9.3

8.064 reviews

English

EN

This week, the Labour government in the UK announced a massive tax increase, resulting in a tax burden higher than ever. This trend is not unique to the United Kingdom but is seen across the Western world. Inflation in the Netherlands remains high, outpacing the rest of the eurozone. Will this trend persist? Finally, we look at gold, where not only has the precious metal’s price hit record highs in the past month, but demand is also stronger than ever. According to the Financial Times, investors are now buying gold in large quantities, spurred by a genuine “fear of missing out.”

Rachel Reeves, the UK Chancellor of the Exchequer, announced a significant tax increase last Wednesday. Four months after taking office, the new Labour government under Keir Starmer has presented a new budget plan with a £40 billion (€47.5 billion) tax hike. This is intended to close a budget deficit and support investments in public services.

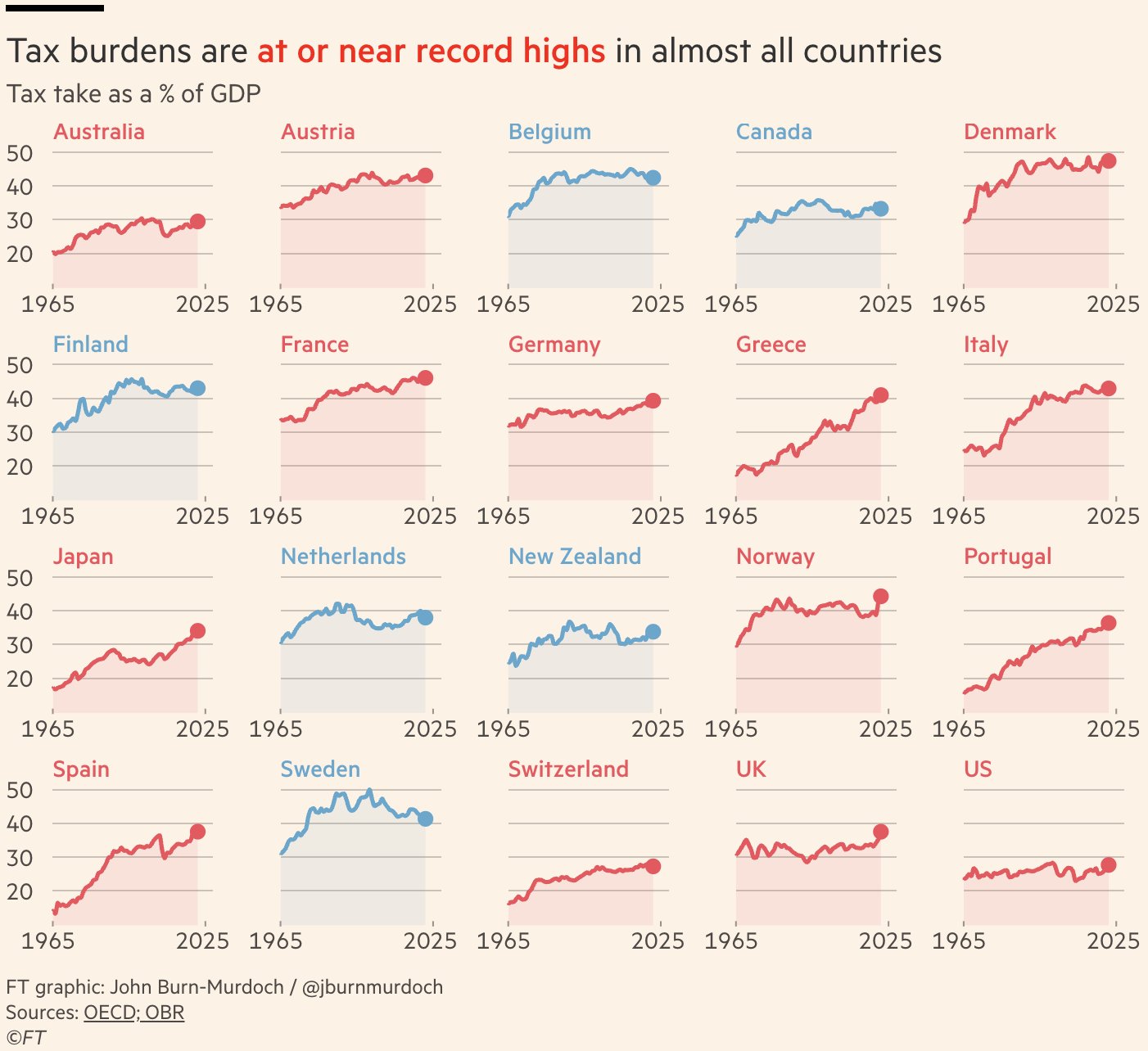

In many Western countries, we are currently seeing a historically high tax burden. (source: John Burn-Murdoch)

The new budget raises the tax burden to 38.2% of GDP, the highest level ever in the UK. This phenomenon is currently seen in most Western countries. The majority of the tax increase comes from a £25 billion rise in national insurance contributions, a payroll tax paid by employers. Additionally, the capital gains tax will increase, and the government plans to end the use of “offshore trusts” that shield assets from British inheritance tax. Labour is ignoring warnings that this could prompt wealthy Britons to leave the UK. We discussed this potential effect in a previous weekly selection about the exit tax. The independent Office for Budget Responsibility stated that Reeves’ package could push inflation up by as much as half a percentage point and put upward pressure on mortgage rates.

One tax increase is not enough to meet Labour’s plans; the government will also borrow more money on a structural basis. The announcement that the government will borrow an additional £28 billion annually had an immediate impact on financial markets. The yield on ten-year UK government bonds rose by 0.05 percentage points to 4.37%, the highest level in five months. The yield on two-year bonds increased by 0.08 percentage points to 4.34%.

UK 10-year yield rose after the announcement. (source: FT)

According to new data from CBS (Statistics Netherlands), inflation in the Netherlands was 3.6% in October, up from 3.5% in September. Food, beverages, and tobacco became 6% more expensive, and service prices rose by 5.4% compared to October last year.

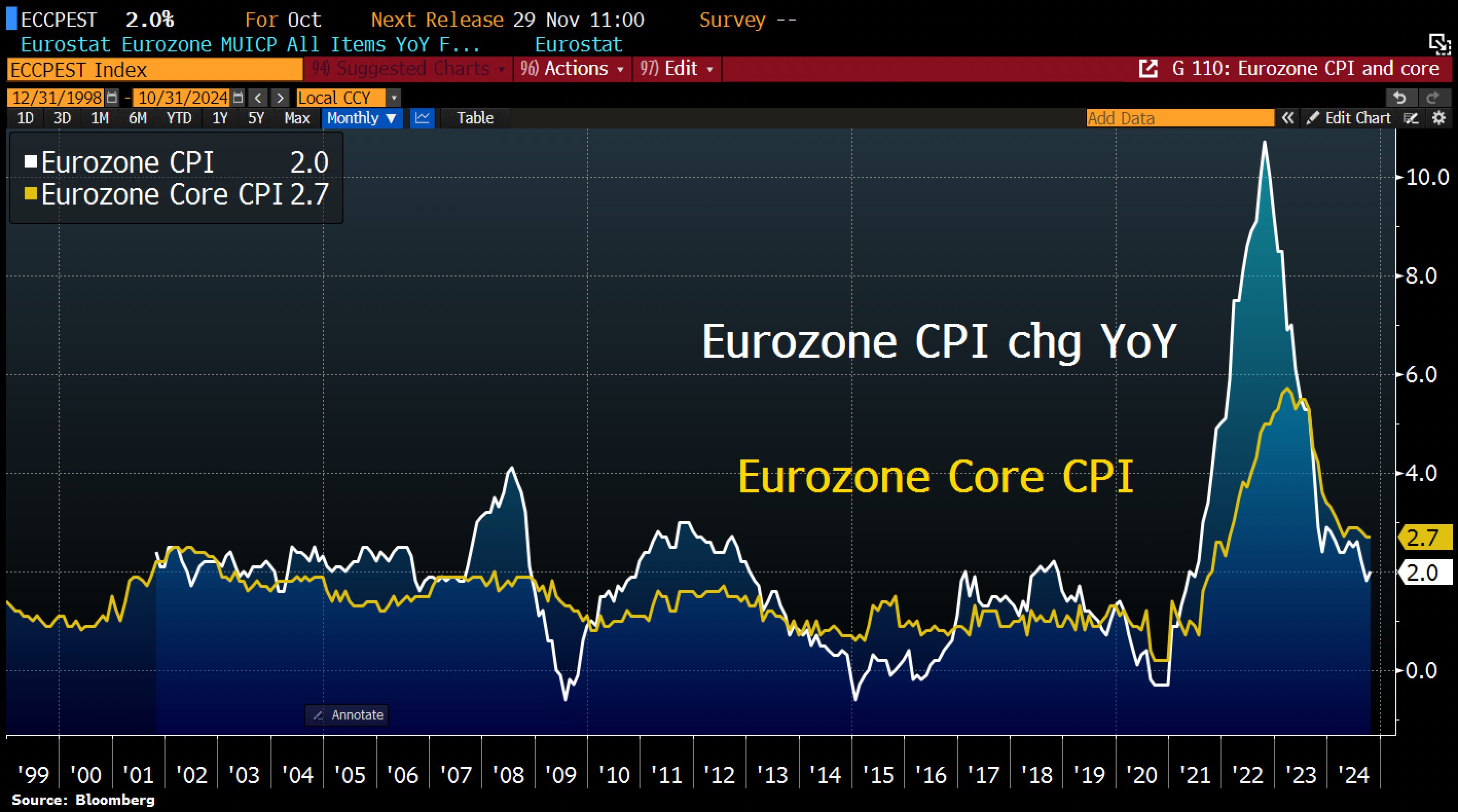

Inflation Eurzone (source: Holger Zschaepitz)

The Dutch inflation rate, based on the European harmonized calculation method, stands at 3.3%, significantly higher than the eurozone average of 2%, which was higher than expected. The strong downward trend of recent months has come to a temporary halt.

ING expects that Dutch inflation will remain above the eurozone average next year as well. This is due to higher taxes and higher wage growth. The ECB is expected to lower interest rates further in December, which will not help reduce Dutch inflation. ING economist Bert Colijn commented, “The ECB is increasingly easing off, and in addition, the government continues to stimulate the economy, so inflation is not being curbed from the budgetary side either.”

Considering this and the previous section on high tax burdens, it’s a good time to revisit a quote from the famous economist Milton Friedman on inflation: “Keep your eye on one thing and one thing only: government spending. Because that is the true tax. If you don’t pay for it in the form of direct taxes, you pay for it in the form of inflation or borrowing.”

The Financial Times reports that the “fear of missing out” among investors has led to record demand for gold. This is based on the new quarterly report from the World Gold Council (WGC). Demand for gold rose by 5% to 1,313 tons, setting records both in dollars and volume. Frank Knopers examined the WGC report and wrote an article about it, which you can read here.

“There are many people who want to buy gold during a price dip,” said John Reade, an expert at the WGC. According to him, family offices and wealthy individuals have been buying more gold in recent months due to concerns about government debt. “Many people love gold; they wanted to invest in it but didn’t have it in their portfolios in the first half of the year.”

Relative value of gold compared to U.S. government bonds (source: Bloomberg, via Luke Gromen)

IGWT declared the traditional 60/40 portfolio with government bonds dead, and sees an important role for gold in the new portfolio. Jeroen Blokland previously explained on our podcast how this works. He sees no future in government bonds, as they are becoming less attractive in terms of return, volatility/risk, and diversification.

Well-known American investor Jim Rogers believes the bull market for gold and silver will continue for another two to three years, citing rising debt and geopolitical tensions. Frank Giustra, a well-known Canadian entrepreneur and investor, is also optimistic about silver and gold. In an interview published on Wednesday, he stated that he expects gold to regain an important monetary role. He believes we are only at the beginning of gold’s price increase and that the devaluation of fiat currency will play a significant role in further gold price rises. The entire interview is interesting, but if you don’t have 100 minutes to spare, click here for the segment on (precious) metals and gold.

The price of silver has increased significantly over the past year, even more than the gold price. In the new Holland Gold monthly update, we take an in-depth look at silver, analyzing demand, supply, and mining costs. Could the price rise further? Check out the monthly update here.

Photo: Rachel Reeves (left) & Keir Starmer (source: UK Parliament)

This article has been automatically translated from Dutch. You can find the orginal article including links to all the sources here.