9.4

7.721 Reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

There she is again—our weekly regular and perhaps the most frequent guest in this selection. Not without reason: Ursula von der Leyen has now become the most powerful woman in Europe. This week, she unveiled a historic EU budget of unprecedented size, packed with new taxes and Eurobonds. But will she get the necessary support? With her increasingly autocratic leadership style, she's alienating both allies and opponents. We also take a deep dive into gold this week: where is the price heading in the second half of 2025?

“A budget for a new era that matches Europe's ambition,” said Ursula von der Leyen, presenting the EU’s new budget proposal for 2028–2034. She aims to raise the budget from €1.2 trillion to €1.8 trillion, with a long-term goal of reaching €2 trillion—a more than 50% increase, depending on how the figures are calculated. In any case, it's a sharp rise. For now, it remains just a proposal; final approval is far from guaranteed. Both EU member states and the European Parliament must approve it unanimously. And the initial reactions? To put it mildly, they're highly critical.

President of the European Commission Ursula von der Leyen (Source: European Parliament)

A key element of the proposal: new EU-wide taxes, including levies on electronic waste, tobacco, and businesses. Germany, the EU’s most influential country, has already come out against extra corporate taxes. Berlin also argues that a general increase in the EU budget is unacceptable at a time when all member states are working hard to get their own budgets under control. The Netherlands—like Germany, a net contributor to Brussels—has also pushed back. Outgoing minister Eelco Heinen called the proposed budget “really too high.”

According to the Financial Times, von der Leyen’s budget plan caused significant uproar within the European Commission. The paper spoke of “chaotic backroom discussions” and highlighted her ultra-centralized approach, which colleagues say is already undermining the proposal. Von der Leyen is said to have spent months secretly working on the plan with top officials, without informing her full team of commissioners. Hours before publication, she reportedly had to make rushed concessions in response to rare internal resistance.

This resistance underscores long-standing frustration with her closed-off leadership style—both among commissioners and civil servants. Critics say this approach makes Brussels rigid and prone to error. Senior officials note that von der Leyen and her powerful chief of staff Björn Seibert have further consolidated control during her second term. More critical voices from her first term, such as Thierry Breton and Margrethe Vestager, are no longer around.

Critics from the Netherlands have also spoken out. Economist Ewald Engelen called the plan to introduce EU-wide taxes “a bad idea: no taxation powers for such an undemocratic institution.” Edin Mujagić likewise believes the proposal goes way too far: “This European Commission is megalomaniacal and is jeopardizing European cooperation with this kind of plan!” Journalist Arno Wellens points out that the proposed increase is on the scale of the temporary COVID recovery fund: “When something is proposed in an emergency like a pandemic, you shouldn’t accept it just because of the urgency—you’ll never get rid of it afterward.”

Lex Hoogduin on X about the future of the Netherlands in the EU (Source: X)

Lex Hoogduin on X about the future of the Netherlands in the EU (Source: X)

Both Lex Hoogduin and Jeroen Blokland have flagged von der Leyen’s plan to issue €400 billion in Eurobonds for unspecified emergency situations. Jeroen highlights her lack of democratic mandate and expects serious opposition. Lex calls for the Eurobonds to be scrapped altogether and has stressed that the future of the Netherlands within the EU must be a central topic in the upcoming election campaign.

This week marked a clear starting gun for what promises to be tense and protracted negotiations. We will continue to monitor developments surrounding the EU budget and Ursula von der Leyen closely. To be continued.

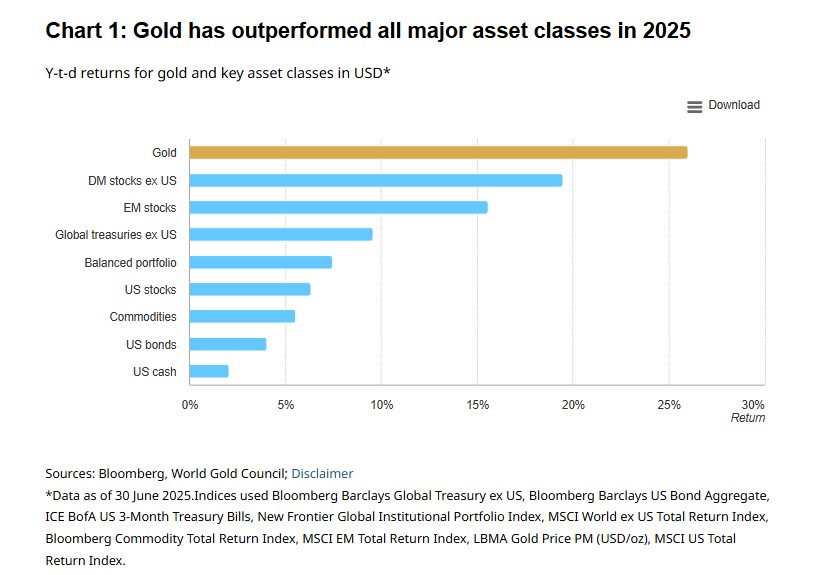

Earlier this week, we covered silver and platinum; now it’s gold’s turn. The World Gold Council (WGC) published its mid-year report this week, reviewing gold’s performance so far and outlining expectations for the rest of the year. Anyone with gold in their vault has likely noticed the substantial rise in value since the beginning of the year. Gold ended the first half of 2025 on June 30 with a return of approximately 26% in U.S. dollars.

Gold performance versus other major asset classes (Source: gold.org)

Gold performance versus other major asset classes (Source: gold.org)

The WGC states that, as of July 1, gold has outperformed all other major asset classes. That’s true, although this definition notably excludes recent strong gains in bitcoin and platinum. The rise in gold is attributed to a mix of factors: a weak U.S. dollar, expectations of future rate cuts, and mounting geopolitical tensions.

It’s not just the gold price breaking records—trading volumes also hit new highs. In the first half of 2025, average daily gold trading volume stood at $329 billion. In April, during heightened market turbulence, that figure peaked at nearly $442 billion per day.

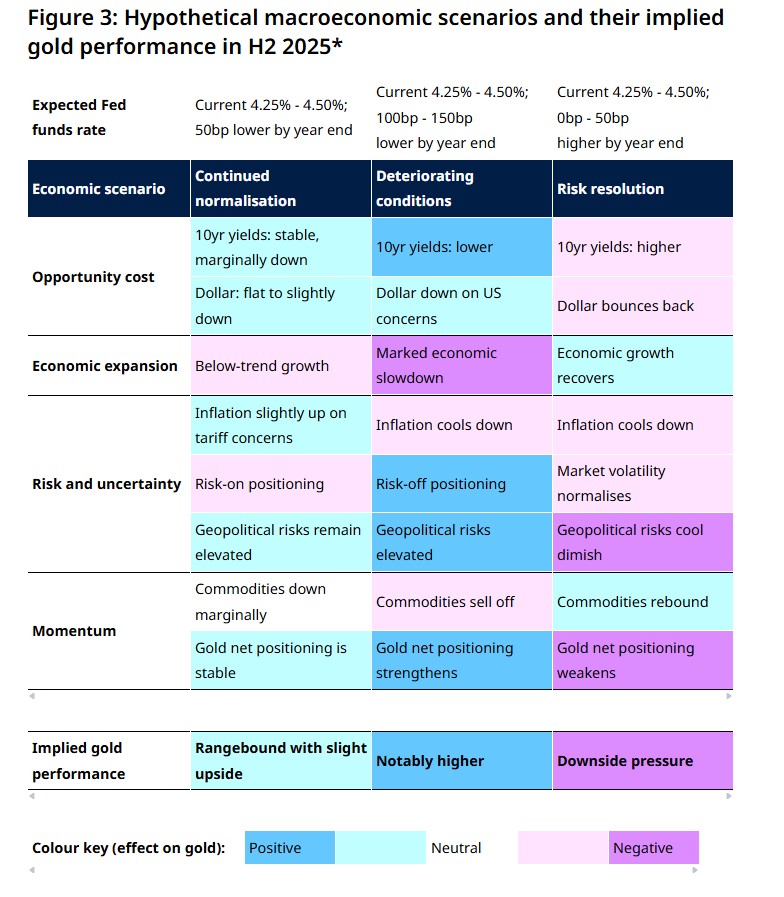

The WGC views the recent consolidation phase as a healthy breather within a broader upward trend. It helps to cool an overheated gold market and may pave the way for new price gains. The Council outlines three scenarios for gold prices: one based on current market consensus, a bullish case, and a bearish case. The analysis considers economic growth, risk and uncertainty, opportunity costs, and momentum.

The three possible gold price scenarios for H2 2025 (Source: gold.org)

The three possible gold price scenarios for H2 2025 (Source: gold.org)

According to the base-case scenario, the global economy will move sideways in the second half of the year and remain below its long-term growth trend. Inflation will stay above 5%, partly due to import tariffs. In this scenario, central banks will cautiously begin lowering interest rates near the end of the year. Tensions between the U.S. and China are expected to remain elevated. The WGC’s Gold Valuation Framework suggests gold could rise modestly—between 0% and 5% from current levels—translating into an annual return of 25–30% in U.S. dollars.

The bull case for gold is, perhaps unsurprisingly, a worse scenario for the global economy. In the event of more severe stagflation or a true recession that prompts investors to flee to safe havens, gold could climb significantly further. In this case, gold could gain another 10–15% in the second half, finishing the year with a nearly 40% increase in U.S. dollar terms.

The bear case envisions a more positive global environment. If sustainable solutions are found for geopolitical tensions, investors might reduce their gold holdings and seek more risk exposure. While world peace sadly still seems distant, this scenario has also been modeled. It suggests gold could drop by 12–17% in the second half of the year.