9.3

8.064 reviews

English

EN

The gold price will return to an upward trend in the second half of this year, according to the Thomson Reuters GFMS in its quarterly report on the gold market. For the third quarter of this year, the research firm expects an average price of $1,135 per troy ounce, which will rise further to an average of $1,175 per troy ounce in the fourth quarter.

The increase in the Gold price According to Thomson Reuters, GFMS will continue into 2016. Due to an increasing demand for physical gold, the price could rise further towards $1,250 per troy ounce next year. It is a very positive sound compared to the mostly negative price targets of Goldman Sachs, ABN Amro, Société Générale and Deutsche Bank. These banks all foresee a further decline in the gold price to below $1,000 per troy ounce.

The positive outlook from Thomson Reuters GFMS is based on the expectation that all the bad news about gold, such as a drop in demand in China and the expectation of an interest rate hike by the Federal Reserve, are already priced in. In a very short period of time, the gold price fell below $1,100 per troy ounce, which is the lowest level in five years measured in dollars.

Global gold supply and demand (Source: Thomson Reuters GFMS)

Less demand for physical gold

Research firm Thomson Reuters GFMS recorded a 12% drop in demand for coins and bars in the second quarter and a 9% decline in the gold jewellery market (from a year ago). As a result, total demand for gold reached its lowest level since 2009.

Total Gold Demand by Sector (Source: Thomson Reuters GFMS)

China

The decline is largely attributable to China, where investors preferred Chinese equities to the yellow precious metal. The demand for gold bars and Gold Coins fell to 35 tonnes in the second quarter, a decrease of 26% compared to a year earlier. Demand for jewellery in China fell by 23% to 102 tonnes in the past quarter. The following chart shows the declining demand for gold in the Chinese gold market. The outlook for the Chinese gold market will be largely determined by the development of the Chinese stock market.

Chinese gold market takes a step back (Source: Thomson Reuters GFMS)

India

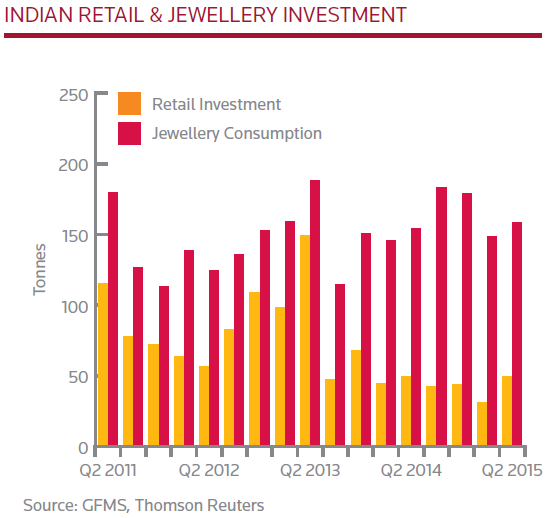

While the Chinese gold market disappointed, the Indian gold market did better than expected. Demand for jewellery rose to 158.2 tonnes in the second quarter, an increase of 2.5% compared to a year earlier. Demand for gold bars and coins remained stable at a volume of 49.5 tonnes in the second quarter.

In the first two quarters of this year, China and India balanced each other well with total gold demand of 394.1 and 391.9 tonnes respectively. According to GFMS, the outlook for the Indian gold market is largely determined by the quality of the harvest. With a good harvest, Indian farmers have more money left over to buy gold. Rural India accounts for about two-thirds of the country's total gold demand.

Indian gold market picks up again (Source: Thomson Reuters GFMS)

Europe

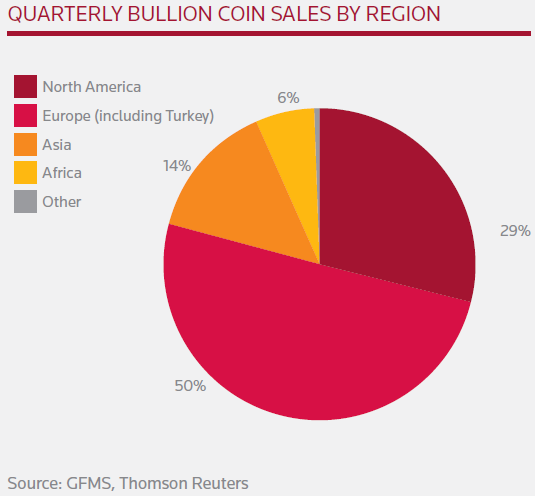

Demand for gold in Europe picked up in the second quarter, which can largely be explained by the problems in Greece. The threat of a Greek exit from the eurozone spurred many investors and savers to Buy gold. On the European continent, gold coins were particularly popular, according to the figures collected by Thomson Reuters GFMS.

Worldwide demand for gold coins in the second quarter of this year was 21% higher than in the same period last year, but in Europe there was an increase of no less than 73%. As the pie chart below shows, half of all gold coins sold in the second quarter were sold in Europe.

Especially in Europe, a lot of gold coins were bought (Source: Thomson Reuters GFMS)

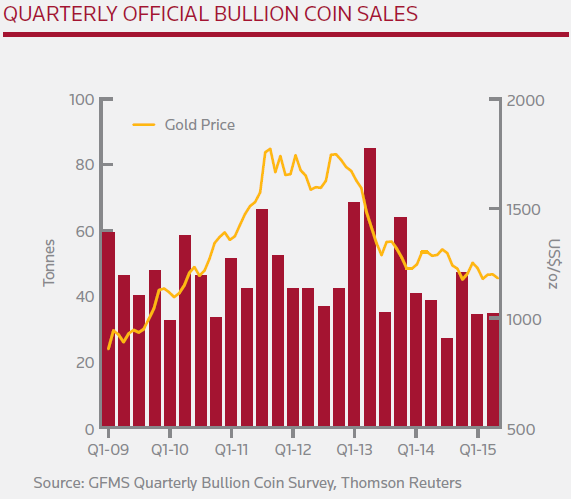

To put the global sale of gold coins into perspective, GFMS has compiled the figures of all mints over the past few years. This shows that in the past many more gold coins were sometimes sold.

Quarterly gold coin sales (Source: Thomson Reuters GFMS)