9.3

8.058 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

It’s just over a month since gold broke through the magical threshold of €100,000 per kilo. Since then, the pace has only accelerated: last night gold briefly touched €120,000 per kilo. Silver also hit a new record this morning at $54.39 per ounce, while platinum earlier this week broke its previous euro-denominated price record from 2008. The market is buzzing with news, rumors, and speculation. What’s driving this exceptional rally in precious metals?

FOMO and Long Lines

In recent days, social media has been flooded with images of long lines outside gold and precious metal shops in Asia and Australia, where investors are trying to get their hands on physical bullion. It doesn’t appear to be fake news—an Australian journalist even interviewed several people waiting in line about their motivations. You can read the article here. Notably, new record prices are often reached overnight or in the early morning, fitting the picture of a gold rush that has broken out across Asia and Australia.

Bloomberg reports that Japan’s largest gold dealer can no longer keep up with demand. Tanaka Precious Metal Group announced on Thursday that it has temporarily suspended sales of 5- to 50-gram gold bars and 5- to 10-gram platinum bars because demand has outstripped production capacity. The company will now ramp up production. But shortages aren’t limited to Asia. The UK’s Royal Mint also warned this week of delivery delays as Londoners rush to buy silver. A surge in retail investor orders there, too, has led to an increase in production.

At Holland Gold it’s also extremely busy, with delivery times increasing sharply, says Paul Buitink on X. Earlier this week we published an article about the physical silver shortage in the London market, in which we already mentioned that we were forced to extend delivery times as well. You can read it here.

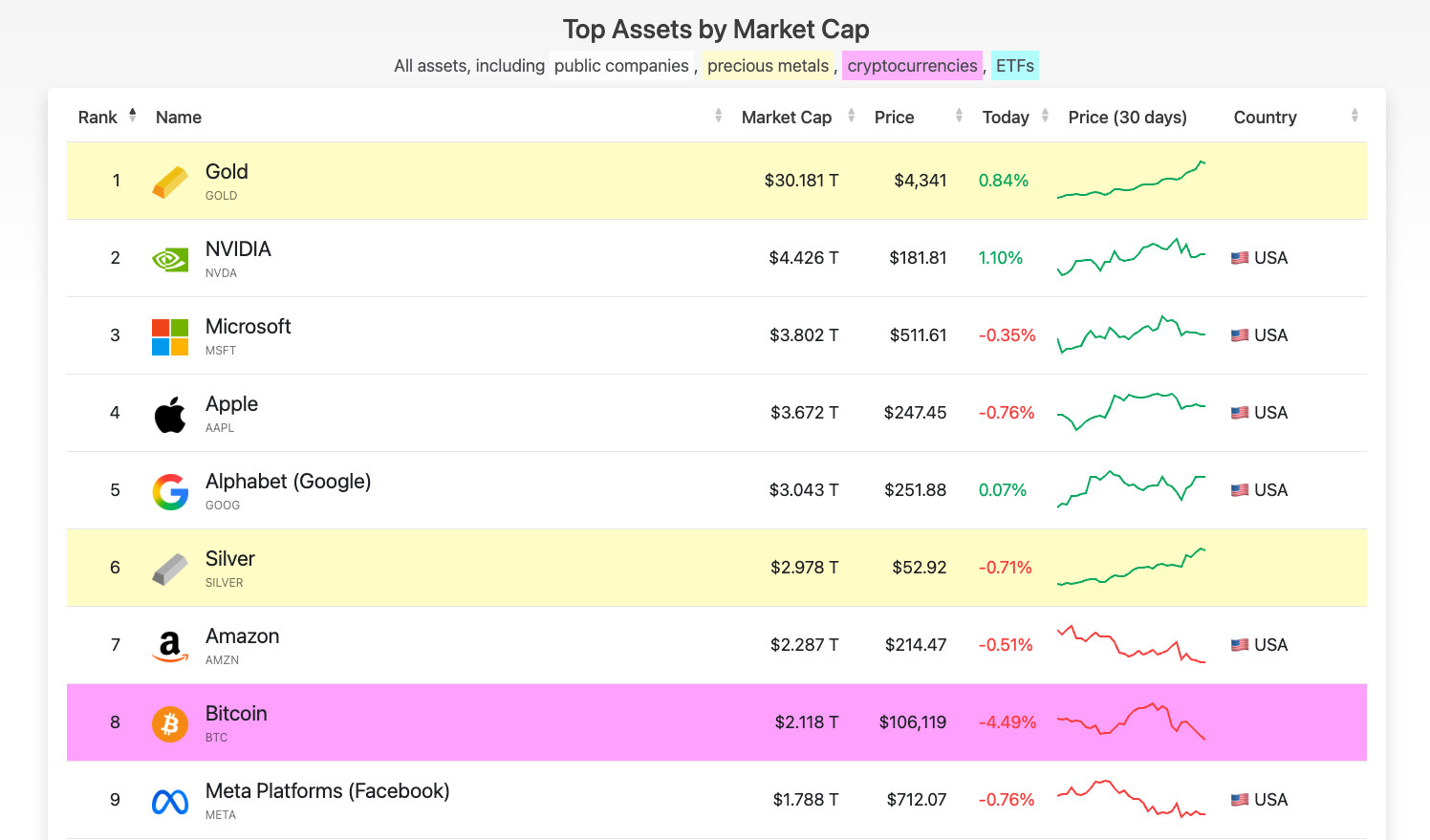

Gold became the first asset in history this week to reach a total market capitalization of $30 trillion. According to a Bank of America survey of 166 fund managers, gold is currently the most “crowded” trade—more popular even than the Magnificent 7 stocks. Despite this, gold remains severely underrepresented among wealthy private investors, who on average allocate only 2.4% of their portfolios to the metal. Moreover, 39% of professional investors surveyed said they have no gold exposure at all.

Safe Haven

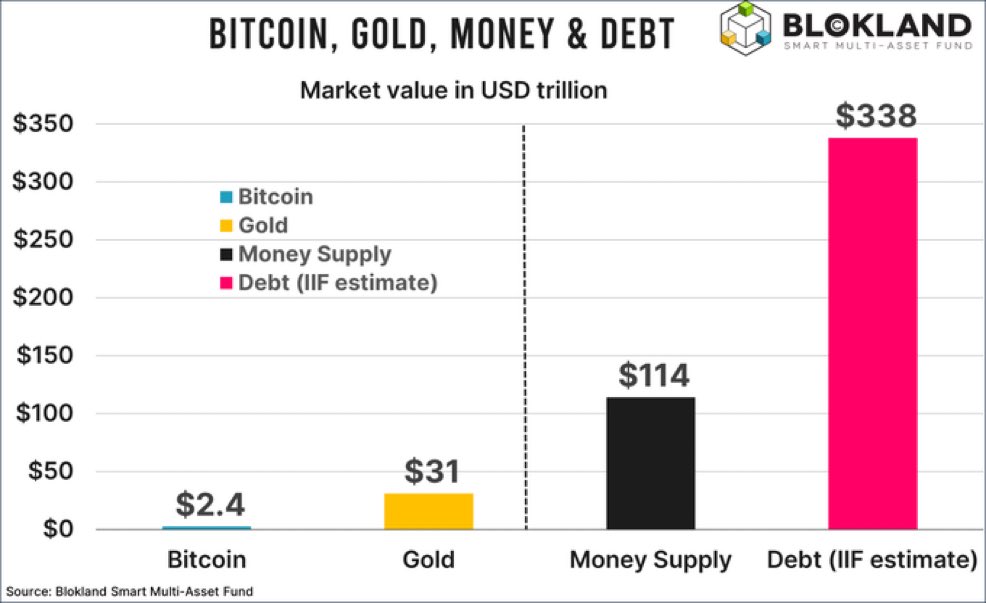

After such a strong rally, a short-term correction is of course possible—though difficult to time. But as Jeroen Blokland notes, many people forget that the global money supply and debt levels continue to grow. “In just the first half of this year, total global debt rose by no less than $21 trillion,” Blokland said. And debt is likely to keep increasing. You can revisit our earlier article on France’s political chaos and Europe’s economic self-destruction for more context.

There is growing concern in the markets about the worldwide rise in government debt. According to economist Robin Brooks, investors expect this to inevitably lead to higher inflation and are therefore fleeing to gold. This movement has in recent months increasingly been called the “debasement trade”—the trade that protects against currency debasement.

Gold seems to have become the ultimate safe haven, as traditional refuges such as German, Japanese, and U.S. government bonds are no longer seen as truly safe. Switzerland is a notable exception: yields on two-year Swiss government bonds have been negative for months, while the ten-year yield is again close to zero. However, Switzerland is far too small to serve as a global refuge. According to Brooks, this helps explain why the gold price is running away. Brooks again stated in a new article this week that this is the main driving force behind the rise in gold prices. At the same time, he noted that it remains unclear who exactly is behind the recent price surge. He voiced skepticism about rumors that central banks have started a new round of gold purchases. Brooks concluded that it’s more likely this is a genuine market move, driven by a growing number of investors concerned about fiscal sustainability and monetary debasement. If that’s the case, the gold rally could go a lot further.

Speculation

CNBC writes that gold has never outperformed stocks this strongly without there being a crisis or bear market. Futures on the metal are up 61% this year, while the S&P 500 has gained just 14%. It’s perhaps not surprising, then, that some suspect the involvement of governments or central banks, and that there’s more going on beneath the surface. Otavio Costa, well known to regular readers, speculates that the price movement is so extreme that the U.S. government might be involved. In another post, he called it one of the most dramatic global wealth redistributions we’ve witnessed in modern history.

Famous “gold bug” Peter Schiff wrote that this is getting serious, with gold at $4,370 and possibly hitting $4,400 tonight, a 10 percent rise in just over a week—something big is happening. According to Willem Middelkoop, gold is sending a clear message: the role of the dollar is diminishing, while gold is gradually returning as the cornerstone of the international financial system. Such monetary resets happen only once or twice a century and unfold over years, sometimes decades.

And it’s not just well-known gold advocates making striking predictions. Jamie Dimon, CEO of JPMorgan Chase, isn’t exactly known as a gold enthusiast. Yet even he said this week that in these kinds of conditions, it could easily go to $5,000 or even $10,000. This is one of the few times in my life when it’s half rational to own some.

Whether they’re right or not, we’ll of course continue to follow closely for you. The recent pace of gains has been exceptionally steep, and it’s particularly difficult to time this market. For those who still wish to try, we’ll end with the words of renowned Dutch gold analyst Jan Nieuwenhuijs: watch out.