9.4

7.466 Reviews

English

EN

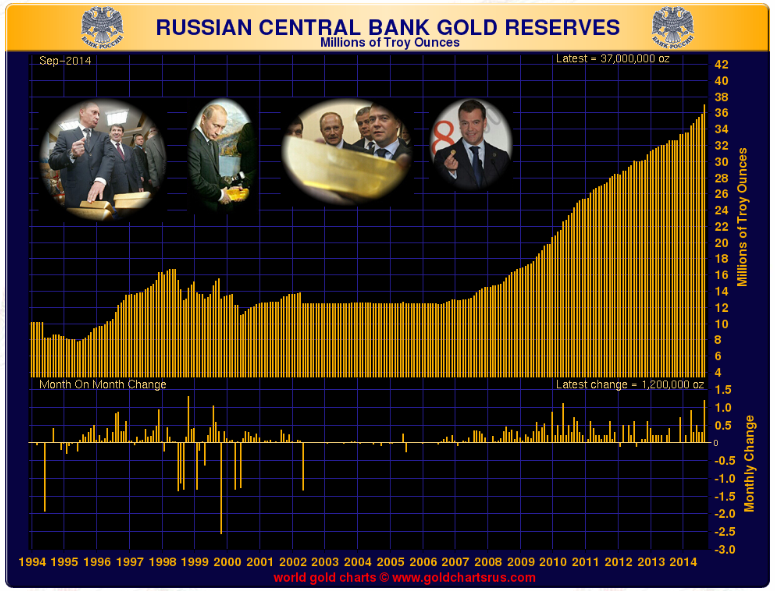

The central bank of Russia has again won gold in the month of October purchased. With a purchase of 19.7 tonnes, the country brings its total gold reserve to 1,169.5 tonnes. According to IMF figures, Russia has already added 134.3 tonnes to its reserves in the first ten months of this year.

According to Elvira Nabiullina, governor of the central bank, the counter for this year stands at 150 tonnes. This means that at least 15.7 tonnes of precious metal were added to the reserves in this month. That's twice as much as the 77 tonnes Russia bought last year. Despite the fact that the ruble is under pressure, the central bank continues to add gold to its reserves.

"The fact that Russia are buying more gold and not seeking diversification in foreign exchange reserves is very positive," FuturePath Trading trader Frank Lesh told Bloomberg. Other central banks are also buying plenty of gold this year, despite the fact that gold has lost value against the dollar again this year. According to estimates by the World Gold Council, central banks will increase by 22% this year. Buy gold than last year.

The Russian central bank started buying the precious metal in 2005, even before the outbreak of the financial crisis. Almost every month it adds a little gold to its reserves, with the result that the country's reserves already consist of 10% gold. In 2005, the Russian central bank had barely 300 tonnes at its disposal. In the space of less than a decade, she has quadrupled her total stock.

A significant portion of the precious metal in the vaults of the Russian central bank comes from Russian mines. The mines sell their production to banks, which then sell the metal on to their own central bank and on the world market. Due to the sanctions against Russia, banks could not store all their gold abroad, so the central bank decided to purchase a larger volume.

Russia bought almost 20 tons of gold in October (Image from Sharelynx)