further.

On Thursday 16 May 2024, Holland Gold will host a event on Gold and world politics in the Georg Kessler Lounge at the AFAS AZ Stadium.

The event consists of three parts: one interview, one presentation and a Q&A session for the audience. For example, the gold rush is discussed in World Politics, the geopolitical tensions that are rising every day; in Ukraine, the Middle East, in West Africa and around Taiwan. What impact does this have on the financial system? Central banks seem to be caught in a gold rush. The yellow metal achieves a Record price. How long will the US dollar remain dominant?

Buy your tickets here: https://www.hollandgold.nl/evenement/

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.