9.4

7.681 Reviews

English

EN

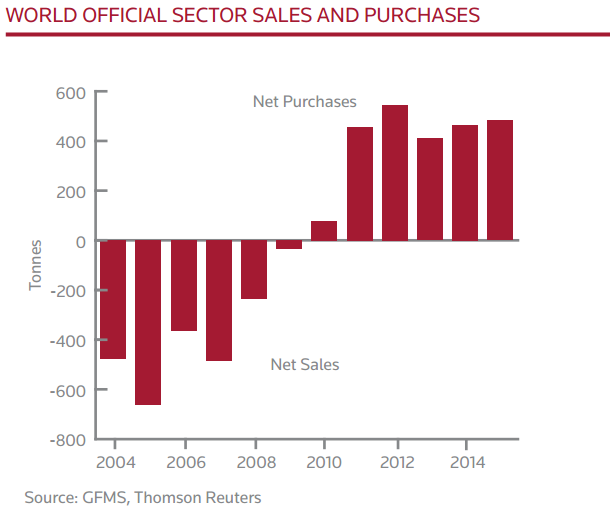

Central banks continue to buy gold as a hedge against geopolitical risks and as a form of diversification of reserves. In 2015, central banks added Thomson Reuters GFMS Globally, 483 tonnes of gold added to their reserves, the second-largest one-year increase since the end of the gold standard.

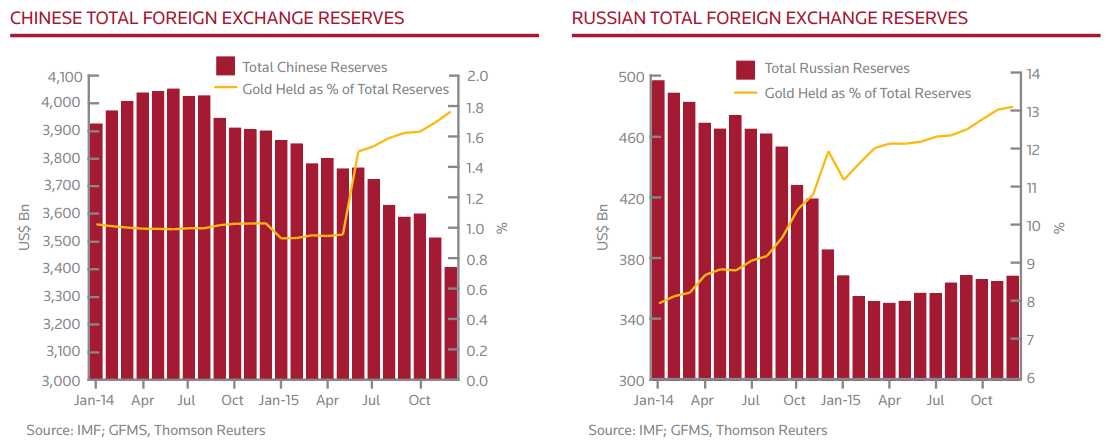

Russia was once again the largest buyer of gold last year, as their central bank added a record 206 tonnes of gold to its reserves last year. China also bought a lot of gold, more than a hundred tons since the figures were published in June 2015.

Research firm Thomson Reuters writes in its latest report on the gold market in 2016 that it is mainly emerging economies that Buy gold. In 2014, they accounted for more than 90% of all gold purchases. In 2015, the central banks of Russia and China alone accounted for 84% of total net purchases of gold.

According to Thomson Reuters, emerging market central banks are aiming for higher gold backing. Russia has already 15% of its reserves in gold and therefore may buy a little less gold in the coming years, while China still has a long way to go with only 2% of its reserves in precious metals.

Central banks also sold 43% more gold in 2015, at 77 tonnes. This increase can be explained almost entirely by Venezuela, which exchanged 44 tonnes of gold for dollar reserves last year. Colombia also sold 6.9 tonnes of gold last year, two-thirds of its total stockpile. El Salvador also sold a large part of its reserves, selling about 80% of its gold with 5.4 tons. Canada, Mexico and Sri Lanka also sold a few tonnes of gold in 2015.