9.4

7.605 Reviews

English

EN

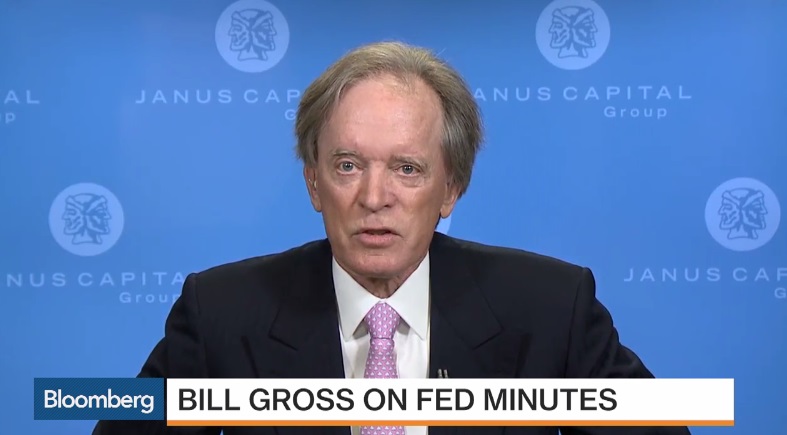

According to Bill Gross, government bonds with these historically low interest rates are too risky Become, because a rise in interest rates then has a much greater impact on the value of the bond. Bill Gross worked for bond investor Pimco for many years, so he knows the bond market like no other.

He has been worried about a bubble in government bonds for some time, because earlier this year he warned that the large mountain of government bonds with negative yields will one day explode like a supernova.

According to Bill Gross, government bonds at these extremely low interest rates are very risky, because he expects inflation to rise again in the future.

"A U.S. Treasury bond with an inflation-adjusted maturity of 30 years yields 1.6% today. I expect inflation to continue to rise with all future obligations such as Medicare, Medicaid and other social services. Then a return of 1.6% is very low."

Bill Gross thinks low-interest government bonds are too risky

Treasury yields have fallen to historic lows due to the flight to safe havens and the stimulative policies of central banks. This week, the average yield on government bonds in Bank of America's World Sovereign Bond Index fell below 1% for the first time in the history of this mutual fund. At the same time, US 10-year yields reached an all-time low of 1.32% and German and Dutch 10-year bond yields fell to new record lows of -0.2% and 0% respectively.

Globally, investors already have $12 trillion in negative-yielding government bonds in their portfolios. That means that the price of the government bond is higher than the sum of the loan amount plus the total interest over the total term of the loan. When interest rates rise, the value of the bond decreases, a risk that many investors underestimate, according to Bill Gross.

Yields on government bond index below 1% for the first time (Chart via Bloomberg)

Bill Gross is concerned not only about the extremely low interest rates on government bonds, but also about the lack of liquidity in the market. He explains this further when he is asked on Bloomberg about the consequences of Brexit.

"The first victims of Brexit - in addition to the British pound, which fell by more than 10% - were the real estate funds in the United Kingdom. Six of them have already had to close their doors as investors pull out their money, reminiscent of Bear Stearns' subprime funds before the Lehman debacle. The UK's property funds manage £25 billion and a quarter of these funds have already closed. This is an indication that there is little liquidity in the market.

Central banks try to reassure the markets by making more liquidity available, but as long as that liquidity cannot flow through the system - in this case to the real estate funds - then more could collapse. This is something I'm concerned about."

Bill Gross sees similarities between the current crisis and the fall of stockbroker Bear Stearns in the spring of 2008, but he doesn't expect it to end as badly now. He also warns investors about the lack of liquidity in the market.

"I don't want to make the comparison with the situation in Lehman Brothers in 2008. The banks are now better capitalised. Investors think that they can get their money back within a day with these types of funds, but in this case it has become clear that the property could not be sold and that the funds do not have enough liquidity.

Investors mistakenly view funds as a kind of ATM from which they can easily withdraw their money. The regulators should take a good look at that as well."