9.3

8.064 reviews

English

EN

This contribution comes from the Boon & Knopers Substack

In Singapore, near Changi Airport, there is a new gold vault Open to store precious metals. This six-storey, 16,700 sq. ft. facility was built to meet the growing demand for secure storage of physical bullion within this region, especially for high-net-worth individuals. The vault can hold up to 10,000 tonnes of silver and 500 tonnes of gold.

Rising demand for physical gold and silver is driven by concerns about economic and geopolitical risks, leading investors to protect their wealth. Singapore is benefiting from this trend due to its stable regulations and reputation as a safe country and has developed into the Switzerland of Asia in recent years. More and more wealthy individuals want to store their precious metals there, including people in Western countries who need geographical distribution of their capital.

The largest public gold reserves are currently held by the Federal Reserve in New York (6,331 tonnes) and the Bank of England in the City of London (5,266 tonnes), both of which hold gold on behalf of numerous other central banks. Also a lot of Bullion banks and gold ETFs keep their physical holdings in London, where it's easy to trade.

The fact that there is so much gold in these two locations is not only due to the fact that Western countries have traditionally had the most gold reserves, but also to the development of the modern banking system around these two nodes on both sides of the Atlantic. To limit the movement of gold between banks as much as possible, these became natural locations to store the gold, for Clearing and Settlement. This network effect was amplified in the run-up to World War II, when many European countries had to take their gold to safety and put it in these two locations.

Switzerland is also an important hub for gold. Not only for storage, but also for import and export of precious metals. Mined gold comes in from various countries, is processed and exported to markets elsewhere in the world. This also explains why there are relatively many smelters in Switzerland.

Due to its geographical location, natural protection of the Alps and its neutral status, Switzerland is a popular place for wealthy people to store gold and other valuable goods. Singapore is beginning to fulfil a similar function due to the increased prosperity in Asia and the central location of the city-state.

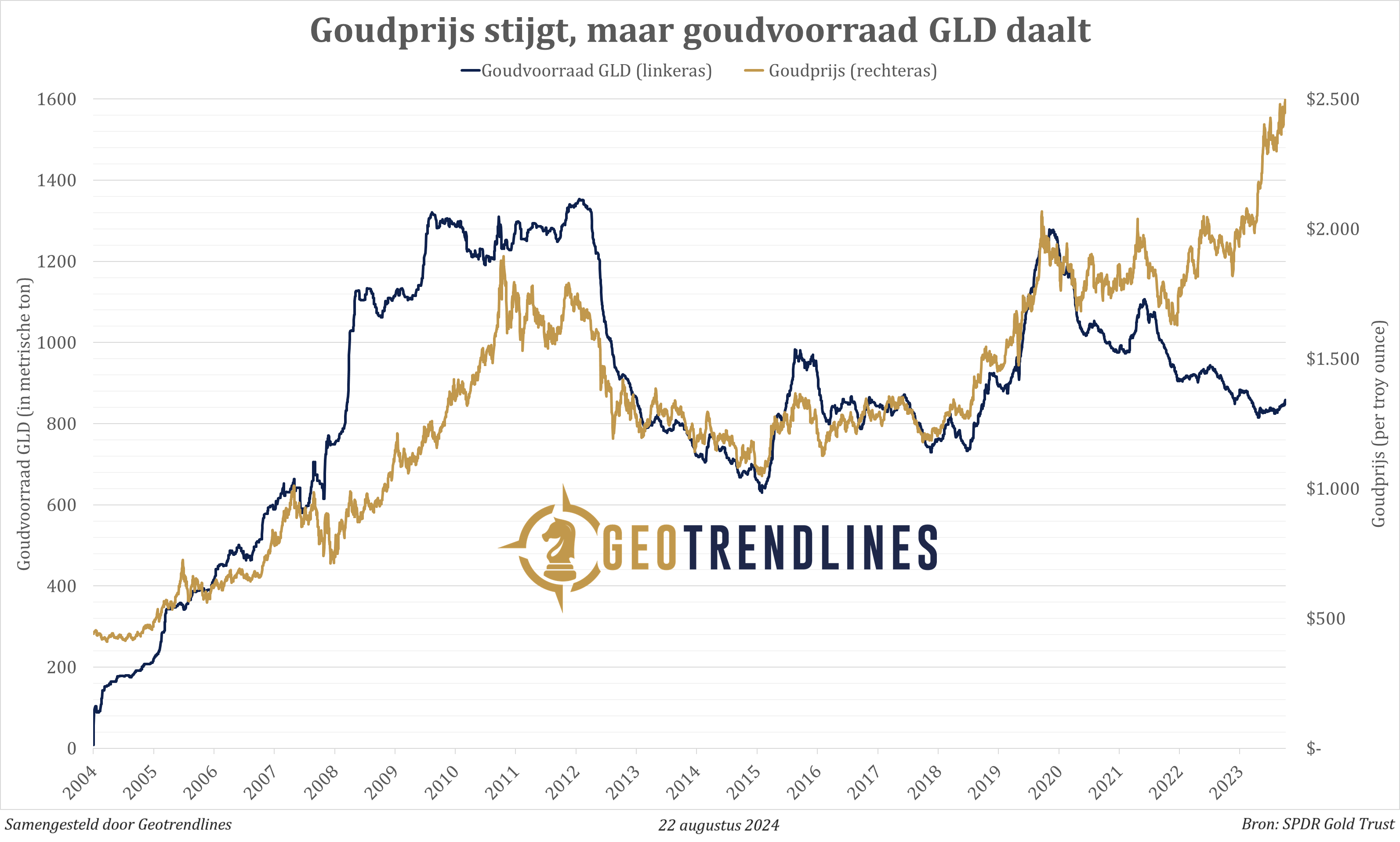

So more gold vaults are being built to meet the increasing demand, but that demand mainly comes from private individuals who want to physically own the precious metal. Funds that make gold tradable in the form of shares, so-called exchange traded funds (ETFs), appear to have lost popularity in recent years. For example, the world's largest gold ETF (GLD) has seen its gold holdings steadily decline over the past four years. The graph below shows the development of the ETF's gold stock (blue) and the gold price (yellow).

Demand is therefore shifting from investment products such as gold ETFs to direct ownership of physical gold bars and coins. This trend is easy to explain, because in recent years more and more attention has been paid to political and geopolitical risks, such as sanctions and (economic) warfare. Against this backdrop, it is more attractive to own physical gold than a derivative. Gold that people prefer to keep with a private storage company and not with a banking institution.

(Photo credit: rawpixel.com)

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.