9.4

7.583 Reviews

English

EN

Marc Faber expects the current monetary system to collapse within five years as a result of the reckless policies of central banks. He expects central banks to continue financing government deficits by buying even more government bonds. According to him, this form of debt financing is nothing different from what has happened before in Venezuela and Zimbabwe, among others. Therefore, the danger of hyperinflation is still lurking.

As a result of central bank monetary policy, new bubbles are being inflated in real estate, stocks, commodities and bonds. But instead of blaming the central banks, Faber expects public frustration to be directed at the super-rich. Although they did not cause the bubbles in the economy, they benefit the most from them. The Epoch Times spoke to the investment guru about his vision for the future.

This is a matter for central banks to decide, and I have no influence on central bank manipulation. Haruhiko Kuroda of the Bank of Japan has already said that there is no limit on monetary inflation and that they can continue to buy financial assets such as stocks and bonds.

So today's madness will continue for a while. In a rigged market, you know it's not going to end well, but you don't know when it's going to end and how long the manipulation can last.

They can essentially buy up anything, and then they have everything in their possession. And through the system of central banks, you then introduce communism and socialism, which means that the state determines all production and consumption. If that's the goal, they can achieve it.

The Bank of Japan already owns more than half of all Japanese ETFs, which in turn have large stakes in a variety of companies. So indirectly, the central bank may already own 20% of all Japanese companies. So they can go much further.

I don't think central bankers are intelligent enough to understand what the consequences of current monetary policy will be. They focus on inflation, but in my opinion they shouldn't do anything at all. They focus too little on the impact of monetary policy on the standard of living of the average citizen and the income of an average household.

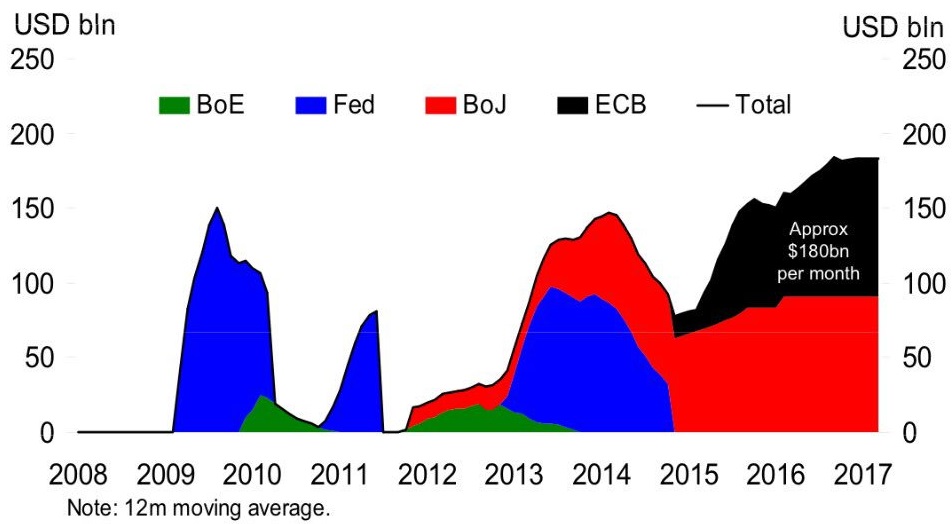

Central banks continue to print money

In developed countries, this may continue for some time. If Zimbabwe prints money and no one else does, the value of your currency collapses. But if the major central banks such as the Fed, the ECB, the Bank of Japan and the Bank of England all print money at the same time and coordinate it with each other, then the currencies will remain reasonably stable relative to each other. There may be fluctuations, but you will not have a total collapse of the currency.

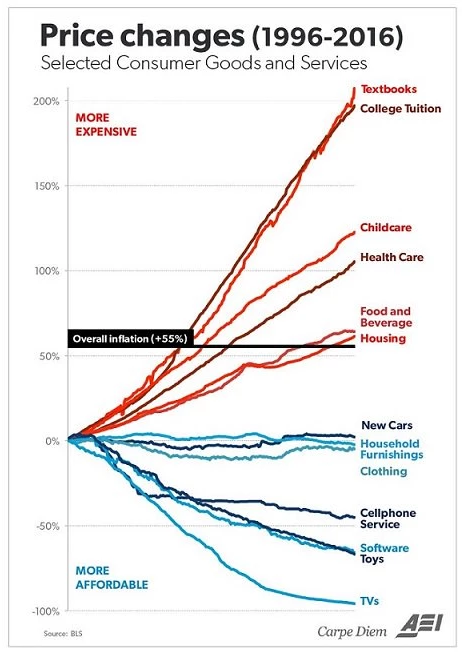

Over the past thirty years, paper money has lost value worldwide relative to stocks, bonds and precious metals. An increase in the price of financial assets is less visible to the average citizen. Most Americans don't have a lot of money, so they don't notice when the prices of paintings and real estate go up, until it affects them personally.

Actual inflation is much higher

It is nonsense to claim that inflation in the United States is rising by only one percent a year. The cost of living for an average household is rising much faster, such as insurance, transport costs and tuition fees. Households are being squeezed financially, but central banks don't look at that.

I expect this system to implode within five years. As soon as central banks start printing money, the end is near.

It's better to ask the bureaucrats who make the plans. They have been using an interest rate of zero percent since December 2008. Eight years will soon have passed, but it has not yielded anything for the economic activity of households. Not in Japan, nor in the United States or the EU. And now they're talking about fiscal stimulus...

We already have large deficits, but no deficit is big enough for the interventionists, so they will increase fiscal stimulus. They finance their deficits by issuing new government bonds, which the central banks will buy. The Treasury Department issues new debt that the Federal Reserve will then purchase. Of course, that will end badly, but at least it will postpone the problems for some time.

Then they will find a few academics who are willing to blame wealth inequality on "evil capitalists" who make so much money from the financial bubbles. This group will be blamed for the economic slump, while they are not at all responsible for the bubbles in the economy. After all, these are the central banks, which have brought interest rates to zero or even below zero.

First you manipulate prices through artificially low or even negative interest rates and then the income of the super-rich rises. At best, it's only the top 0.1% who really benefit from the rising prices of assets, at the expense of all the people who don't own them. As a result, wealth inequality will rise and that will be cited as a reason to demand more tax from the rich.

Taking money from the rich is an attractive way to win votes. You address the voters and say "The economy is doing badly because of the rich people. We have to take 20 percent of them and give it to you." I dare say that almost everyone will vote for this, because the rich are in the minority. This is what is going to happen once monetary policy fails.

Some well-connected rich people will be able to secure their wealth in time, but a lot of people will not be able to do so. But even if you take half of the wealth of the rich, it's not enough. The next step will be to take money from the middle class, the interventionists will go very far in this.

Most asset classes are currently overpriced if you value them with traditional valuation methods. But are they also overvalued compared to zero percent interest rates or negative interest rates? If you take the German, Swiss or Japanese 10-year bonds, you will receive virtually no interest. But if you can buy stocks that pay a dividend of 2% or more, then stocks are still cheap relative to zero interest rates. But based on traditional valuation methods, stocks aren't cheap at all.

Still, it is dangerous to tell someone that he or she should keep all his or her assets in cash. First, you have to decide which currency, second, you don't know when things will go wrong. In a situation where central banks print a lot of money, the Dow Jones index can rise to 100,000 (now stands at more than 18,000 points).

Stock markets can continue to rise indefinitely in nominal terms, but not against precious metals. I have witnessed several cases of hyperinflation up close, and in all of them, the standard of living declined for most people.

If central banks raise the negative interest rate from -0.5% to -5%, citizens and businesses will withdraw their money from the financial system on a large scale and store it in a safe deposit box in the form of banknotes. So this is not going to work unless you do away with cash. You can still hoard food, cigarettes, and precious metals, but not cash. I expect that can happen, if they really want to push through negative interest rates.

In the late 1990s, I made a very strong case for gold, silver and platinum. I wrote the book "the gold of tomorrow", which by the way was not about gold but about the rise of Asia. The price of gold rose sharply from 1999 to 2011, but then corrected again. Probably the price had risen too quickly. But between October and December last year, gold mining stocks and precious metals prices have once again bottomed. From that level, prices can rise again.

Whether the price of gold will rise tomorrow or in the next three to five years, I don't know. But if you keep printing money, the money supply increases, and assets are scarce – whether it's a classic car or a painting – they are scarce and will therefore increase in price.

Not all assets will increase at the same time and to the same extent. There will also be bubbles in real estate and in collectibles. There will also be bubbles in equities, which we have had three times since 1999.

I think it's risky to keep all your money on the sidelines. I would strive for diversification. So I own cash, bonds, stocks, some real estate and some precious metals. By applying more diversification, you will achieve a less than optimal return, but it is most likely that you will retain your capital.

Throughout history, Physical Gold always know how to retain value. According to the World Gold Council, negative interest rates are even a reason to keep twice as much gold in the portfolio.