9.3

8.064 reviews

English

EN

The silver price reached a new all-time high on Monday morning at €1,429 per kilo and $51.63 per troy ounce. Bloomberg reports that the London silver market is in severe turmoil due to a historic short squeeze. At Holland Gold, we are also seeing a surge in silver orders. What does this mean for you?

London is the global center for physical precious metals trading. A shortage of silver has now emerged there. “There is indeed a shortage of silver in London, but on the Comex (US) there are 500 million ounces sitting idle,” said Ryan Mangan, head of global metals and bulk trading at Macquarie, according to Reuters. Earlier this year, large amounts of silver were shipped from London to the US to avoid potential future import tariffs.

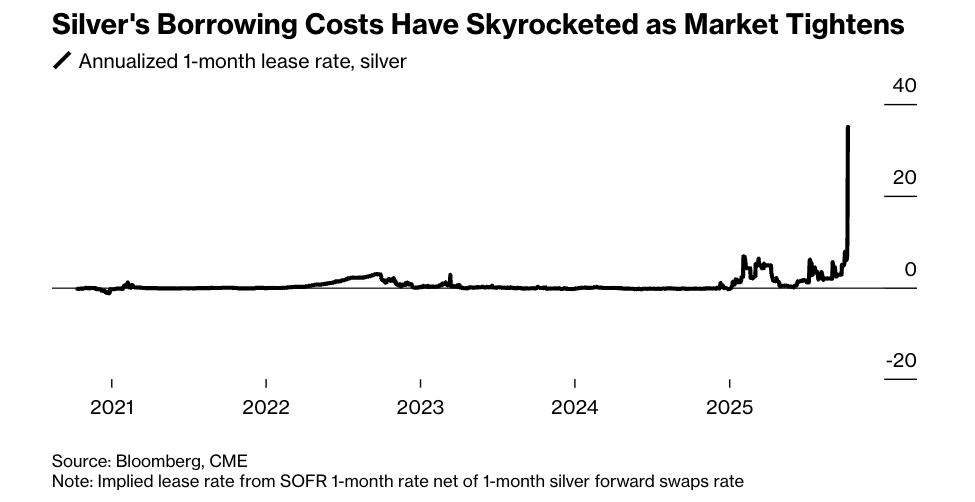

In London, silver lease rates have now risen to exceptional levels. These rates reflect the cost of borrowing physical silver and are a key indicator of demand. According to Reuters, they are now extraordinarily high due to the low liquidity in London—caused by a recent surge in demand from silver ETFs and the earlier outflow of silver to the US. The cost of borrowing silver “overnight” in London has soared to over 100% on an annualized basis.

Monthly silver lease rates (source: Bloomberg)

Last week, silver surpassed its historic 1980 record. According to Bloomberg, the recent price explosion is largely driven by a wave of investment in gold and silver, fueled by concerns over the rapidly rising debt levels in the West and the debasement of currencies—the so-called “debasement trade.” They also point to silver-specific factors: a sudden surge in demand from India, a shrinking supply of deliverable bars, and fears of potential US import tariffs.

The London silver price has reached rarely seen highs compared to New York. Bloomberg notes that market liquidity has virtually dried up: “Those holding short positions in physical silver can hardly find any metal and must pay exorbitant borrowing costs to roll over their positions.” The situation has become so extreme that some traders are reportedly booking last-minute cargo space on transatlantic flights to transport large silver bars.

This phenomenon is known as a silver squeeze. Ole Hansen, head of commodities at Saxo Bank, stated on Monday morning that the silver squeeze shows no signs of easing.

At Holland Gold, we are now feeling the same effects. Due to the extraordinary market pressure, we have been forced to adjust our delivery times and increase premiums. The premium is the difference between the current spot price and the final retail price of a coin or bar, reflecting scarcity in the physical market. That same physical scarcity is also extending delivery times: 1000-ounce silver bars, which are normally available within two weeks, now have a delivery time of around four weeks.