9.4

7.456 Reviews

English

EN

The situation in our eastern neighbours is still very dire. The country is being battered by a perfect storm, writes economist Han de Jong. In fact, he is so concerned that he talks about 'existential problems'. The economy is also a cause for concern at the European level. According to ABN Amro, the recovery of the eurozone is in jeopardy. Does that pave the way for the European Central Bank (ECB) to cut interest rates even further?

De Jong sums up the problems in German industry. The industry is particularly vulnerable due to its heavy dependence on cheap energy. Europe imports much of its energy, and since the war in Ukraine, cheap Russian energy is no longer available. In addition, European countries are very ambitious with the greening of energy sources, which also leads to higher costs. As a result, production in Germany has been declining for months.

Production in Germany has been declining sharply since the war in Ukraine. (Source: Tradingeconomics)

Production in Germany has been declining sharply since the war in Ukraine. (Source: Tradingeconomics)

In addition, it does not help the Germans that China is also in dire economic straits and is growing at a slower pace, resulting in a reduced demand for German products. The Chinese central bank intervened at the end of September by simultaneously lowering the policy rate, the interest rate on existing mortgages and the minimum reserves for commercial banks. The fact that the central bank is intervening so firmly at once is unique, he wrote The Economist. Whether the measures will have the desired effect remains to be seen. The Chinese Purchasing Managers Index had risen slightly last month, but at 49.8 was still below the limit of 50.

The third point De Jong writes about concerns the automotive industry, which was in the news last month due to Volkswagen's disturbing report that it is considering the closure of factories in Germany. The group got itself into trouble with the diesel scandal and was then unprepared for the EU's new emission standards. During the corona pandemic, the automotive industry struggled with chip delivery problems due to purchasing blunders, and during the war in Ukraine, the supply of car wiring came to a halt. Currently, Volkswagen just can't seem to match the low prices of Chinese electric cars. Volkswagen kept the development of the software in-house, an expensive exercise. Renault, a French car manufacturer, has now changed its mind and is going to bring cheap electric cars to the market by outsourcing the software.

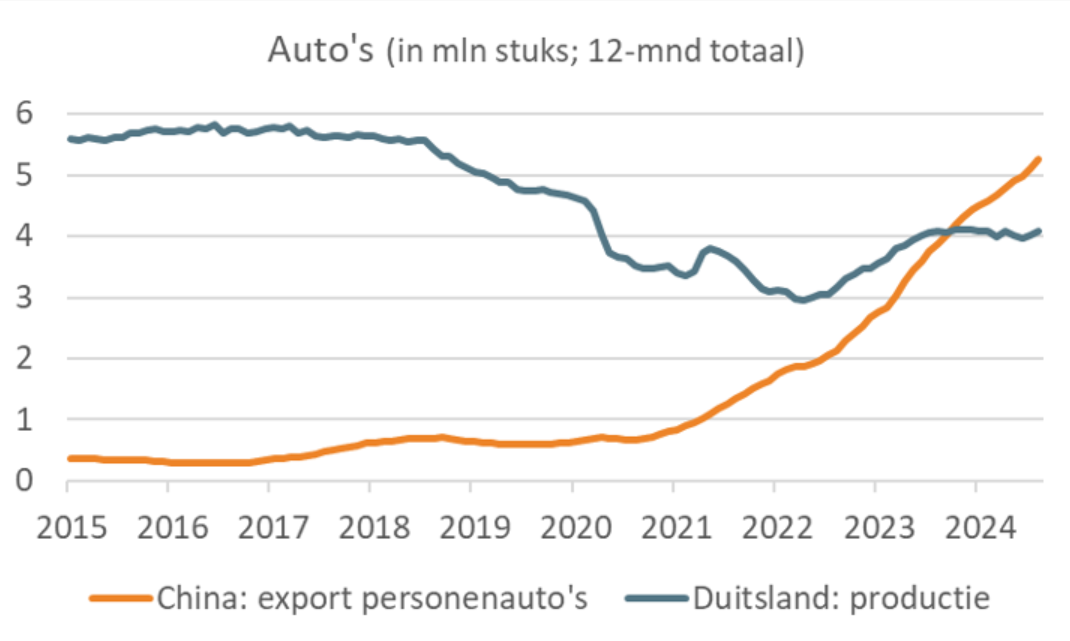

As can be seen in the graph, car production in Germany has declined, while China is only putting more cars on the market. (Source: Crystalcleareconomics)

As can be seen in the graph, car production in Germany has declined, while China is only putting more cars on the market. (Source: Crystalcleareconomics)

ABN Amro also wrote an article this week about the Ailing European economy and stated that the ECB faces a difficult choice. The European economy is facing weak demand. According to the bank, this could cause companies to lay off employees, which is worrying. In recent years, employment in the eurozone has remained very strong, as companies have been waiting for the recovery. Now that the recovery seems to be stagnating, it is possible that companies will lay off employees in the coming period. At the moment, unemployment is not yet rising, but the sub-indices of the PMI do point to imminent rounds of layoffs. The disturbing news of Volkswagen's possible factory closure may therefore be real.

The good news is that inflation is falling. Inflation in the eurozone was 1.8 percent, below the ECB's policy target of 2 percent inflation. Core inflation, which excludes volatile energy and food prices, fell by 0.1 percentage points to 2.7 percent. According to ING, it is likely that the ECB will also achieve the policy target in the medium term. However, the danger has not yet completely passed, as services inflation remains high. The inflation rate is a general figure, but it says nothing about the underlying dynamics. Therefore, the inflation rate may seem low, while certain products are still much more expensive than they were a year ago.

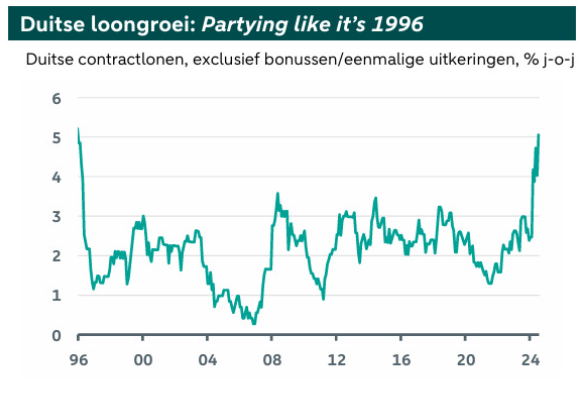

It is precisely this inflation in services that remains a cause for concern. An important factor in this inflation is wage growth, which rose sharply despite weaker activity. Wages in the Netherlands were average in the third quarter 6.8 percent higher than one year previously. Adjusted for inflation, wages in the Netherlands rose by 3.1 percent. Wage growth is unlikely to remain this high in the coming months, but in the short term it could push inflation back up somewhat. That's because companies will pass on these higher labor costs to customers. Dutch inflation is currently the second highest in the EU, but wages are also rising sharply in other countries. As can be seen in the graph below, wages in Germany have not risen this fast since 1996.

German wage growth is at its highest level since 1996. (Source: ABN Amro)

German wage growth is at its highest level since 1996. (Source: ABN Amro)

The above factors pose a dilemma for the ECB. On the one hand, the ECB would like to cut interest rates to avoid a possible recession. European activity will pick up again if interest rates fall. On the other hand, price stability remains the ECB's goal, and with high wage growth, high inflation remains lurking. At the moment, a new interest rate cut by the ECB seems plausible, but as soon as inflation threatens to rise again, the central bank simply cannot lower interest rates.

Photo: Wolfsburg - Inside the Volkswagen Plant (source: Roger W)

Have a look at us YouTube channel

On behalf of Holland Gold, Paul Buitink interviews various economists and experts in the macroeconomic field. The aim of the podcast is to provide the viewer with a better picture and guidance in an increasingly rapidly changing macroeconomic and monetary landscape. Click here to subscribe.