9.3

8.064 reviews

English

EN

This article has been automatically translated from Dutch. Click here to see the orginal article including all links to sources.

Something in the air? Spain and Portugal suddenly went dark—perhaps a warning of what lies ahead for the rest of us. What can we learn from this situation? Meanwhile, the gold price is consolidating after a record surge. Is this the beginning of a new upward phase—or the peak for now? We've gathered key facts, insights, and expectations for you. Read on!

When Spain and Portugal suddenly lost power earlier this week, one thing became painfully clear: cash remains essential. On Monday, the Iberian Peninsula experienced a blackout that lasted about half a day. At first, media outlets seemed eager not to blame the energy transition or renewable power. Dutch broadcaster NOS even suggested “vibrations in the air” as a possible cause.

Fortunately for NOS, the recent climate “disinformation” motion from the GroenLinks party failed to gain a majority in parliament. Fortunately, numerous critics and energy experts pushed back against the state broadcaster’s explanation. A cyberattack or extreme weather was quickly ruled out, and it became clear the cause likely lay in solar energy and the structure of the grid itself.

Solar farm in Spain (source: Shutterstock)

Javier Blas, energy analyst at Bloomberg, called it “the first major blackout of the green electricity era.” On X, Bjorn Lomborg wrote that the energy transition had made power supply increasingly fragile.

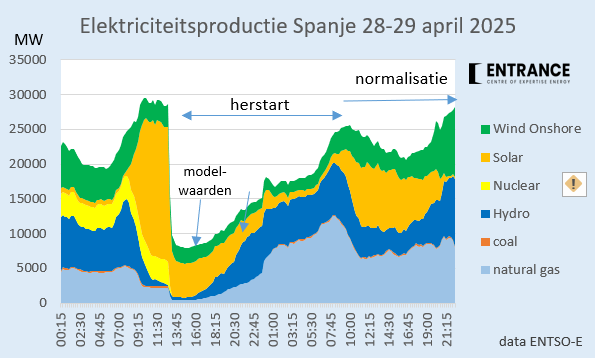

The Financial Times reported that Spain's electricity grid was unable to handle an unusually high input from solar power. At the time of the outage, solar energy accounted for around 55 percent of Spain’s electricity generation—much higher than usual. Within five seconds, 15 gigawatts dropped offline, triggering a massive shutdown of energy systems in both Spain and Portugal.

Spain's electricity generation (source: Martien Visser)

An electricity oversupply may have been the initial cause. Normally, grid operators would ask traditional power plants to lower output—but that wasn’t possible because so few of them were online. As a result, generation was automatically shut down to protect equipment, which ultimately caused the blackout.

According to the Financial Times, Spain lacked sufficient “firm power”—dispatchable backup capacity from reliable sources such as gas, coal, or nuclear. The risk of a blackout had previously been raised, but was ignored by politicians in Madrid who continued to push the energy transition. Martien Visser, a guest on our podcast, rightly questioned how Spain’s power grid would have restarted at all without gas-fired plants.

The International Energy Agency acknowledges that power grids dominated by solar and wind are more vulnerable. It remains unclear how the grid will perform when weather conditions are unfavorable. It’s no surprise that Clintel warned this is the direction the Netherlands is heading as well. Even the “most right-wing cabinet ever” appears determined to continue the transition.

It wouldn’t hurt to prepare for similar disruptions. Consumers and businesses were unable to process electronic payments. Politico wrote that the incident painfully exposed the risks of a cashless society. Prime Minister Sánchez has in recent years actively worked to limit cash use, including lowering the legal limit for cash transactions from €2,500 to €1,000 in 2021.

Paying with cash (source: Shutterstock)

Cash is also under pressure elsewhere in Europe. Central bank digital currencies (CBDCs) are increasingly viewed as potential replacements for physical money, and even in the Netherlands, cash payments are being restricted. Last year, the Dutch parliament passed a law banning cash transactions of €3,000 or more. Fortunately, it's still legal to hold cash for emergencies. We also believe precious metals—unlike bitcoin—will prove especially useful in a crisis, particularly in the form of coins and bars. So make sure to have a supply on hand!

After last week’s enormous gold price record, we’re seeing some consolidation. In this week’s monthly update, Frank Knopers joined us to discuss gold price developments in detail. Was last week the top—or is the real breakout only beginning? We also saw that Chinese demand for gold is massive. Watch the episode here! Since recording, several interesting developments have taken place.

Gold price trend over the past month (source: Holland Gold)

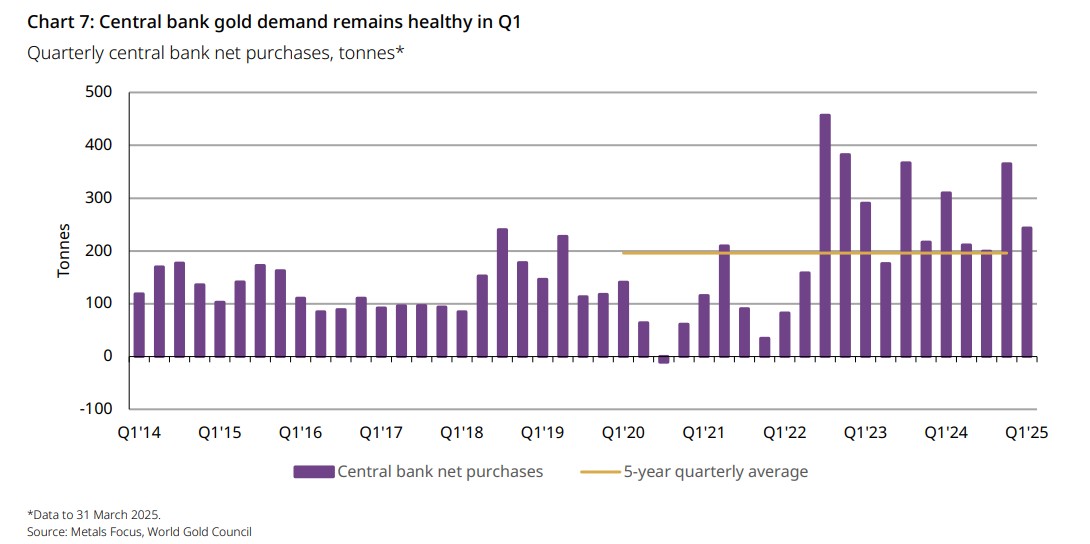

According to a new World Gold Council report, gold demand in Q1 rose to a record 1,206 metric tons. The leading gold authority wrote that surging inflows into gold ETFs played a key role in the price increase. Total investment demand more than doubled to 552 tons in Q1 2025, largely due to the rebound in ETF inflows.

Central banks also continued buying gold—adding 244 tons in the first quarter. The biggest buyers: Poland and China.

Central bank gold purchases Q1 (source: World Gold Council)

The Financial Times also highlighted the enormous demand from China. The country accounted for more than half of global inflows into gold ETFs over the past four weeks. The paper also noted a broader trend: China is gradually reducing its exposure to U.S. Treasuries and turning to gold instead. The reason China isn't dumping Treasuries all at once, according to the FT, is that the Federal Reserve could easily neutralize such a move by stepping in to support bond prices and lower interest rates—meaning China would just be selling into a falling market.

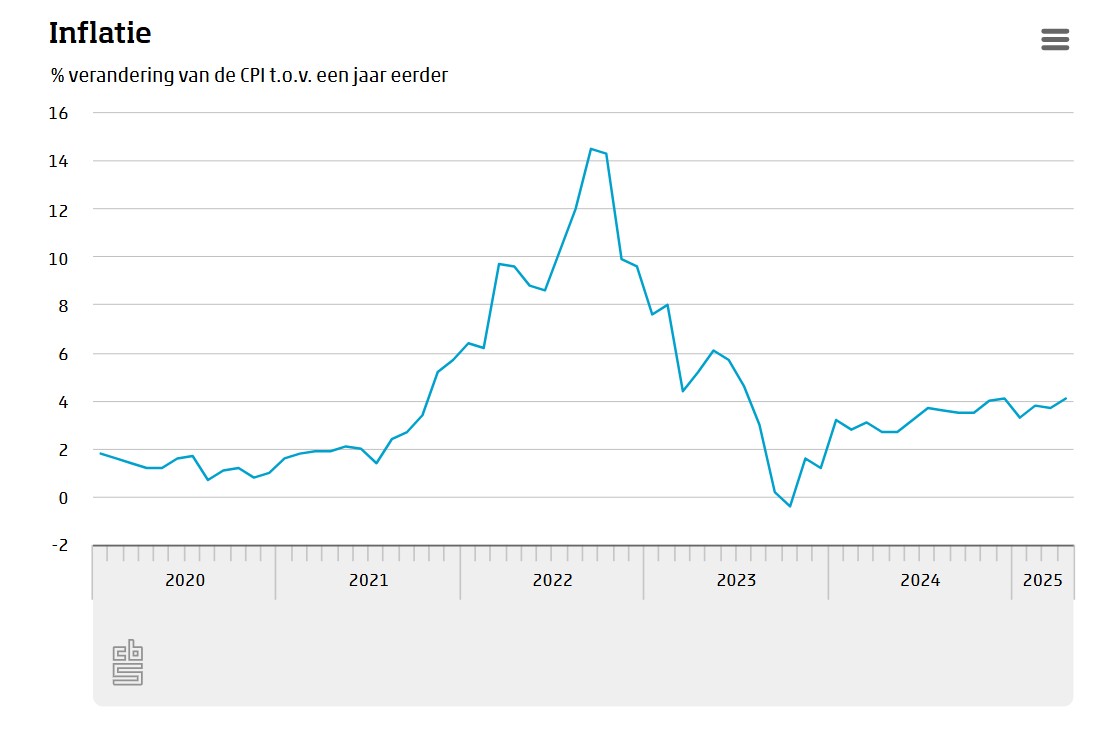

Dutch inflation rising again (source: CBS)

Meanwhile, the euro continues to lose purchasing power. According to new figures from the Dutch statistics agency CBS, the euro lost 4.1 percent in value compared to a year earlier. Inflation is clearly picking up again: in January, it stood at 3.3 percent. In the Netherlands, inflation has been well above the ECB’s target for some time. For the eurozone as a whole, inflation is also now above target, hitting 2.2 percent. In April, the ECB still cut interest rates—potentially fueling even more inflation.

So how high can gold go? It’s a question on many minds, but not one with a simple answer. For some perspective, we can look at what analysts are saying. In a recent article on our website, Jack Hoogland cites a particularly bold figure—read it [here].

Billionaire investor John Paulson expects gold to rise to nearly $5,000 per ounce by 2028. Well-known gold analyst Jan Nieuwenhuijs—who told us on the podcast he sees $8,000 as a long-term target—agrees that Paulson’s forecast is realistic. This week, Nieuwenhuijs published a new article arguing that, based on comparisons with previous bull markets, the gold price could theoretically rise to $16,000 per ounce. Regarding his earlier forecast, he wrote: “When gold was still at $2,700 in January, I estimated it could reach $8,000 this decade. While I still feel confident about that conservative estimate, I wouldn’t be surprised if gold far exceeds expectations.”

Nieuwenhuijs believes we are in the final stage of a debt cycle, making gold primed to surge. He calls gold: “the only neutral, indestructible, and globally accepted financial asset that is evenly distributed around the world. There’s no better asset than gold when trust in credit collapses.”

In this week’s podcast, Frank Knopers shares his grounded perspective. He notes that in the short term, the gold price could also fall—such as if peace is reached in Ukraine. Watch the full discussion below!