9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

This week, concerns over France’s public finances intensified, as the yield on long-term French government bonds is now almost equal to that of Italy. What’s happening behind the scenes? Meanwhile, more and more analysts expect gold to soon reach new all-time highs. What role is the Fed playing in this? Read on!

For the first time since the 2008 financial crisis, the yield on long-term French government bonds is almost equal to that of Italy. The spread with Italian bonds is now just 0.14 percentage points. French yields have been rising for some time—last year we already noted they were approaching those of Greece. Investors are increasingly viewing the EU’s second-largest economy as less of a safe borrower.

Rising yield on French 10-year government bonds (source: Trading Economics)

Reform in France is notoriously difficult. The state now consumes 57% of the economy. Around 30 million French citizens depend on state income, representing 44% of the population and 60% of the electorate. This group includes pensioners, civil servants, and welfare recipients. Running an election campaign with radical spending cuts as the main promise is therefore not a winning strategy in France. It’s no surprise that politicians like Macron are seeking a way out through (more) joint European debt.

Last month, the French government did present a package of €44 billion in tax hikes and spending cuts. Prime Minister François Bayrou called it a “moment of truth,” aimed at avoiding a debt crisis like Greece’s. However, without a parliamentary majority, passing the package will be extremely difficult. His predecessor, Barnier, failed as well. The debt ratio is thus expected to rise further—from 113% to 118% of GDP. With these figures, it’s easy to see why multiple credit rating agencies have assigned France a “negative outlook.”

Von der Leyen, Macron & Meloni (source: European Union, 2023)

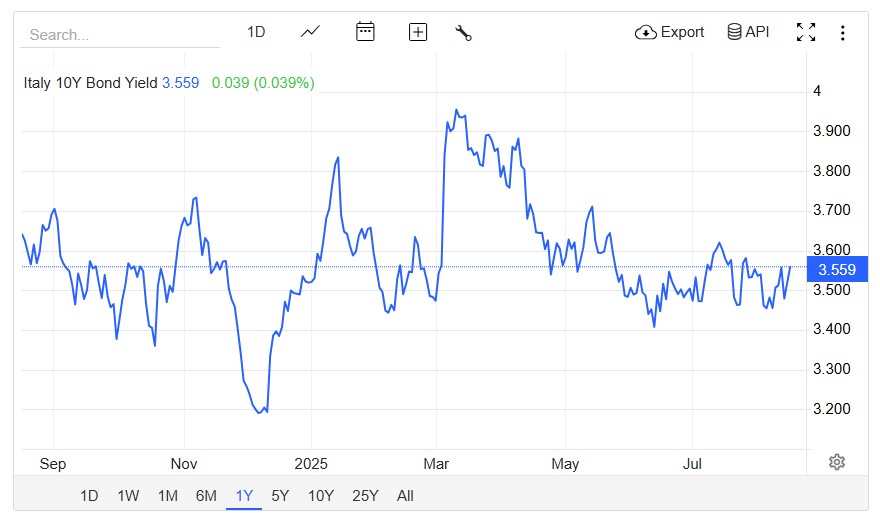

It’s not all bad news. Italy’s borrowing costs have been falling in recent months. According to the Financial Times, Meloni’s right-conservative coalition is providing rare political stability, and her government has earned investor confidence through fiscal discipline.

Rome is working hard to reduce its budget deficit—from 4.3% of GDP in 2024 to a projected 2.8% in 2026, well below the EU’s 3% ceiling. France, by contrast, does not expect to hit the 3% mark until 2029.

Yield on Italian 10-year government bonds (source: Trading Economics)

Meloni recently noted that Italy’s spread with Germany has narrowed sharply—from 2.5 percentage points at her 2022 election victory to 0.8 points now. Former southern “problem countries” like Italy and Greece seem to be stabilizing, while political unrest and economic troubles are shifting toward core EU countries like Germany and France.

Last week, it briefly seemed gold might be affected by Trump’s import tariffs. However, he quickly eased fears of disruption in the global gold market, writing on Truth Social on Monday: “Gold will not be Tariffed!”

Trump’s statement on gold (source: Truth Social)

After Trump’s post, gold prices fell 1.2% on Monday, but rebounded sharply a day later following the release of U.S. inflation data. CPI remained flat at 0.2% month-on-month, despite expectations that tariffs would push inflation higher. This strengthened expectations of a Federal Reserve rate cut.

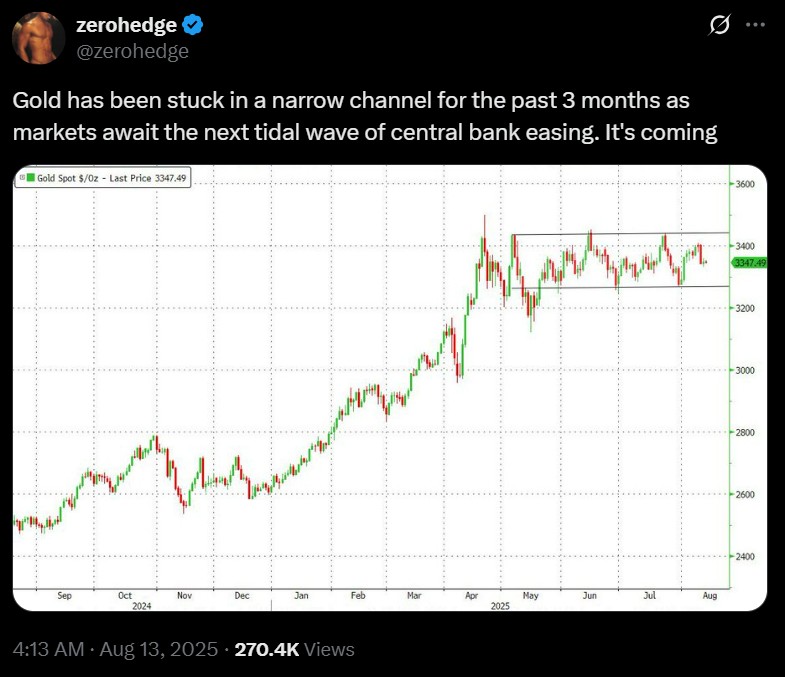

Zerohedge on the gold price (source: Zerohedge)

As Zerohedge summed up: “Gold has been stuck in a narrow channel for the past three months as markets await the next tidal wave of central banks easing. It’s coming.”

Rate cuts make non-yielding gold more attractive. An unexpected large rate cut at the Fed’s September meeting could push gold prices sharply higher. Trump and his team have long been pressuring the Fed to cut rates.

Treasury Secretary Scott Bessent added fuel to the fire this week, saying the Fed’s policy rate should be at least 1.5 percentage points lower than it is now. “I suspect we could have had rate cuts in June and July already,” Bessent said. Since it is unusual for a Treasury Secretary to comment on central bank policy—given the importance of independence—he later qualified his remarks in an interview: “I did not tell the Fed what to do.” In reality, of course, his public comments did just that.

Bad news arrived Thursday for Trump and Bessent, as additional inflation data came out—this time from producers (PPI). Producer prices rose in July at the fastest pace in three years, up 3.3% versus the 2.5% expected. Tariffs are driving up the prices businesses charge each other, which will eventually filter through to consumers. This makes it harder for the Fed to cut rates to support a weakening labor market without reigniting inflation.

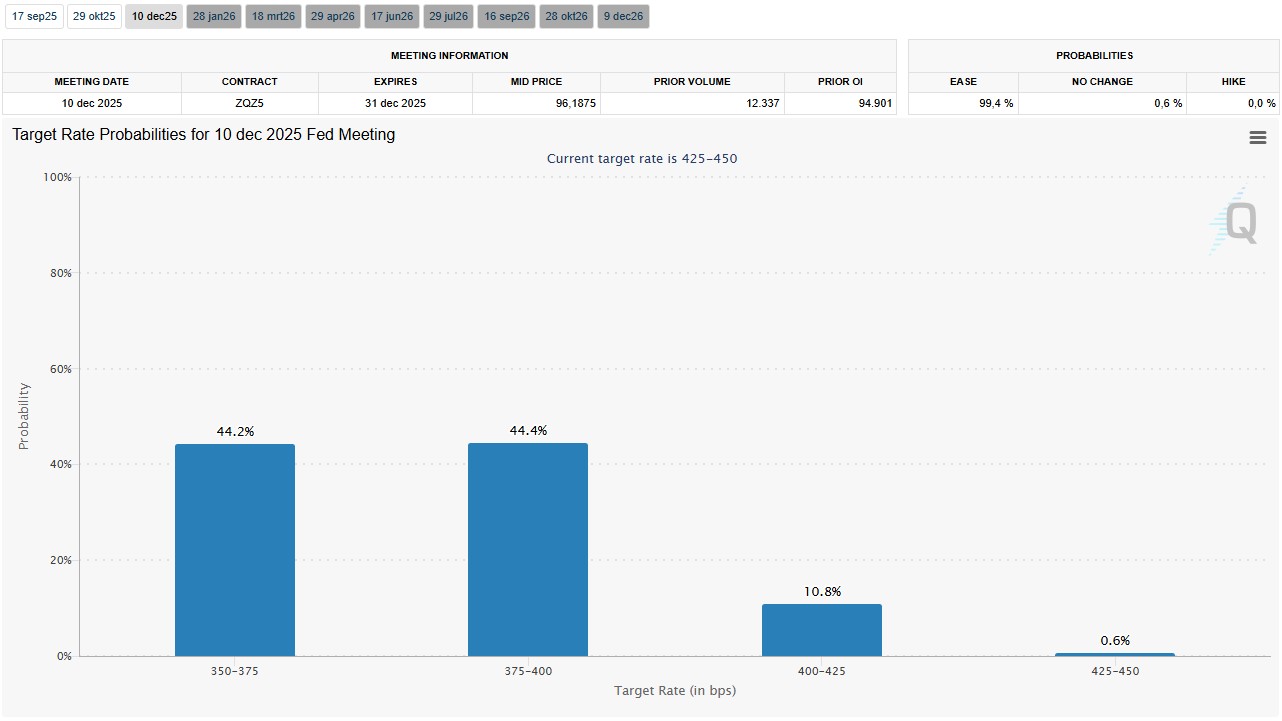

Market expectations for Fed rate in December (source: CME FedWatch)

Still, a September rate cut looks likely. The CME FedWatch Tool puts the probability of a 25-basis-point cut in September at nearly 93%, and the odds of even lower rates by December at over 88%. Most central banks globally are currently in a rate-cutting cycle.

On our website yesterday, Jack Hoogland wrote that he expects not only rate cuts but also a return of the printing presses. He noted that most fund managers anticipate the Fed will move toward QE—or even yield curve control—expanding the money supply and driving up the value of scarce assets like gold.

ING seems to agree. The bank raised its gold price forecast, citing U.S. rate cut expectations as a driver that could push prices to new records. ING also expects central banks to keep buying and points to strong inflows into gold ETFs, as well as persistent geopolitical tensions and trade disputes. For Q4, ING now forecasts an average gold price of $3,450 per ounce. As we reported earlier, Citigroup and Goldman Sachs both forecast $4,000 per troy ounce.

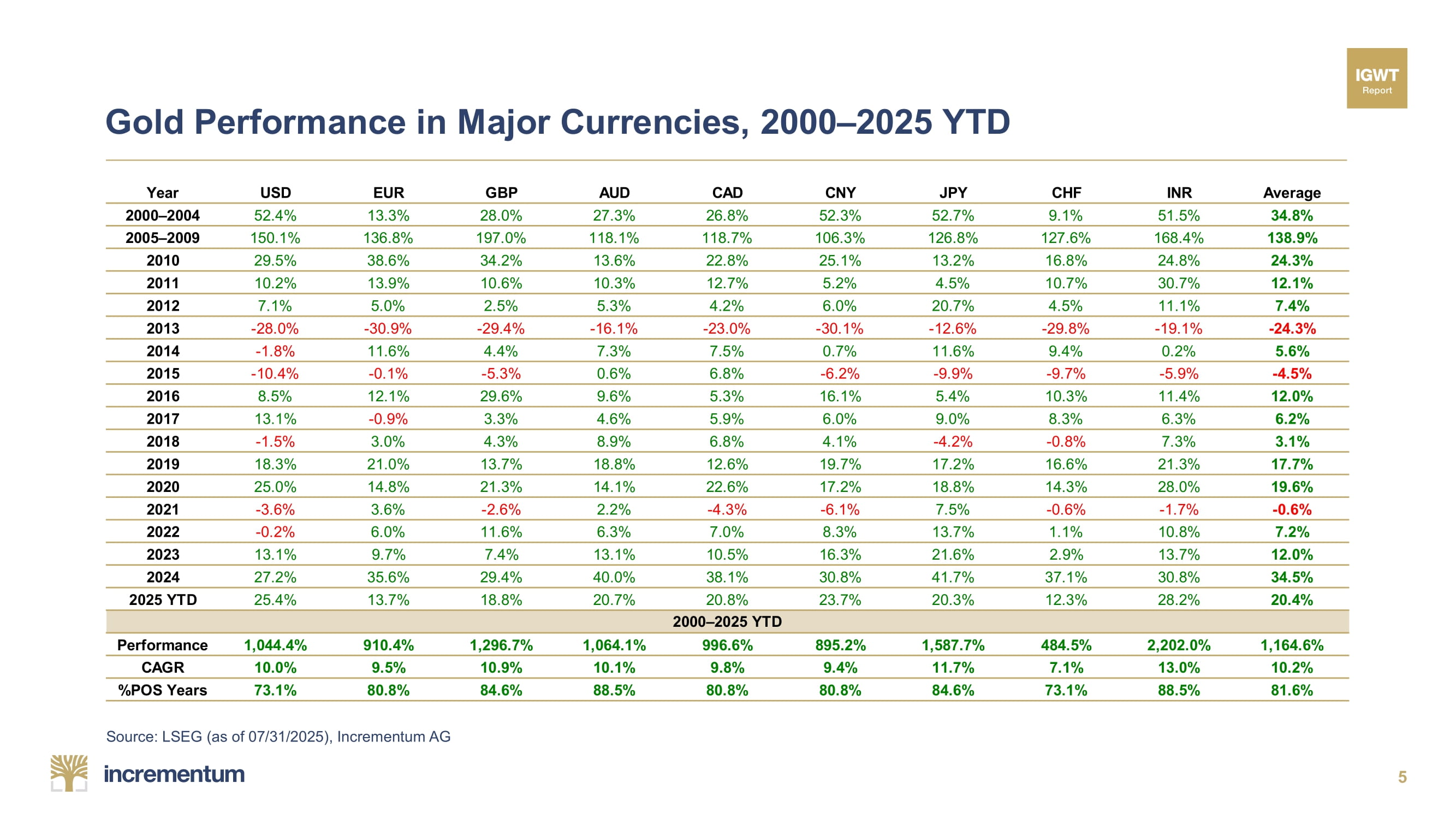

Gold returns in various fiat currencies since 2000 (source: IGWT)

In a recent interview with Kitco, Thorsten Polleit, professor of economics at the University of Bayreuth, said gold and silver are on the verge of major structural breakouts due to the unlimited expansion of the paper money system. He believes people are becoming increasingly skeptical of the purchasing power of all fiat currencies, prompting “a desperate rush for safe havens.”

Like Hoogland, he expects not only central bank rate cuts but also a possible return to yield curve control. He said the Fed hopes that rate cuts will also lower long-term yields. If not, central banks may well resume large-scale bond purchases. He expects gold prices to rise further once rates drop.

Otavio Costa notes that inflation expectations are rising while interest rates are likely to remain artificially low. He sees this as one of the most powerful drivers for hard assets like gold. The World Gold Council recently published a detailed gold price forecast for the second half of 2025, based on three scenarios—you can read it here.

Meanwhile, in Asia, more ultra-wealthy families are stepping directly into the physical gold trade. In China, the share of gold in portfolios rose from 7% last year to 15% this year. To be continued.