9.4

7.566 Reviews

English

EN

China's central bank has added an estimated 21 tonnes of gold to its reserves over the past month added, the largest monthly purchase since it was announced in June that its gold holdings had increased by more than 600 tonnes of gold since 2009.

The value of China's gold reserve rose from $59.52 billion at the end of October to $63.26 billion at the end of November, which is equivalent to an increase of 21 tonnes of gold when adjusted for the change in the gold price. In October China also bought an additional 14 tonnes.

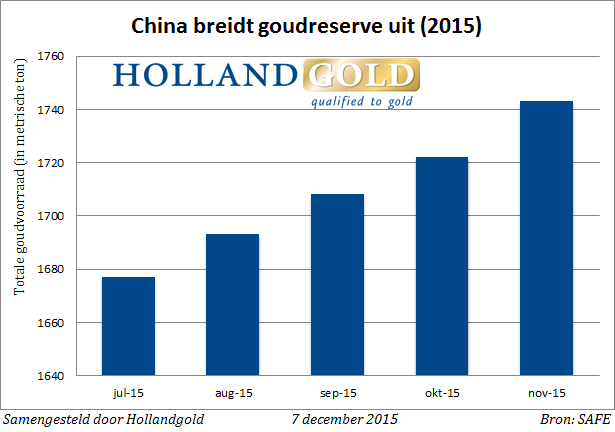

With the November purchase, the total size of China's gold reserve grew to 1,743 tonnes. That seems like a lot, but against the current Gold price it is not much more than two percent of the total reserves. Nevertheless, the gold reserve has increased sharply in absolute terms, because in the spring of 2009 the Chinese gold reserves did not exceed 1,054 tonnes.

China benefited from a lower gold price in November, as the precious metal became 7% cheaper last month. The expectation of a rate hike by the Federal Reserve continues to put pressure on precious metals prices.

China continues to shift its focus from foreign exchange reserves to gold, as in November Fell the foreign exchange reserve by $87.2 billion to $3.44 trillion. This is the lowest level since February 2013 and the third month of decline in a row. Last year, China's foreign exchange reserves hit a record $4 trillion.

China has reportedly sold dollars to support the value of the yuan. The currency was devalued by a few percent in August, making it the plaything of speculators on the foreign exchange market. By selling tens of billions of dollars in dollars, the Chinese central bank was able to restore confidence in the yuan.

It's not just China that is systematically adding gold to its reserves. Also countries such as Russia and Kazakhstan report an increase in their gold holdings almost every month. Since the outbreak of the financial crisis, central banks have become net buyers of gold, and China and Russia have a remarkably large share in this.

China bought 21 tonnes of gold in November, the largest purchase in at least five months