9.4

7.550 Reviews

English

EN

In the meantime, the Bank of Japan has three-quarters of the Japanese exchange traded funds (ETFs) market. This is remarkable, because until the end of 2010 the central bank had no ETFs on its balance sheet at all.

To deal once and for all with the ailing economy and the threat of deflation, the central bank decided to structurally withdraw equities and other debt securities from the market, with the result that the central bank is now the largest player in the market for ETFs.

Because the Bank of Japan buys so many shares of ETFs, the supply of these investment instruments has also increased sharply. For example, since the start of the asset purchase program in 2010, the assets under management of all Japanese ETFs have increased by a factor of ten to ¥25 trillion yen ($230 billion). This in turn has a positive effect on the stock market, because there are also ETFs that hold a basket of stocks as collateral.

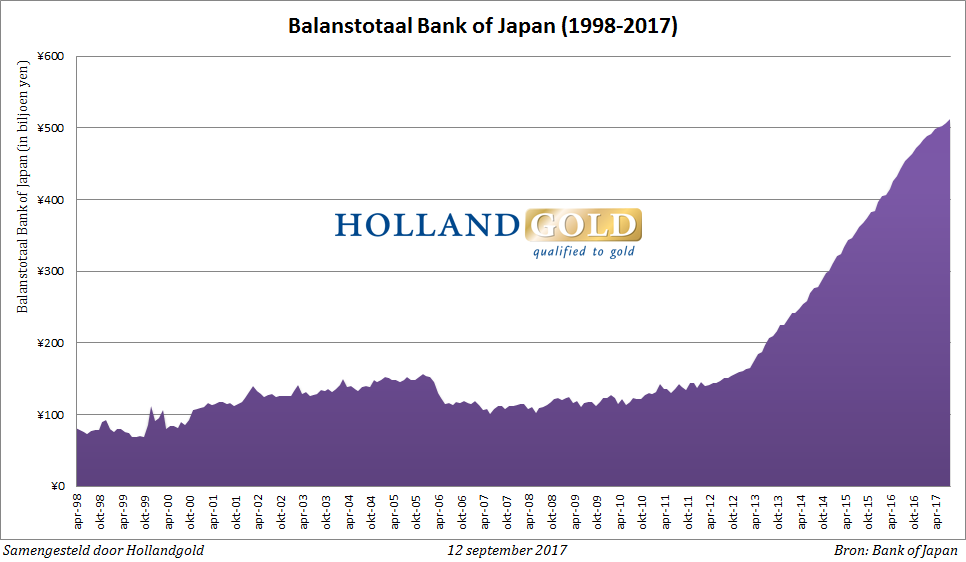

The central bank is expected to hold about 80% of all Japanese ETFs by the end of this year. The Bank of Japan's balance sheet total has now swelled to ¥511 trillion. That's the equivalent of $4.6 trillion, more than the balance sheet total of $4.45 trillion of the Federal Reserve and the €4.3 trillion of the ECB.

Total Bank of Japan assets since 1998