9.4

7.451 Reviews

English

EN

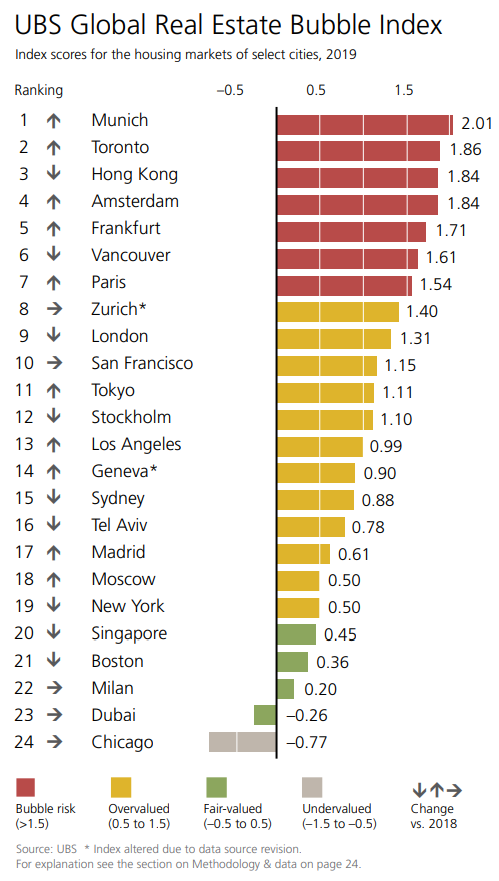

The housing market in Amsterdam is starting to take on more and more characteristics of a bubble. This is the conclusion of the Swiss investment bank UBS in its latest report on the real estate market. In the latest edition of the Global Real Estate Bubble Index For the first time, Amsterdam is in the top five cities with the most overvalued housing market. This means that our capital leaves other world cities such as Paris, London, New York and Tokyo behind.

UBS's index looks at various factors, such as the ratio of incomes to house prices and household indebtedness. Amsterdam scores high on this, because house prices have risen much faster than incomes in recent years. In fact, over the past five years, house prices have risen nowhere as fast as in our capital. Adjusted for inflation, prices rose by an average of 10% per year during this period, a multiple of the average wage increase over the same period.

UBS Global Real Estate Bubble Index 2019 (Source: UBS)

According to the Swiss bank, this price increase is the result of flexible lending and the entry of speculators into the housing market. Due to the low interest rates, many investors are also diving into the market, only to rent out homes at a high price. These factors have pushed up house prices in recent years, but that is not a sustainable trend, according to the bank. People are already moving to surrounding cities, where the affordability of housing is a lot better.

UBS writes in the introduction to its report that a further rise in house prices is no longer self-evident. Urbanisation has kept real estate in the big cities attractive, but prices have risen so much in recent years that affordability is becoming a problem in more and more cities. If potential buyers do not succeed in finding an affordable home, they will move to other places, the bank concludes. As a result, the attractiveness of the city in question decreases.

UBS writes in the introduction to its report that a further rise in house prices is no longer self-evident. Urbanisation has kept real estate in the big cities attractive, but prices have risen so much in recent years that affordability is becoming a problem in more and more cities. If potential buyers do not succeed in finding an affordable home, they will move to other places, the bank concludes. As a result, the attractiveness of the city in question decreases.

For the time being, there are no indications of a correction in the housing market in Amsterdam. The Global Real Estate Bubble Index merely indicates the current market situation. Still, it's a signal to keep an eye on, as home prices have fallen since then in all four cities that topped this index in 2016. This is mainly due to all the measures these cities have taken to curb speculation. On average, prices in there have fallen by 10% from the top.

Although prices are already relatively high in many cities, the Swiss bank does not rule out the possibility that house prices will rise even further. This is possible, for example, if interest rates fall even further. With lower interest rates, households can borrow more money and it becomes more interesting for investors to invest in real estate.