9.3

8.064 reviews

English

EN

Europe needs to recalibrate the international position of the euro, according to the Advisory Council on International Affairs (AIV). A lot has happened on the world stage in the past year, which has consequences for the position of the dollar, euro and the renminbi. In the AIV's view, much can be done to strengthen the euro's position. How should Europe respond to the geopolitical turmoil?

It goes without saying that the dollar has been the world's currency since the Second World War. A majority of foreign exchange reserves are currently denominated in dollars, and many international transactions have been conducted in dollars for decades. On several occasions, economists have considered the dollar as the world's reserve currency to be short-lived, but since the war in Ukraine, a turnaround seems to be taking place. More and more countries are looking for alternatives to the dollar. Jelena Postuma During a podcast on Holland Gold, he went deep into the rise of the BRICS countries and the initiatives to circumvent the dollar.

For the first time since the founding of Bretton Woods, the AIV agrees that dollar hegemony is no longer a certainty in the long term. A trend towards de-dollarisation is visible since the dollar is increasingly being used as a weapon. For example, Chinese renminbi are now being used as an alternative to the Petro Dollar used in oil transactions in Saudi Arabia and countries such as India are seeking to join the Russian and Chinese versions of SWIFT and CIPS. Brazil and Pakistan are also now concluding contracts in renminbi. In time, this could lead to a world in which different currencies are dominant in different regions, such as Zoltan Pozsar recently as well.

But while Zoltan Pozsar sees the renminbi dominating in certain regions, the AIV is more cautious about the successor to the dollar. In the AIV's view, both the renminbi and the euro are flawed. For example, the Chinese capital market has major restrictions on international capital flows. That limits the renminbi as a reserve currency. The advent of the digital renminbi could change this. Countries such as China, India and Russia are focusing on cross-border payments when launching their digital currencies. For example, the digital renminbi could be used by African exporters to make paymentswithout intervention SWIFT or even its own central bank.

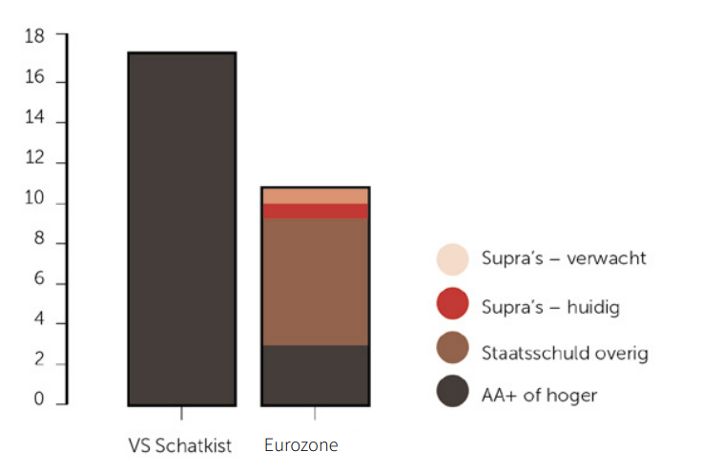

The euro is also lagging far behind the dollar in certain respects. For example, the capital market in Europe is still highly fragmented, with differences in national regulations and supervision. Also, credit here is mainly provided by banks, while in America there is a much larger market for bonds and stocks, which are much easier to trade than bank loans. In America, there is also a large supply of safe bonds, while bonds from countries such as Italy score lower. As a result, interest rate differentials between countries in Europe also increase rapidly when uncertainty arises in financial markets.

In Europe, financing comes mainly from banks, in America there is a much broader market for bonds and equities (Source; AIV)

Comparing the debt securities of Europe and America (Source; AIV)

So the euro is still far behind the dollar. While the dollar is used all over the world, the use of the euro is mainly limited to Europe. Central banks also prefer the dollar to the euro in their currency reserves. More than twenty years after the introduction of the euro, the share of the euro in foreign exchange reserves has not really increased, as can be seen in the graph below.

The share of the euro in the foreign exchange reserves of central banks has remained more or less the same in twenty years (Source; Rabobank, The)

The AIV proposes a number of improvements that could help the EU strengthen the euro's international position. For example, Europe could respond to the energy transition. New energy sources do not yet have a fixed currency in which they are settled. The EU could price these new energy sources in euros, including in countries outside the euro area. While China is now mainly focusing on the petro-yuan to Petro-dollar Europe, Europe would be able tohydro-euro be able to introduce. Nevertheless, an agreement to use euros in these transactions requires a lot of political pressure and persuasion.

Between 2018 and 2020, the share of natural gas contracts concluded in euro increased from 38% to 64%. On the other hand, a large November 2022 LNG contract concluded between Qatar and Brunsbüttel's German LNG terminal is likely to have been concluded in dollars rather than euros. So it remains to be seen whether Europe has the strength to force this change.

The EU could also come up with an alternative to SWIFT in order to gain more autonomy. In the AIV's view, this is not obvious. SWIFT's headquarters are already in Belgium, but the Americans still have a lot of influence on the network. That's because transactions are often completed with dollars, or through a U.S. bank or software. The EU could also encourage cross-border payments with the advent of the digital euro. However, this is also an unrealistic scenario, as the digital euro accounts are likely to be a limit of 3,000 euros. As a result, cross-border volume transactions are not possible.

If the EU wants to catch up with the dollar by the euro, the EU will need to complete both the Capital Markets Union and the Banking Union. Two pillars of the banking union have already been completed; common supervision of banks and a single resolution mechanism for failing financial institutions. The third pillar, the European Deposit Insurance Scheme, still seems to be a bridge too far. Journalist Arno Wellens previously called it a 'blank cheque'. Also VVD MP Eelco Heinen is not yet jumping; 'Otherwise, all Dutch savers will be exposed to the risks in Italy. I would never agree to that."

The European financial market could also be strengthened by the issuance of Eurobonds. These are bonds issued by the European Commission. In this case, there is risk sharing between European member states. The euro has eliminated exchange rate risks between countries, but this risk is now reflected in interest rate spreads between Member States. For example, interest rates on Italian government bonds bounce up more sharply when uncertainty increases than yields on Dutch government bonds.

This led to the introduction of the controversial Transmission Protection Instrument. The instrument aims to reduce interest rate differentials between Member States by buying bonds of problem countries, but selling the bonds of countries with low interest rates. In this way, the interest rate differential between the countries is narrowing. This problem could also be solved by the advent of Eurobonds. In such a scenario, countries jointly guarantee part of the debt. If countries want to borrow more, this is their own responsibility. Governments no longer have to step in when problems arise in other countries.

The downside is that weak countries can piggyback on the creditworthiness of strong countries. This creates moral misconduct and the incentive for prudent fiscal policy disappears. There is also little political support for Eurobonds in countries such as the Netherlands and Germany. As a result, the chance that Eurobonds will be introduced in the short term seems small.

The AIV's latest improvement is the creation of a network of swap lines. These are liquidity lines that make it easy for countries to obtain a certain currency against collateral. A euro swap line could boost the use of euros, just as the dollar swap lines did for the dollar. Poland used the dollar swap line after the fall of the Berlin Wall, Brazil and Mexico used the dollar swap line after the outbreak of the corona crisis.

Swap lines are often used to internationalize a currency. Japan also tried to stimulate the use of the yen with a swap line in the 1990s. China is now also setting up swap lines to strengthen the position of the renminbi. The swap lines are still mainly used to obtain dollars. The swap lines for renminbi are still relatively little used. The strong position of the dollar in this area is therefore currently unquestionable.

Nevertheless, a change is visible and countries will go further and further to reduce their dependence on the dollar. In theory, the euro could fill a gap and strengthen its international position. However, this requires a great deal of political pressure, willpower and persuasion. There is a lot of resistance to plans to strengthen the financial markets in the Eurozone. For example, both the European deposit insurance scheme and the advent of Eurobonds are met with a lot of resistance. In addition, European countries often have to negotiate for a long time to reach agreements. Time will tell whether Europe will be able to take the necessary steps.

![]() Have a look at us YouTube channel

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink and Joris Beemsterboer interview various economists and experts in the field of macroeconomics. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.